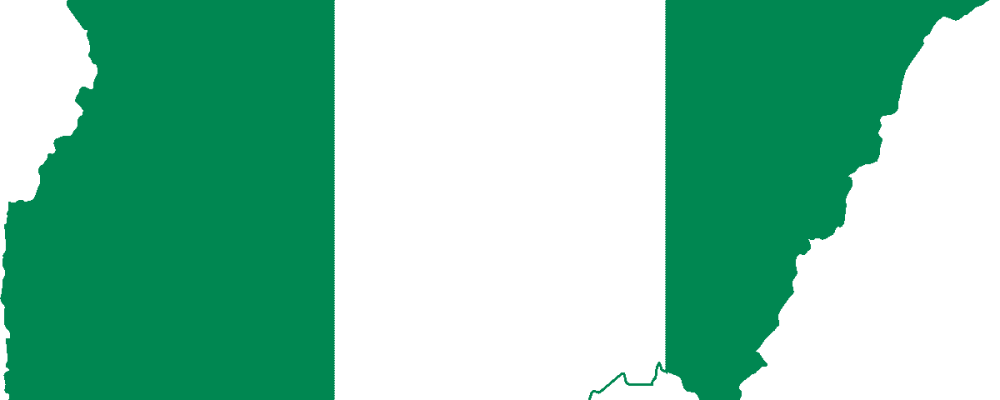

Central bank digital currencies, or CBDCs (Central Bank Digital Currency) are cryptocurrencies issued by government bodies that are closely tied to the fiat currency of the issuing country. This is in contrast to traditional cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH), which are not tied to any central authority that controls them. The government of Nigeria, the largest economy in Africa, recently decided to introduce such a currency. Nigeria is one of the first countries in the world to make this move. We talk about how this digital currency will work and why Nigeria wants to introduce it below.

Augment GDP by adopting digital currency

On Monday, October 25, 2021, Nigeria’s President Muhammadu Buhari, in his inaugural address, enunciated that: “Nigeria has become the first country in Africa and one of the first in the world to introduce a digital currency for its citizens.” The currency in question is the eNaira, a digital version of the naira, the official currency of Nigeria. The eNaira is designed to be a complement to the classic naira, which has weakened by as much as 5.6% in 2021 – even despite the Central Bank of Nigeria’s efforts to stabilize it.

The president argues the introduction of the eNaira token is because the token will contribute to Nigeria’s GDP growth. Here is what he said: “The adoption of the Central Bank’s Digital Currency and the underlying blockchain technology could increase Nigeria’s gross domestic product by $29 billion in the next 10 years.”

The eNaira platform is integrated with 33 banks operating in the country and to date, 500 million tokens have been successfully minted, equivalent to $1.2 million. The Governor of the Central Bank also confirmed that so far eNaira has served more than 2000 customers. Another important fact is that the government guarantees that one eNaira will always be equal (and exchangeable) for one naira.

Consequences of the introduction of eNaira

As we have already mentioned, the Nigerian government declares that the introduction of eNaira is expected to boost Nigeria’s GDP growth. But let’s consider – how is this supposed to happen? The Central Bank asserts that the digital currency is expected to boost cross-border trade and financial integration as well as streamline transactions and improve monetary policy. It is also supposed to encourage businesses to stop operating in the “grey market” and instead, use eNaira so that their transactions are recorded.