The CEO of popular stock and cryptocurrency trading platform Robinhood, has shared his thoughts on Dogecoin (DOGE). He notes that the meme coin could become the native currency of the Internet.

Plan ready, time to implement

Vladimir Tenev shared on Twitter with his 200,000 followers a scenario that could give Dogecoin a very wide range of possibilities. As he writes in the introduction of his monologue:

Can #Doge truly be the future currency of the Internet and the people? As we added the ability to send/receive DOGE on Robinhood, I’ve been thinking about what that would take.

— VLAD (@vladtenev) April 14, 2022

“Can Doge really be the future currency of the Internet and the people? As we added the ability to send/receive DOGE in Robinhood, I wondered what that would mean.”

He points primarily to the need for low transaction fees that would make such adoption meaningful. He notes that this aspect is already in place for DOGE:

First off, transaction fees have to be vanishingly small. We’re already there. As of last Nov’s 1.14.5 update, typical transaction fees have been ~$0.003 – which you can experience on @robinhoodapp – compared to the 1-3% network fees that major card networks charge. pic.twitter.com/KHk83nDaek

— VLAD (@vladtenev) April 14, 2022

“First, transaction fees must be negligible. We have already achieved this. Since the 1.14.5 update last November, typical transaction fees are ~$0.003 – which you can check on the RobinhoodApp site – compared to 1-3% network fees charged by major card networks.”

However, the shortcomings of the dog coin have not escaped him. Network bandwidth plays a major role here:

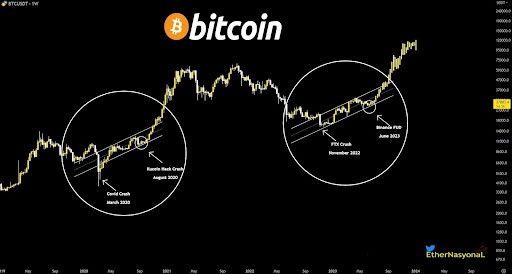

Currently, with a 1MB block size and 1 minute block time, Dogecoin’s throughput is about 40 transactions per second (tps).

— VLAD (@vladtenev) April 14, 2022

“Currently, with a block size of 1 MB and a block duration of 1 minute, Dogecoin’s throughput is about 40 transactions per second (tps).

He compares it to other known payment methods:

As a comparison, Visa’s network can theoretically handle 65,000 tps. Doge would need to be able to significantly outperform Visa, which entails increasing throughput by at least 10000x. Fortunately, this is easy to solve simply by increasing the block size limit.

— VLAD (@vladtenev) April 14, 2022

“By comparison, Visa’s network can theoretically handle 65,000 tps. Doge would have to be able to significantly outperform Visa, which means increasing bandwidth at least 10000 times. Fortunately, this problem can be easily solved by simply increasing the block size limit.”

In further words Vladimir Tenev calls for further development of Dogecoin, increasing its blocks to 1 GB and further up to 10 GB. He points out that this operation will not require a second layer.

He also addressed critics of Dogecoin, who often point to its infinite supply and the 5 billion new DOGEs created every year. According to Tenev’s calculations, the inflation rate in this case is close to 5%, which is currently lower than the inflation rate of the US dollar.