Ethereum is the popular blockchain on which the second largest cryptocurrency in terms of market capitalisation called Ether (ETH) is built. Unlike Bitcoin, Ethereum is not just a coin, but also a platform for creating independent tokens and applications. On the fundamentals of Ethereum, many projects have been created recently, and some of them are part of DeFi. These include Maker, Aave or even Chainlink (LINK). The Ethereum project is thus very popular.

History of Ethereum (ETH)

Ethereum was created by programmers among whom the leading figure is Vitalik Buterin. This Canadian of Russian origin, as an expert in cryptography, initially wrote for Bitcoin Magazine and therefore expanded his knowledge in the field of cryptocurrencies. Over time, however, he set his sights on his own project. In 2014 he launched Ethereum, a blockchain platform with enormous potential and with the extremely capable cryptocurrency Ether (ETH).

Technical aspects of Ethereum (ETH) and the development of DeFi

Ethereum (ETH) is primarily a platform for building decentralised applications. Recently, popular DeFi projects are programmed and developed on the fundamentals of Ethereum.

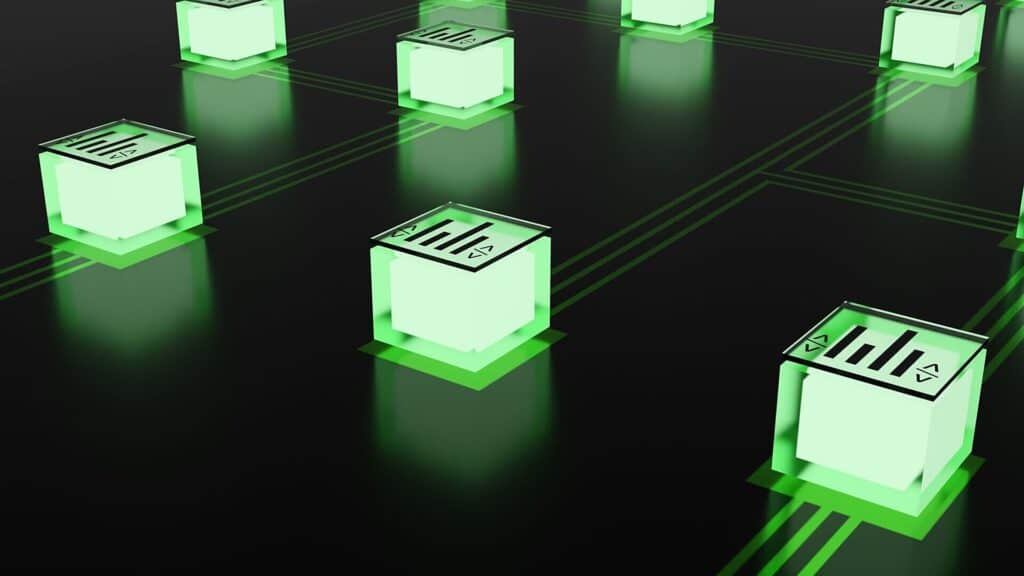

DeFi, or Decentralized Finance, are systems that transfer financial services from traditional banking to the blockchain network. Everything is done so that transactions take place without the participation of intermediary institutions. We owe the existence of DeFi not only to Ethereum, but also to the smart contracts based on its blockchain.

Smart contracts

As we already know, when creating Ethereum, Vitalik Buterin did not focus on creating a cryptocurrency, but on a platform through which the blockchain could grow. One of the main objectives of the Ethereum (ETH) platform was to create a network of smart contracts. Smart contracts are pieces of programming code distributed across the network. They operate without the involvement of third parties and transactions are made when particular conditions for which they were designed are met. ERC20 tokens are based on smart contracts. This is the largest family of digital tokens in the blockchain space with Ethereum as their underlying base.

The price development of Ether (ETH)

The Ether cryptocurrency is younger than Bitcoin and it has been characterised by much higher price fluctuations than its older brother. One of the factors influencing this is primarily the much lower market capitalisation. This does not change the fact, however, that Ether (ETH) has been recognised in the community of cryptocurrency enthusiasts as the king of altcoins. Ethereum is the first platform that sparked the so-called ‘’altcoin seasons’’. The most famous one took place right after the bursting of the Bitcoin bubble in 2017. It led Ether in January 2018 to a High of $1420. Subsequently, Ethereum followed Bitcoin in a bull market. However, Ethereum’s growth brought us to the point where the aforementioned peak was pierced on 19 January 2021. The fact that Ether, as the second cryptocurrency in the world, began its listing on the CME exchange on 8 February 2021 adds additional flavour. The consequence could be further significant price movements.

What is Ethereum 2.0 (ETH)

Since the beginning of December 2020, the Ethereum (ETH) network has been in the transition to version 2.0, which is expected to last many more months. This brings with it numerous changes and the success of this long-term operation can have a significant impact on the value of your cryptocurrency portfolio. For many months, Vitalik Buterin has been talking about plans to launch a new version of Ethereum.

Ethereum 2.0 is primarily a shift from Proof of Work (PoW), to Proof of Stake (PoS). This means slowly shutting down the Ether mining process and replacing it by a different consensus algorithm. This means that holding and locking a minimum amount of 32 ETH by validators, will result in staking rewards. Staking, in turn, is much cheaper than token mining as it does not require expensive technology to be acquired.

The move to Proof of Stake primarily results in strengthening the network. According to Vitalik, the security of Ethereum will surpass that of Bitcoin. The network will also be able to process many more transactions in a much shorter time than it did before.

What impact could this have on the Ether price (ETH)?

Incentivizing the locking of 32 Ether for Proof of Stake (PoS), reduces its availability. At this point, a deflationary factor takes place which consequently becomes another factor that can significantly increase the price of Ether (ETH).