Traditionally listed cryptocurrency exchange Coinbase, has agreed to a settlement with the US regulator. As a result, the platform is to pay a huge fine, as well as support the AML program with $50 million.

Coinbase case settlement

The New York State Department of Financial Services (NYDFS) has reached a major settlement with the Coinbase exchange. On January 4, a decision was reached that the exchange will pay a $50 million fine and invest the same amount in improving its compliance program.

The subject of the dispute between the institutions was New York State’s financial services and banking regulations. According to the regulator’s representatives, the exchange faced a number of problems regarding compliance deficiencies with anti-money laundering (AML) requirements.

NYDFS representatives comment on the matter with these words:

“Coinbase has admitted its deficiencies in this regard to the Department. Moreover, some of these issues had been known to Coinbase since at least 2018, flagged through both internal assessments and external reviews, including examinations by the Department. While Coinbase has worked to correct these issues, its progress has been slow: progress in some areas did not occur until recently, and work remains unresolved to date.”

Unsatisfactory level of verification of customers’ identities

One of the exchange’s main problems was said to be the processes involved in creating new user accounts. According to representatives of the Department of Financial Services, the rapid growth in the number of users of the exchange, at some point, became a hindrance. Newly opened accounts were not sufficiently verified, which had a direct impact on AML violations. According to the New York regulator, as many as 100,000 transactions may have been affected, which were called alerts during the investigation.

Coinbase’s chief legal officer, Paul Grewal, also summed up the case:

“We are proud of our commitment to compliance, but we are also ready to acknowledge where we fell down, including paying fines and working hard to fix the problems.”

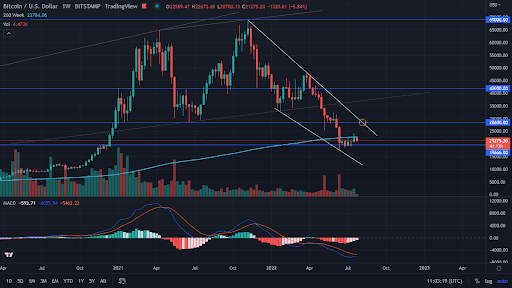

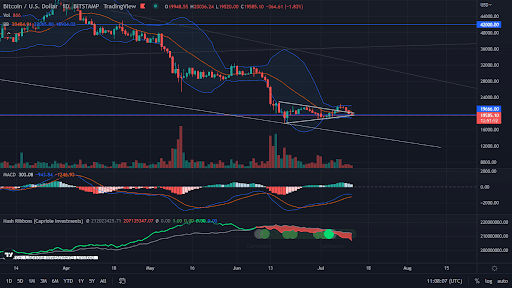

Coinbase overtakes Bitcoin in terms of growth

The publication of this news triggered a real rally in COIN shares. In just a few hours after the verdict, the company’s value rose 13.1%. Compared to the cryptocurrency market, including Bitcoin itself, this result is downright fantastic. Nevertheless, COIN still remains nearly 91% below its All Time High. Its price at the time of this writing is exactly $38.18.