The well-known and respected investor and billionaire, John Paulson, recently surprised the public with a controversial sentence he uttered during an interview for the Bloomberg portal. The sentence read as follows: “I would not recommend anyone to invest in cryptocurrencies”. Paulson claims that cryptocurrencies are “a financial bubble that will eventually burst”. The same investor in 2007 correctly predicted (and bet on) the crisis in the mortgage markets. Who is John Paulson and what exactly did he say, in the article below.

John Paulson – genius or madman?

John Paulson is an American billionaire, investor and in the past also a hedge fund manager. The financier earned nearly $4 billion in 2007 when he bet against the subprime mortgage market, which he predicted would collapse. The fortune he gained as a result has been called “one of the largest fortunes in Wall Street history.”

Paulson’s interview with Bloomberg

During his recent interview with Bloomberg, Paulson described cryptocurrencies as tokens devoid of any real value except for the fact that they exist in limited supply. The investor even went a step further by predicting the collapse of the cryptocurrency market. Here are Paulson’s words when asked if he is a fan of cryptocurrencies:

“No, I’m not. And I would say that cryptocurrencies are a bubble. I would describe them as a limited supply of nothing. So if demand is greater than the limited supply, the price will go up. But if demand goes down, the price goes down. None of the cryptocurrencies have intrinsic value, except for a limited amount.

Cryptocurrencies, no matter where they are traded today, will eventually prove worthless. When the vibrancy wanes or liquidity dries up, they will drop to zero. I wouldn’t recommend anyone invest in cryptocurrencies.”

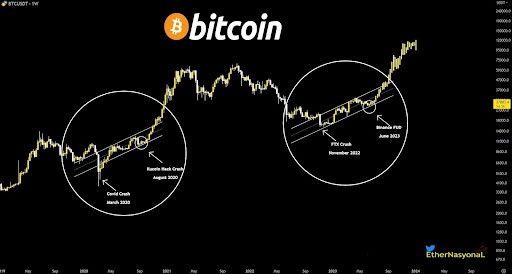

Given the ever-growing popularity of cryptocurrencies, Paulson’s words are likely to stir up quite a bit of controversy. But this is not the end of the billionaire’s statement. Paulson also added that the cryptocurrency market is too volatile to successfully bet on it, as he did in 2007.

What can we conclude?

John Paulson is not the only skeptic of blockchain technology. Many other well-known investors, such as Warren Buffett, share his opinion on the “supply of nothing”. These same businessmen are also predicting a looming financial crisis that is being driven by cryptocurrencies. On the other side of the coin, however, are unquestioning cryptocurrency fans such as Elon Musk. Who will turn out to be right? For the time being, no one is able to predict it.