Very positive news is coming from the world’s largest hedge fund. Bridgewater Associates is preparing to invest in the cryptocurrency sector. The first target is an external entity specialized in crypto.

A serious player

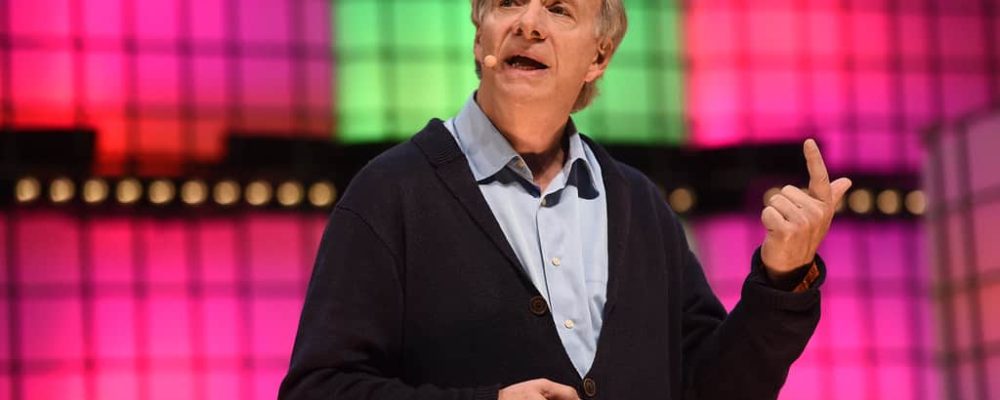

Bridgewater Associates is the largest hedge fund in the world with $150 billion under management. Its founder is Ray Dalio who is also well known in the cryptocurrency space. At one time, he was eager to speak out about Bitcoin, suggesting in May 2021 that he owned it himself.

According to Bridgewater Associates representatives, the fund does not plan to enter the cryptocurrency space directly. Its presence is expected to be indirect and will begin sometime in the first half of 2022. The investment is supposed to be in an as yet undisclosed entity closely related to the industry. Back in February of this year, a representative of the fund confirmed it in these words:

“While we will not comment on our positions, we can say that Bridgewater is still actively exploring cryptocurrencies, but currently has no plans to invest in this sector.”

There are well-known investors in talks with the fund, who have shown their willingness to put money into the new initiative. Probably, they want to take advantage of Bridgewater Associates’ reputation and thus diversify their investment portfolios.

Modest beginnings, great effects

Bridgewater has its headquarters in Connecticut, US and its beginnings date back to 1975. Founder Ray Dalio is a graduate of Harvard Business School. He took his first steps with the company in his Manhattan apartment. The business grew rapidly, achieving spectacular global success. The constant growth makes the fund interested in the cryptocurrency space. In the longer term, it does not rule out directly allocating some capital to digital assets. However, this move is preceded by a series of extremely precise analyses. According to people gathered around the fund, the company is conducting a deep research on liquidity and service providers. The interest in cryptocurrencies on the part of Bridgewater Associates should not come as a surprise, as Dalio himself noted in one of his interviews that in his opinion Bitcoin is “a hell of an invention”.

For the cryptocurrency market, such information is another signal of credibility. Recognition of the potential of digital assets like Bitcoin by a powerful hedge fund strengthens the foundation of crypto. It is also opening the door to investors with very sizable portfolios.