One of Deutsche Bank’s leading economists and market strategists notes that Bitcoin has the potential to become the gold of the 21st century. The data collected by the bank itself is interesting against the background of her statement.

Big opportunities ahead for Bitcoin

One of the leading figures of Deutsche Bank, who is also a university lecturer at Harvard, Yale and the University of Paris, sees great potential in Bitcoin as well as in the cryptocurrency market. Marion Laboure shared her opinion pointing out that the digital assets market cannot be ignored, in fact it is necessary to get used to it.

Laboure tries to maintain a rational and cool attitude. She recognizes the fact that Bitcoin is a means of payment, yet if not for the Lightning Network, it would be quite expensive to use. She also notes that the cryptocurrency’s limited supply contributes to its recognition as a hedge against rising inflation. In turn, when asked about the perception of Bitcoin as digital gold, she responded as follows:

“People have always sought assets that were not controlled by governments. Gold has filled that role for centuries. And so, I could potentially see Bitcoin becoming the digital gold of the 21st century. Let’s not forget that gold has also been historically volatile. But it’s important to remember that Bitcoin is risky: it’s too volatile to be a reliable store of value today. And I expect it to remain ultra-volatile for the foreseeable future.”

Laboure’s words may indicate that Deutsche Bank is sympathetic to digital assets. It recognizes the disadvantages that surround them, but also points to opportunities that can take hold over them.

Research points to an interesting investor attitude

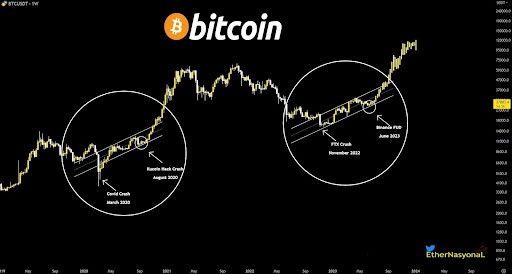

Deutsche Bank was also tempted to conduct research in the form of a survey, from which very interesting conclusions can be drawn. The report entitled “The Future of Cryptocurrencies” indicates that less than half of people would sell their crypto assets even if their value dropped by 80%. Furthermore, according to the bank, nearly 65% of investors first entered the market in 2021 with an average investment of less than $10,000. The metric still shows men as being more favorable to the market and having a greater appetite for risk. Women made up just 14% of new investors in 2021.

The survey also asked about the long-term outlook for the price of BTC. It turns out that about 25% of all hodlers say Bitcoin will be worth more than $110,000 in the next five years.