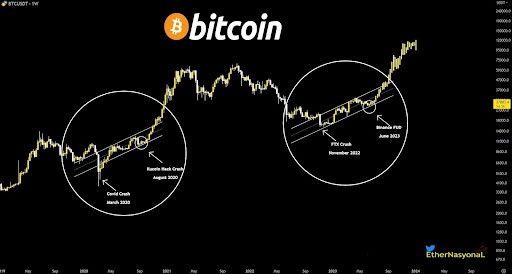

More than 50,000 Bitcoin that have been confiscated by US law enforcement agencies over the past few years have just changed their addresses. The lion’s share of them ended up on the Coinbase exchange.

Major government Bitcoin reshuffle

Huge Bitcoin transfers were detected between the 7th and 8th days of March. They involve more than 50,000 BTC, with a total value of more than $1 billion. These coins are well known to the market. This is because they are Bitcoin holdings that were held in various wallets owned by US law enforcement agencies. They come from seizures that have been made over the past few years. These primarily concerned the market known as Silk Road.

Most of these Bitcoins were consolidated into two new addresses. However, it turns out that a huge portion, amounting to exactly 9,861 BTC went to the Coinbase exchange. It can therefore be assumed that they will be liquidated in the near future. This information was confirmed by the analytical company PeckShield.

Silk Road and its history

2011 was a time when Bitcoin was still a very poorly recognized invention. That was the year that Silk Road, a modern black market, was founded by Ross Ulbricht, better known by his nickname “Dread Pirate Roberts.” It was this space that was one of the first to favor BTC, while accepting payments in this cryptocurrency. He undoubtedly contributed to the popularization of the solution. Silk Road was, of course, noticed by US law enforcement agencies. The use of Bitcoin, due to its presence in just such a space, contributed to the temporary weakening of the cryptocurrency’s image. Over time, the relevant institutions managed to confiscate many items belonging to the founder of the Silk Road, including a huge stock of BTC. These were later put up for auction.

A great beneficiary of these was, for example, the popular crypto proponent Tim Draper, who bought almost 30,000 BTC in 2014. Another sizable auction took place in 2015, when nearly 50 BTC were put up.

A situation unlike any other

Despite the fact that the trade in seized Bitcoins has taken place more than once, the market seems to be genuinely concerned about the current movements. Therefore, it is not surprising. Bitcoin is currently in a deep slump, with relatively little liquidity, which could mean that a small drop would trigger serious price drops. Fortunately, less than 20% of the government’s holdings were sent to the exchange. The remaining 40,000-plus BTC are most likely waiting for better times.