Despite popular opinion, cryptocurrencies were not expected to influence the final collapse of three US banks. This is the opinion of the Treasury Department’s Undersecretary for Finance. Meanwhile, Martin Gruenberg reports that the FDIC plans to return $4 billion in Signature cryptocurrency deposits soon.

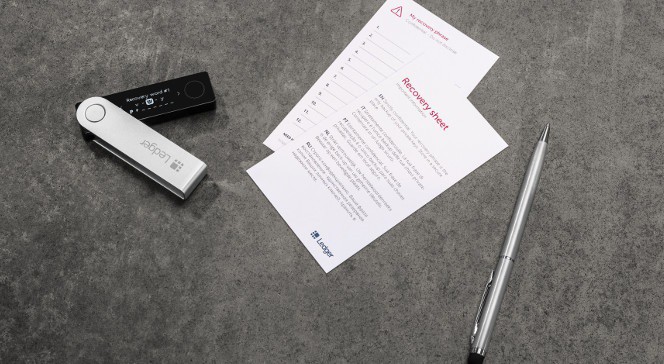

Return of crypto-related deposits

Martin Gruenberg, chairman of the Federal Deposit Insurance Corporation, has announced that the FDIC plans to return some $4 billion in deposits related to Signature Bank’s digital asset banking business. This is expected to take place no later than early April.

At a March 29 hearing before the House of Representatives Committee on Financial

Services, which is investigating federal regulators’ responses to recent banking collapses, Gruenberg said deposits that were not included in New York Community Bancorp’s bid for Signature would be returned “early next week.” The case involves as much as $4 billion in deposits related to digital assets, and reports indicate that the FDIC will close all cryptocurrency-related accounts that are not part of the NYCB deal by April 5 if depositors do not move their funds.

Gruenberg stressed that Signature’s payment platform, Signet, along with deposits of digital assets were not included in the NYCB’s offering, but were “currently being marketed” to potential buyers. The FDIC, along with New York financial regulators, closed the cryptocurrency-friendly bank on March 12, citing risks to the U.S. economy following the collapse of Silicon Valley Bank and Silvergate Bank.

Cryptocurrencies exempt from prosecution

In a hearing on the collapse of U.S. banks, Nellie Liang, Under Secretary for Domestic Finance at the U.S. Treasury Department, expressed her views on the role of cryptocurrencies in the collapse of Signature and Silicon Valley Bank. She said she does not believe cryptocurrencies played a direct role in their failure:

“Although I know that Signature had activities related to digital assets, I don’t think this is the main cause.”

The March 29 hearing was the second in which Liang, FDIC Chairman Martin Gruenberg and Fed Vice Chairman for Supervision Michael Barr spoke before lawmakers about the banks’ collapse. The previous one took place the day before, on March 28, during which Gruenberg claimed that Silvergate Bank had mismanaged risks, which ultimately resulted in its collapse.

Government battle between supporters and opponents of cryptocurrencies

While some lawmakers and regulators appear to be suggesting that banks join forces with digital asset companies, many have criticized the merger, finding it without merit. Barney Frank, a former member of the House of Representatives, believes that officials are trying to incite “a very strong message against cryptocurrencies.” The claim that the bank had no solvency problems at the time of its closure, in his view, is meant to serve that narrative. However, as some commentators note, the attempt to undermine the credibility of cryptocurrencies by overly linking them to banks is purely artificial.