Two alternative coins, Solana (SOL) and Avalanche (AVAX), are gaining increasing interest and are successively attracting the attention of investment funds. Although bitcoin (BTC) remains the main focus, altcoins are gaining attention.

Solana and Avalanche with significant capital inflows

According to the latest report, funds continued to flow into cryptocurrency mutual funds in the past week, with particular investor interest focused on Solana and Avalanche. According to CoinShares, funds investing in these two cryptocurrencies received $3 million and $2 million, respectively.

The recent surge of interest in Solana, which is the sixth-largest cryptocurrency by market capitalization, and Avalanche began back in November. The move was related to the involvement of large companies in both networks. J.P. Morgan announced the use of the Avalanche blockchain to tokenize wallets, while Visa and Shopify declared recent use of the Solan blockchain.

Significant increases in the value of SOL and AVAX

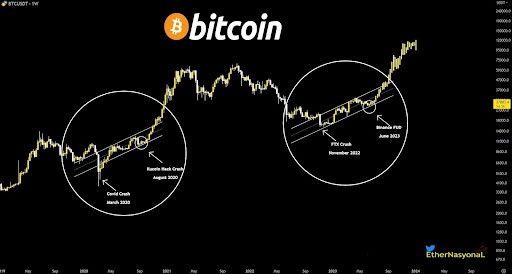

SOL is currently trading in the neighborhood of $69.00. As a result, the cryptocurrency has gained 15% over the past week. AVAX, on the other hand, has gained as much as 66% over the past seven days, reaching $36.25.

CoinShares reports that investment products related to digital assets have recorded their eleventh consecutive week of inflows, totaling $43 million. They include institutions such as 21Shares, Bitwise and Grayscale.

Although interest in Bitcoin remains strong, investors are definitely turning their attention to other cryptocurrencies. According to CoinShares, last week’s inflows into Bitcoin-related products totaled $20 million, bringing the total investment in such products to $1.7 billion.

Ethereum is also gaining ground

A report on Monday noted that the renewed interest in Ethereum, the second-largest cryptocurrency, was a “remarkable turnaround.” While it wasn’t long ago that investors were withdrawing ETH-related funds, creating an outflow of $125 million since the beginning of the year, there is now a spike in interest. Ethereum funds have recorded deposits totaling $19 million this year.

The return of large investors to the world of cryptocurrencies is a reaction to analysts’ predictions about the likely approval of a Bitcoin exchange-traded fund (spot ETF) in the coming months. Such a product would allow traditional investors easier access to the world of cryptocurrencies, in a regulated and seamless manner.

As a result, the price of Bitcoin has seen a rise this year, and altcoins are gaining interest.