A new budget proposal authored by U.S. President Joe Biden hits the cryptocurrency sector, and mainly Bitcoin, very hard. One gets the impression that it is characterized by a great deal of injustice, as well as stigmatization of the area of virtual assets.

New tax will hit cryptocurrencies

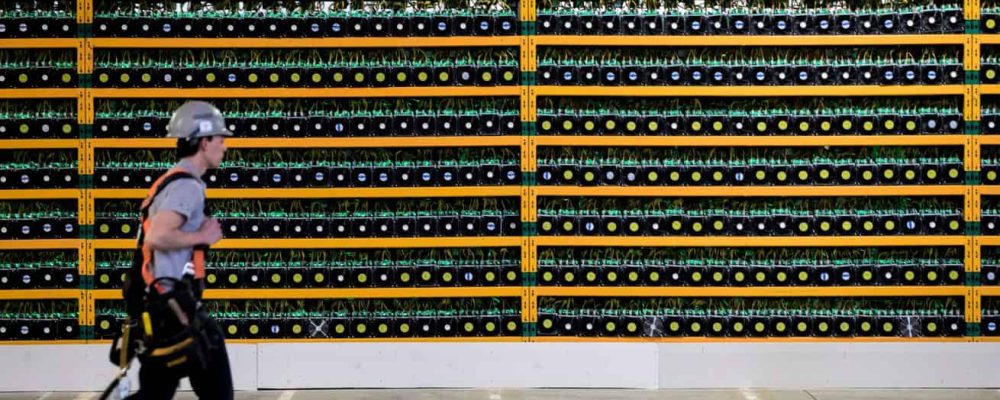

It is still undecided whether Joe Biden’s new proposal, which saw the light of day on Thursday, March 9, will go into effect. However, it is drastic for the cryptocurrency market, and mainly Bitcoin, whose mining in the United States is widespread. Meanwhile, according to the latest assumptions, the sector could be hit by a huge tax, which could become a real challenge for many mines.

The new tribute will total 30% and will be phased in over a period of 3 years, starting at the beginning of the new year. It is to cover electricity from both on-grid and off-grid sources. As the contents of the official document report: “each company using resources will be subject to an excise tax equal to 30% of the cost of electricity used in the mining of digital assets.”

The proposal to phase in the tribute would result in a tax of 10% when the law is implemented. With each subsequent year, that 10% would be increased by another, and so on until the previously assumed level is reached.

Cryptocurrencies to the detriment of the environment

The Treasury, justifying the possible introduction of such a burden, stated that “cryptocurrency mining operations have a negative impact on the environment.” This would also translate into increased prices and create uncertainty for local utilities, both public and social.

It is difficult not to resist the impression that such a narrative significantly detracts from the cryptocurrency market, pointing to its lesser importance to the economy. For those unconnected to the market, it may even suggest that cryptocurrencies, are merely a pastime that is irrelevant in the real world, and merely an unnecessary burden. This kind of stigma has the right to act as a brake on the momentum of adoption.

Cryptocurrency taxes next target for Biden

On March 9, the White House issued a statement confirming the search for a way to end the tax strategy on cryptocurrency transactions, which would raise an estimated $24 billion.

Currently, cryptocurrency investors have the option to sell their digital assets with negative earnings to minimize taxes – known as “tax-loss harvesting” – and immediately redeem their cryptocurrencies.

The new rules would harmonize tax rules for cryptocurrency trading with those for stocks, where the practice of wash sales is not allowed.