Software company MicroStrategy announced that it has upgraded its covered bonds from $400 million to $500 million, bearing interest at 6.125% and maturing in 2028. The firm has received a large number of orders totaling $1.6 billion from hedge funds, which also prompted it to update its pricing. According to a release issued by the firm, the bonds are to be “fully and unconditionally guaranteed on a senior secured basis.” MicroStrategy intends to use the funds raised to purchase Bitcoin (BTC). It seems that MicroStrategy’s main investors have been aiming for more cryptocurrencies all along. After all, the secured bonds issued by the company have sold out at an alarming rate!

MicroStrategy Buys Bitcoin (BTC)

While MicroStrategy has been investing in Bitcoin since as early as 2020, the real trend of buying this cryptocurrency started back in early 2021. It also looks like the company sensed a good time to invest in BTC – since 2020, the value of Bitcoin has increased by as much as 400%!

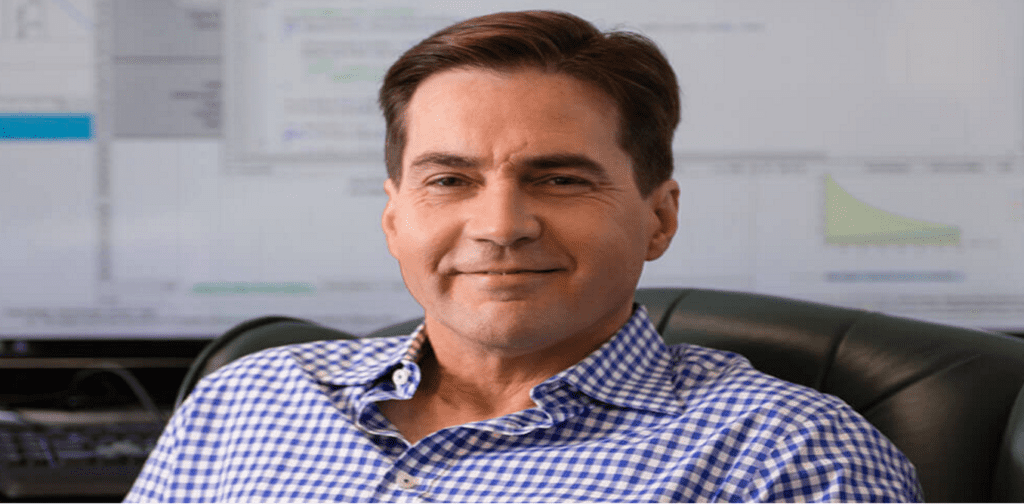

In Q1 2021 alone, MicroStrategy purchased as many as 20,857 Bitcoins, which is in line with the company’s growth plan outlined by its CEO, Michael Saylor. He claims that Bitcoin will fully dominate the 21st century, and that there are no factors that threaten its existence. Michael Saylor also believes that Bitcoin is an emergency as well as a strong asset that is perfect for storing value in the 21st century.

Michael Saylor is one of the largest investors in the Bitcoin market. He has personally invested as much as $175 million in this cryptocurrency! In an interview with tcnTV station, Saylor stated that with the current macroeconomic conditions, Bitcoin is becoming one of the most valuable assets in the world.

Strategy for the future

By buying more Bitcoin, MicroStrategy wants to generate additional value for its shareholders. As of today (June 15, 2021), MicroStrategy’s stock is trending upwards, and in the last 24 hours it has risen as much as 5.17%. The market capitalization of the company is about 5.68 billion dollars, of which more than half, because 3.5 billion, is stored in Bitcoins.

So far Michael Saylor has been consistently implementing his strategy. The company intends to use the profits from the sale of secured bonds to buy new Bitcoins. In a statement released by MicroStrategy we can read that a new entity named MicroStrategy LLC will be created specifically to hold this cryptocurrency. The same statement also mentions the creation of another subsidiary, MicroStrategy Services Corporation.