Ethereum whales are moving their funds en masse from cold wallets to exchange portfolios. The upcoming big event, The Merge, is resulting in ETH respecting important resistances and an early sell-off.

Significant ETH whale moves

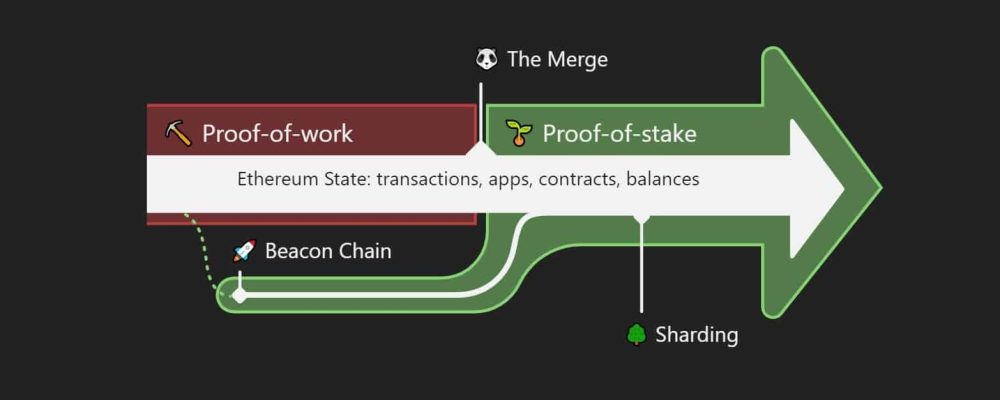

The Ethereum network is in the process of undergoing one of the longest and most complicated processes in its history. The consensus Proof of Work will be replaced by Proof of Stake. Before this can happen, however, certain transition steps must take place. One of them is Merge, which if ETH developers are to be believed is scheduled to take place on September 15, 2022. After successful testing in the Goerli network it seems that the consensus merger will indeed take place then.

The Merge has been such a hot topic in the market that it has triggered Ether’s surge, which at its peak drove the cryptocurrency to a valuation in excess of $2,000. From a technical point of view, this is a resistance zone that has not escaped the whales’ attention.

For this reason, the network is seeing significant movements. In the past three months, the top ten Ethereum addresses on OTC portfolios have seen their holdings fall 11%. At the same time, the top exchange addresses have seen an increase of 78%.

Santiment confirms

The total increase in the value of ETH, registered from mid-July to mid-August, was almost equal to 100%. Therefore it is not surprising that some investors decided to move to the profit realization phase.

Representatives of the popular analytical platform Santiment, confirm the above recorded data in a post dated August 25:

? The gap between #Ethereum's top 10 largest non-exchange addresses & exchange addresses is closing as we head toward the #merge in 3 weeks. Since May 10th, these top non-exchange $ETH addresses hold 11% less coins, & top exchange addresses hold 78% more. https://t.co/k5OlJ1hG3D pic.twitter.com/XOAVhXaKPG

— Santiment (@santimentfeed) August 24, 2022

“The gap between the top 10 Ethereum addresses and the stock market addresses is narrowing as we approach the Merge, which is just three weeks away. Since May 10, these top ETH addresses have 11% fewer coins, while the top exchange addresses have 78% more.”

This kind of flow reflects the current or upcoming bearish sentiment. Moreover, the market inherently likes to price future events well in advance. This results in the popular “buying rumors and selling facts.” Selling facts in this situation, of course, is the significant decline that can take place around the final event. As a result, many popular market analysts indicate that further Ethereum increases can still take place, but around The Merge, significant sell-offs should be expected.

Milestone

Scheduled for mid-September, the consensus merger, as we know it, is the next step in Ethereum’s transformation. Developers will thus have surpassed 50% of the way they have to come, in order to achieve the coveted Proof of Stake. The closing date of the process is not yet known. However, expect that its announcement may result in more interesting rallies.