Bitcoin’s bumpy road to new highs continues. This time, the macroeconomy gets in the way.

Is Evergrande a black swan?

In recent days, great confusion in the global financial markets is caused by the specter of the collapse of the company Evergrande. Shares of this Chinese developer, after changes in regulations governing the sector in China, in six months lost more than 80% of their value. This is due to the rapid development policy of the company, for which the new rules are a strong blow to its foundations. It is worth noting that the Chinese economic growth of more than 20% is based on the construction sector. The cultural awareness of China is based on values of ownership, mainly real estate. Such a strong interest in the segment results in a system of many financial and supply connections built around it, in which a breach of one domino block has the right to cause an unfortunate avalanche of events, spilling far beyond the borders of China. After all, we are talking about the second largest company of its kind in the country, whose debt has already reached $305 billion. This is the level recorded by medium-sized countries.

Meanwhile, September 23 is the deadline for Evergrande to repay a tranche of its $83.5 million debt. If the deal fails to materialize, trouble in global markets could worsen, sending the company into bankruptcy. Many customers, investors and creditors may not get their money back. Among the latter are such powerhouses as UBS, HSBC, or even indirect cryptocurrency investor Black Rock. There is conflicting information coming out of China about whether the government will want to support the giant and save both its own and the global economy. On the one hand, we hear that it will let Evergrande pay for its mistakes, and on the other, that it is talking to creditors and has already prepared a temporary support of $18.6 billion. The issue is so dynamic and the information is ambiguous that we are observing a real confusion on the financial markets. Emerging economies are being hit the hardest, but developed ones are also feeling the pain. Economists wonder if Evergrande is a black swan for the global economy. Just how does this relate to the cryptocurrency sector?

Bitcoin – dynamics on the chart

In times of crisis, high-risk assets lose the most. Investors first close their positions in them to escape to a safe haven, which for them is usually the US dollar.

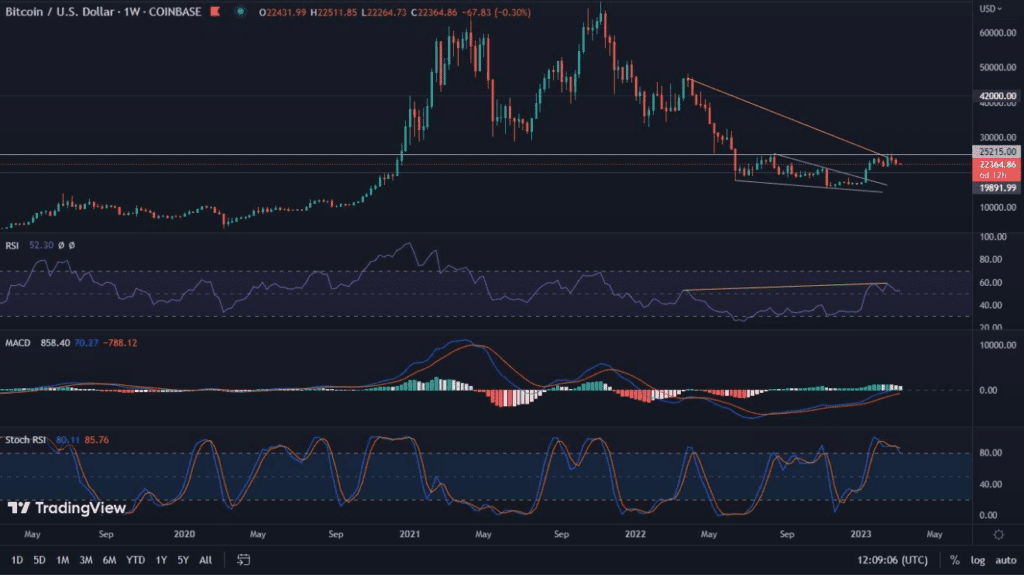

On the Bitcoin chart we observe a breakout of all the key levels. Both the 200-day moving average (yellow line) and the $42,000 level did not withstand the selling pressure. At the same time, we see BTC going beyond the Bollinger Bands, which may indicate short-term overly negative sentiment. The price action resulted in the formation of a falling pennant, which usually results in an upward breakout. It should be supported by the bullish divergence observed on the RSI (pink line).

From a technical point of view, we should expect a dynamic trend reversal and a contradiction of the lower highs and lower lows currently observed in order to get back on a steady upward trajectory.

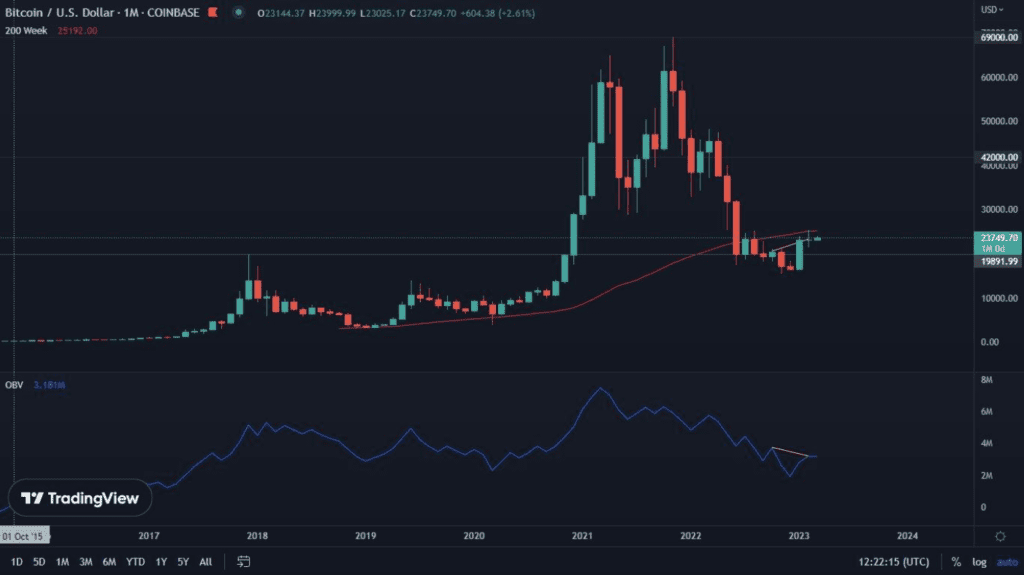

Bitcoin still on the right track

Meanwhile, PlanB, the creator of Bitcoin’s famous price model, Stock to Flow, reassures that the oldest cryptocurrency is still on the right track to reach a valuation in excess of $100,000 by the end of this year. As he points out, his prediction of BTC’s value for September even pointed to the vicinity of $43,000, only to truly explode in the last quarter and surpass the previously indicated magic mark. As PlanB says, the model on which he bases his valuation is the pessimistic option. So if Evergrande is kept afloat and nothing else disrupts the current cryptocurrency cycle, we may be in for some extremely strong gains soon.