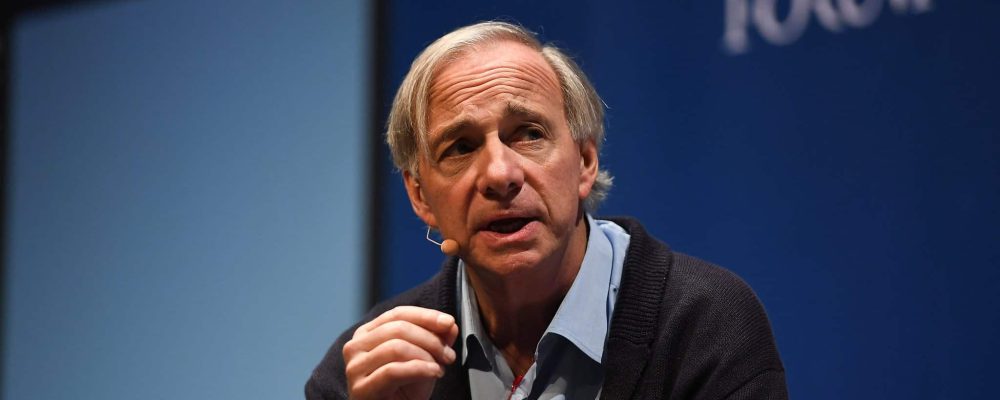

According to the well-known investor and founder of hedge fund Bridgewater Associates, money as we know it so far is in danger. Bitcoin, on the other hand, has not done well as its replacement. Is this the end of Dalio’s fondness for the cryptocurrency market so far?

Dalio criticizes the traditional financial system and Bitcoin

Ray Dalio, is one of the big financial figures who over the past few years has been quite optimistic about the cryptocurrency market, with Bitcoin at the forefront. In turn, he noted a number of shortcomings and mistakes that are being made in the segment of traditional finance. In doing so, he paid particular attention to the massive printing of money, which also became the subject of his commentary this time.

The founder of Bridgewater Associates, on Thursday, February 2, was a guest on CNBC’s Squawk Box. On that occasion, he expressed doubt about whether the printing of the U.S. dollar, and other global reserve currencies, makes them “effective money.” To quote his words:

“We are in a world where money as we know it is under threat. We are printing too much, and it’s not just the United States, it’s all reserve currencies.”

Complementing his statement, Dalio turned to Bitcoin supporters and announced:

“It will not be effective money. It is not an effective way to store wealth. It is not an effective means of exchange.”

Time for new coin

Dalio was equally skeptical about stablecoin, which he believes is a replica of a fiat currency backed by a country. The problem presented, however, was not left alone. The well-known investor went a step further and suggested that the world is looking forward to a new coin that would be linked to inflation. It would aim to preserve the purchasing power of consumers. He also pointed out that a similar product already exists:

“The closest thing is an inflation-indexed bond, but if you created a coin that says OK this is the purchasing power that I know I can save and put my money over a period of time and transact anywhere, I think it would be a good coin.”

He then turned again to what the cryptocurrency market currently represents, and added:

“So I think you’re going to see the development of coins that you haven’t seen, which will probably end up being attractive, profitable coins. I don’t think Bitcoin is that.”

Expecting the impossible

Dalio’s words resonated with many. One person who decided to comment on them was digital asset manager Eric Weiss. He presented his point of view on Twitter:

“According to Ray, Bitcoin is very close to being the solution to the world’s problems, but it is too volatile. He is waiting for and vaguely describes a solution that does not and cannot exist.”

It is worth noting at this point that Ray Dalio’s views on Bitcoin have changed. As recently as January 2021, he pointed to BTC as a “hellish invention” that could save the world from inflation. However, time has verified his views to the detriment of the cryptocurrency.