Bitcoin in early 2023 has already risen by more than 78%, far outpacing the potential gains that could have been seen in traditional markets. This is noted by the famous investor Anthony Scaramucci, who says that anyone who can afford a period of 4 years of patience always has a reward waiting.

Bullish about Bitcoin

Anthony Scaramucci, founder of SkyBridge Capital, believes that the cryptocurrency market still has a lot to offer. In an interview with Yahoo Finance on April 6, Scaramucci said that while it’s impossible to be certain, he believes “we’re still in the midst of a bear market,” which presents a good opportunity for his company to invest in cryptocurrencies. At the same time, Scaramucci admitted that this is only his assumption, not a certainty. Nevertheless, he noted that bitcoin has outperformed every other asset class over longer periods of time. As he states:

“In every four-year interval that you held Bitcoin, you outperformed every other asset class.”

Scaramucci also expressed his bullish outlook for the leading cryptocurrency by market capitalization ahead of the next halving cycle, due in early March 2024. He believes this could boost Bitcoin’s value, which will benefit investors.

Halving driving force behind BTC’s value growth

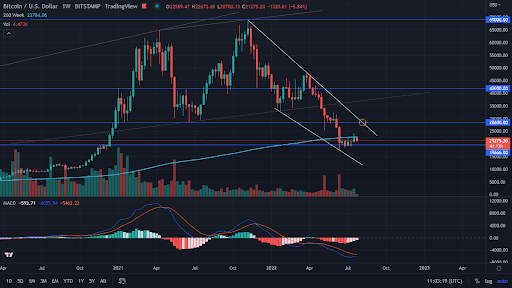

Bitcoin is a cryptocurrency that operates in four-year cycles, each of which begins with halving. Halving in practice means that the block reward for mining during the event is halved, which directly reduces the mining market supply.

In 2023, Bitcoin experienced an increase of more than 78%, reaching $29,380. By comparison, the famous S&P 500 index is up just over 7%. This is an impressive achievement, especially since it took place in a difficult market and regulatory environment that could have negatively affected the price of cryptocurrency.

Cryptocurrency market strength

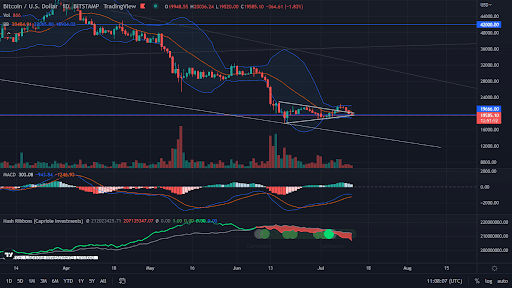

The inspections by regulators that the world’s two largest crypto exchanges recently faced did not negatively affect sentiment in the cryptocurrency world. Coinbase received a notice from the Securities and Exchange Commission for possible enforcement action, while Binance was sued by the Commodity Futures Trading Commission for alleged violations of trading and derivatives rules.

Despite these challenges, Bitcoin continues on its path and remains an important asset for investors interested in the future of digital currency.

And if you are interested in what may await Bitcoin in the near future, we invite you to read our most recent analysis, titled: “Bitcoin is constantly hitting resistance, is it time to overcome it? Let’s find out!”.