This time we take a look at another project that dived deep into the hearts of investors. What exactly is Terra (LUNA)?

Blockchain Terra (LUNA) is intended for general-purpose

One may often get the impression that cryptocurrencies are a technology that one must consciously join in order to participate. It turns out that this is not necessarily the case. This is evidenced by the Terra ecosystem (LUNA), which is able to connect blockchain with the real world, and without the awareness of the latter. How does this happen?

Terra (LUNA) is a network whose main purpose is to create stablecoins linked to various fiat currencies. The blockchain is very young, as its origins date back from 2019. It was created to support payment systems for e-commerce platforms and become a solid competitor to market molochs such as PayPal, for example.

The premise of Terra is to facilitate as many fast transactions as possible. A perfect reflection of how Terra works is a Korean application Chai Payment. We will tell you about it in a moment, but right now it is worth mentioning that it was created by the co-founders of Terraform Labs. They are Daniel Shin and Do Kwon. The project from the beginning was ambitious and, in contrast to many others, did not rely on hype, but on usability. On its fundaments the first stablecoin in the Terra ecosystem was created. This stablecoin was linked to the Korean won (TerraKRW).

Let’s move on to the essence of the Chai application, because it is of fundamental importance for the entire ecosystem. Its author is Daniel Shin, who decided to solve the problem faced by Koreans who use traditional payment methods. As it turns out, Korean gateways have a transaction processing period of 3 to even 14 days. In turn, their fees are as high as 3% of the transaction value. The use of the Terra blockchain has brought the transaction speed down to just 6 seconds and the cost to between 0.5% and 1.3%.

Thanks to the use of Terra-based stablecoin, Chai is very fast., Its users, for the most part, do not even know that the quality of their application’s performance is due to the use of blockchain technology.

Technical aspects of Terra (LUNA)

Terra (LUNA) was built by using the Cosmos SDK platform. It is based on the Proof of Stake (PoS) consensus algorithm. The blockchain enforces the existence of 100 validators. This is not a huge number, which raises questions about decentralization. The ecosystem has its own token called LUNA to support stablecoin creation. Thus, when there is an increased demand for a given stablecoin, LUNA users start burning the token to cash in on the increasing stablecoin rate. This situation can work the other way around. That is, demand for the LUNA token can trigger a wave of stablecoin burning. Thus, the market regulates itself, keeping values in check while providing financial cover.

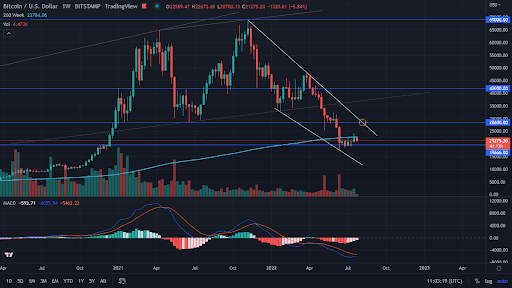

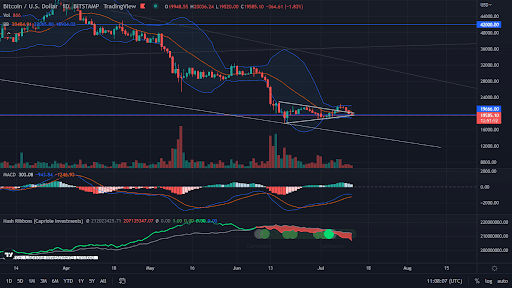

Terra (LUNA) price action

As we mentioned earlier, Terra (LUNA) is a young project that is currently experiencing its first bull market. Nevertheless, the token has broken into the top ten projects with the highest market capitalization. It is interesting to note that the maximum supply of LUNA is 1 billion tokens, with their possible excess intended to be automatically burned by the network.

LUNA’s price as recently as June 2020 was $0.20. However, the value it has brought to blockchain technology has already pushed it up to $23.30 on March 21, 2021. Later, with the strong discounting of the entire market, the price decreased as low as $4.00. Eventually, it reached its current All-Time-High (ATH) of $106.30 on December 27, 2021.

Summary of Terra (LUNA)

Terra (LUNA) is definitely a project unlike any other. Its focus on real world needs has influenced its instant adoption. This is appreciated by investors, who successively increase the value of the LUNA token. There are many indications that the ecosystem has a bright future ahead of it.