CME Group, observing an increase in interest in ETH trading on futures and micro options, decides to launch a new trading instrument. Ethereum futures options will debut on September 12.

Ether to follow Bitcoin

Chicago Mercantile Exchange Group is set to launch a new investment product. In an announcement published on Thursday, August 18, the group says:

Looking for a new opportunity to add the flexibility of options to your cryptocurrency portfolio? Meet CME Group’s Ether options, launching Sept. 12. https://t.co/yHc3s6oL9h pic.twitter.com/wlKTGNyE5K

— CME Group (@CMEGroup) August 18, 2022

“Looking for a new way to add option flexibility to your cryptocurrency portfolio? Meet CME Group’s Ether Options, launching September 12.”

Accordingly, and based on a regulatory review, Ether futures options are set to have their launch three days before the scheduled update The Merge. We wrote about The Merge itself and its newly set date in an article titled: “Coming soon: ETH developers push back the Merge date”. The event is currently driving ETH trading and bringing a real revolution to the second largest cryptocurrency. If you are not yet familiar with it, be sure to read and learn more.

The launch of Ether options is the next natural step in the development of trading on the CME. So far, the exchange has Bitcoin (BTC) and Ether options (since March 2022), BTC options trading products (since January 2020) and BTC futures (since December 2017).

Growing interest in ETH

News of the CME’s new investment opportunities coincides with the pending implementation of the merger of the Proof of Work and Proof of Stake consensus on the Ethereum network. CME Group’s head of equity and FX products, Tim McCourt, says this. In doing so, he points out that this is a response to an increase in trading volume and interest in ETH futures:

“I have seen increased activity in our September and December Micro Ether options, which may also suggest that participants are hedging risk around the proposed merger date. 78% of the open interest in Micro Ether options is in the September and December contracts.”

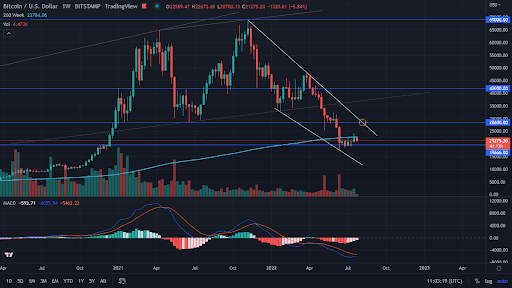

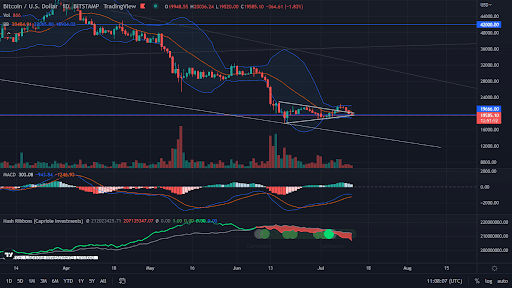

Ether on the minds of many investors

CME Group reported a 7% increase in the average daily trading volume of ETH futures contracts. Micro ETH futures, on the other hand, boasted an increase of up to 41%. This occurred in June and July alone. Meanwhile, ETH, in anticipation of The Merge, is experiencing a real rally on its chart. We wrote about it in our last analysis. If you want to learn more, be sure to take a look at this article: “Bitcoin at an important decision point, what Ethereum and the altcoin market have to say about it.”