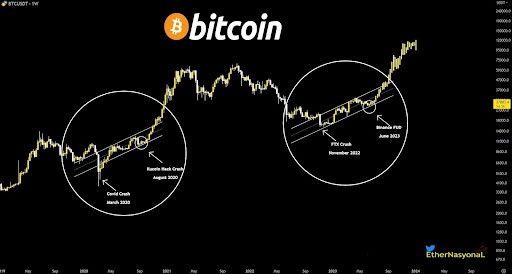

One of the largest retail banks in the United States confirms the launch of a custody service for customers holding Bitcoin, Litecoin and Bitcoin Cash.

US Bank and NYDIG collaboration

US Bank customers in the Cayman Islands and the United States will be able to take advantage of a new service from now on, according to an October 5 publication. Through a partnership with New York Digital Investment Group, the bank will provide private key storage for its customers who have decided to purchase assets such as Bitcoin, Litecoin and Bitcoin Cash. As the bank’s representatives point out, both the offer and the provider network may be expanded soon.

For now, the service is directed to institutional clients with private funds in their resources. According to Gunjan Kedia, Vice President of Wealth Management and Investment Services of US Bank, the interest in the cryptocurrency industry, among investors, has significantly increased, so the Bank decided to meet them:

“Our clients, in the form of funds and trust institutions, have accelerated their plans to provide cryptocurrency services, making it a priority for us to accelerate our ability to offer trust services in response.”

However, Gunjan Kedia pointed out that the uncertainty surrounding regulation around the crypto sector creates anxiety. For this reason, the Bank’s decision makers decided to partner with a reputable partner for whom both professionalism and security are important:

“Integrity and expertise are critical to protecting our clients’ most valuable assets, and we are pleased to offer NYDIG’s industry-leading Bitcoin expertise, backed by US Bank’s financial strength.”

Cryptocurrencies and banks – isn’t that a conflict of interest?

Combining traditional banking with the crypto segment (unless it’s a CBDC), raises many community concerns. After all, the essence of Bitcoin itself is decentralization and the elimination of intermediaries. Gunjan Kedia recognizes this and has made the point in her statements that crypto stocks cannot ignore the existence of third parties in the system. She also points out that fund managers need the support of more financial institutions to effectively address their clients’ concerns.

To some extent, this may represent a crack in the glass of the essence of cryptocurrencies. However, given that a sizable portion of the market is expecting mass adoption of them, this is a step that is not only necessary, but actually inevitable. Even more so in the U.S., where the tension that has been building around regulatory uncertainty can be completely quelled, thanks to heavy investment.