The richest man in the world, once again speaks out on cryptocurrencies. Moreover, he once again does so in positive terms. This time, he points to cryptocurrencies as a good way to hedge against inflation.

Elon Musk is not selling

Inflation has been reaching record levels recently. This applies to the United States as well as other, much smaller economies in the world. The biggest discussion related to this topic is in the United States, the most developed area with the most influential currency.

The billionaire CEO of Tesla and SpaceX, Elon Musk, also gave his opinion regarding this matter. He shared his thoughts on Twitter:

It is not entirely unpredictable that you would reach that conclusion

— Elon Musk (@elonmusk) March 14, 2022

“It’s not entirely unpredictable that you would come to this conclusion.

As a general rule of thumb, for those seeking advice in this thread, it’s generally better to own physical things like a house or stock in companies that you think make good products than dollars when inflation is high.”

Musk’s position is therefore clear – in the face of inflation, the dollar is not a safe haven, only a risk. Continuing he added:

“I still own and will not sell my Bitcoin, Ethereum or Doge.”

The last sentence in this tweet is what cryptocurrency holders have been hoping for the most. It is a strong voice of support for cryptocurrencies as a means of protection against the impoverishment caused by the increasing pressure to raise prices and weakening of the purchasing power of traditional money.

It has been known for over a year that Elon Musk, as well as Tesla, own Bitcoin. Musk’s involvement with Dogecoin and the sizable stock of Dogecoins he owns are also obvious. His son, who received a DOGE wallet from his dad when he was still a young child, is also a DOGE breeder. Ethereum, on the other hand, may come as a surprise, as Musk so far has not particularly bragged about it.

Michael Saylor responds

The discussion in which cryptocurrencies were cited as a hedge against inflation called to the board another well-known, great investor in Bitcoin – Michael Saylor. He responded to Musk’s opinion as follows:

Better to own scarce, desirable assets than currency derivatives in times of inflation. We agree on the general principle. The challenge lies in sorting out which things (including physical property, digital property, & corporate equity) are most scarce & desirable over time.

— Michael Saylor⚡️ (@saylor) March 14, 2022

“In times of inflation, it is better to own scarce, desirable assets than currency derivatives. We agree on the general principle. The challenge is to figure out which things (including physical property, digital property, and corporate capital) are most rare and desirable over time.”

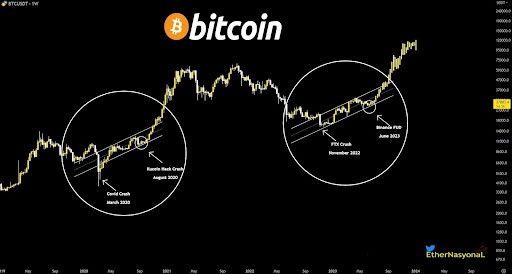

Meanwhile, both Bitcoin and the cryptocurrency market as a whole have been steadily losing value since the beginning of the year. Is rising inflation likely to reverse this trend and protect investors from losses? Take a look at the analysis section to see what may await Bitcoin in the near future.