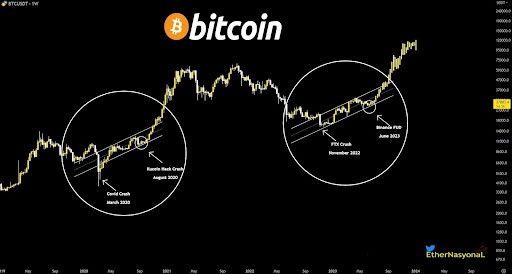

Another correction, another opportunity? Many think so, and among them are Salvadoran President Nayib Bukele and MicroStrategy CEO Michael Saylor.

El Salvador does not slow down

Black Friday has become a real occasion in the crypto market. While Bitcoin took an 8.8% dive that day, El Salvador’s President Nayib Bukele, once again commissioned the purchase of BTC for his national portfolio. Thus, he acquired another 100 pieces of the largest cryptocurrency.

Recall that this small country from the Central American region, is the first to adopt Bitcoin as legal tender. This took place in September of this year. Since then, every market correction is perceived by President Bukele as a buying opportunity. In the face of this, El Salvador’s treasury is estimated to hold around 1220 BTC.

MicroStrategy is also buying

El Salvador was not the only one to perceive the correction as an investment opportunity. MicroStrategy did the same. The company managed by Michael Saylor has made massive purchases totaling as much as 7002 BTC. The investment was announced on Twitter by the interested party himself:

MicroStrategy has purchased an additional 7,002 bitcoins for ~$414.4 million in cash at an average price of ~$59,187 per #bitcoin. As of 11/29/21 we #hodl ~121,044 bitcoins acquired for ~$3.57 billion at an average price of ~$29,534 per bitcoin. $MSTRhttps://t.co/OA8VWG1bZX

— Michael Saylor⚡️ (@saylor) November 29, 2021

MicroStrategy has been the publicly traded company with the largest proprietary BTC holdings to date, and increasing them only solidifies the company’s leadership position. It didn’t take Michael Saylor particularly long to reach this level at all. As he himself declared at this year’s conference in Miami, he made his first purchases in June 2020.

Since then, Saylor has steadily acquired new coins while focusing exclusively on Bitcoin. His portfolio has grown, benefiting from virtually every market correction. Saylor himself has become the face of the 2020/2021 bull market, holding multiple conferences for potential investors.

MicroStrategy is raising money for purchases by issuing new bonds, among other things, and Saylor declares that neither he nor the company, no matter what happens to the price of BTC, will ever sell their own funds.

A bullish signal for the market?

Both Salvador and Microstrategy’s portfolios are among the market’s whales. The moment in which these accumulate is usually a signal suggesting the possibility of further increases in the value of Bitcoin to come. So will this be the case and will we see a dynamic price movement in the last month of the year? We will soon find out.