With the early 2021 surge in the cryptocurrency market, the discussion on whether Ethereum can surpass Bitcoin in terms of market capitalization has become heated. We are taking this topic on the road and will try to look at the substance of the discussion as well as its arguments.

Differences between Bitcoin and Ethereum

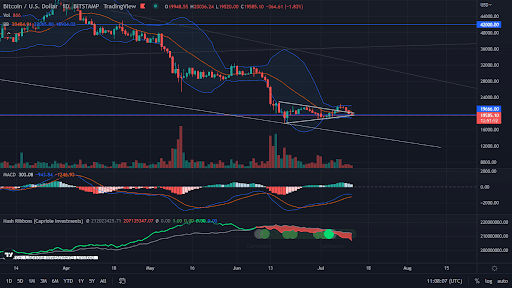

End of May 2021. Taking a look at coinmarketcap, we can see that the first-place Bitcoin has a market capitalization of just under $700 billion. Ethereum is right behind it and boasts a value already exceeding $300 billion. A seemingly huge difference, but as we know, not for the cryptocurrency world.

However, to talk about any race for the first position in the ranking, it is necessary to understand what both projects really are. So let’s visualize them in the simplest possible way.

Bitcoin (BTC) was created as a potential means of payment. It has become synonymous with financial freedom. Many companies and institutions use its form of purpose, but the narrative comparing Bitcoin to digital gold has taken hold. “Store of value” is the term most often heard in reference to the current occupant of the first position in all rankings. This very idea guides many institutions currently entering the cryptocurrency market.

Ethereum (ETH), on the other hand, finds many comparisons. One of the most reflective of its essence is putting it next to a platform like Amazon. As we know Amazon is one of the highest valued companies in the world. However, it is not an entity in its own right. In addition to its own products, it provides growth opportunities for many much smaller companies through its extensive logistics infrastructure. Its warehouses, platform and supply chains form a strong and growing network. The growth of the altcoin king looks similar. Ethereum is the platform on whose shoulders the DeFi base is built. It is through Ethereum that the popular ERC20 tokens are created, as well as some decentralized cryptocurrency exchanges.

As you can see, in this unofficial battle, projects with quite different characteristics are facing each other. Both are of great interest to investors, but each carries different values.

It is worth noting here that there are categories in which Ethereum has already managed to overtake Bitcoin. As of early 2021, it was reported that the number of addresses holding any part of ETH is 30 million higher than the number of addresses holding BTC.

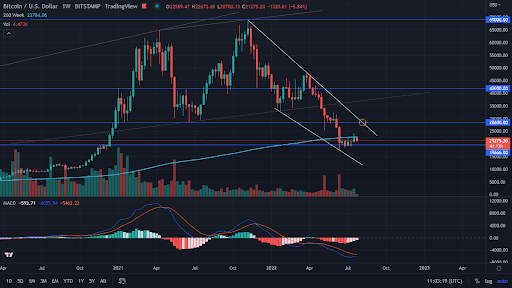

It is also interesting to see the growth of both coins, counting from the deepest bottom of the 2018 bull market. We can observe that Bitcoin has risen from $3,000 to a peak of just under $65,000. This gives a return on investment of over 2000%. At the same time, Ethereum boasts a progression of 5350% reflecting the movement from the level of $ 80 to $ 4.4 thousand.

Black horse of the competition

As you can see, both projects are characterized by different values and tasks. Every scenario seems likely here. Bitcoin has never left the first place in the capitalization rankings. Ethereum is showing a lot of strength at the same time, suggesting a willingness to fight for the dominant position. However, it is important to keep in mind what is happening behind their backs.

Cardano, in the face of the ubiquitous discussion about the amount of energy consumed by the Bitcoin network, may become a popular means of payment. At least that’s what its creator Charles Hoskinson suggests. The simultaneous update of Alonso, the launch of smart contracts and the application of a converter for ERC20 tokens, could in turn affect the position of Ethereum. It’s hard to talk about Cardano’s chances of topping the charts here. However, it is worth watching its movements, because in the fight between BTC and ETH, ADA can stir up a lot and add a little oil to the already heated rivalry. And as we know, where two fight, often the third one benefits.