The U.S. arm of the world’s largest exchange by trading volume, has announced the removal of two key assets from its platform. They are Tron (TRX) and Spell (SPELL). Delisting of the former may have a strong connection to the problems faced by its creator.

TRX and SPELL are losing ground

Binance US has announced that it will soon remove two tokens from its offering. As of April 18, TRX and SPELL will no longer be available for trading and deposits. Although withdrawals of these cryptocurrencies will still be possible, the exchange has decided to remove them from its list due to a routine review process. Binance US stresses that it considers factors such as trading volume, liquidity, regulatory standing or evidence of fraudulent or unethical behavior associated with a particular cryptocurrency when deciding whether to delist it.

A statement from Binance US reads: “As a digital asset company, we operate in a rapidly evolving space, so our market monitoring procedures are designed to respond to market and regulatory changes. When a particular cryptocurrency no longer meets our high standards or industry circumstances change, we conduct a more in-depth review and make a decision on whether it is necessary to withdraw it from the market.” It is worth noting, however, that Binance US will continue to support USDT and USDC stablecoins issued on the Tron network.

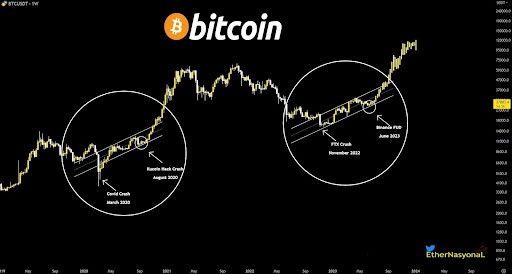

Serious impact on the TRX and SPELL prices

The announcement of the withdrawal of TRX and SPELL from the Binance US offering had an immediate and adverse impact on the value of these coins. TRX, the 17th largest cryptocurrency by capitalization, fell to a three-week low of $0.062, only to rebound sharply moments later. Despite this, TRX’s recorded daily loss was 4.7%, which turned out to be the largest drop among the 50 largest cryptocurrencies.

SPELL, on the other hand, is a lesser-known asset, used as a reward associated with the abracadabra.money lending platform. It uses the interest-bearing tokens as collateral for loans to its dollar stablecoin Magic Internet Money (MIM). Its losses were comparable to those of Tron.

Justin Sun facing serious charges

In recent days, the Securities and Exchange Commission (SEC) announced that Justin Sun – the founder of Tron – and his companies had violated securities laws. The charges involve market manipulation, fraud and illegal sales of unregistered securities to investors. In the complaint, the SEC specifically named three of Sun’s companies: Tron Foundation, BitTorrent and Rainberry. In addition, it alleged that Sun received illegal profits of $31 million from the sale of TRX.