Bitcoin, being in a corrective move, finds support in an important area. This gives a chance for another attack on higher price levels. In the meantime, a major event is taking place – the number of wallets holding a minimum of 1 Bitcoin reaches a special level.

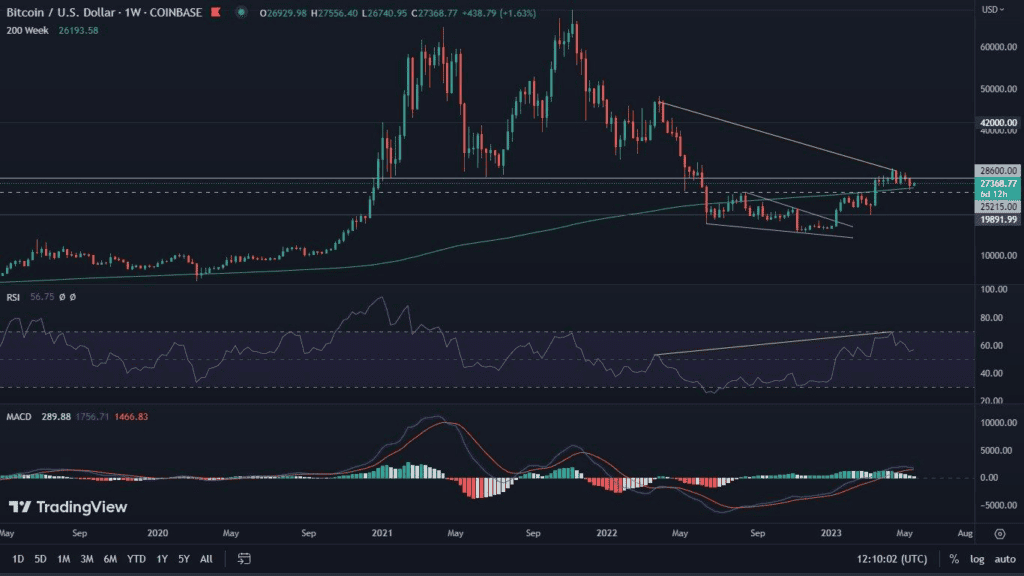

Bitcoin on the weekly chart

Observing the weekly chart, we can see that for the second time in a row Bitcoin has constructed a clear red candle on it. In doing so, the decline amounted to 5.4%. The RSI is steadily maintaining a bearish divergence, which, as we have mentioned many times, may continue to widen. It is interesting to note that the MACD marked weakening momentum for the fourth consecutive time, potentially heading towards a bearish cross. The last time this indicator was in the “red area” was last August. If the cross does indeed take place, it will happen after one of the longest periods in BTC’s history when the cryptocurrency was in a positive zone.

Looking for positives, on the other hand, we can see two. The first is the RSI value, noting a level of 55, which still indicates a definite bullish advantage. In addition, it is worth keeping in mind the 200-week moving average, which proved to be a significant bounce point for Bitcoin.

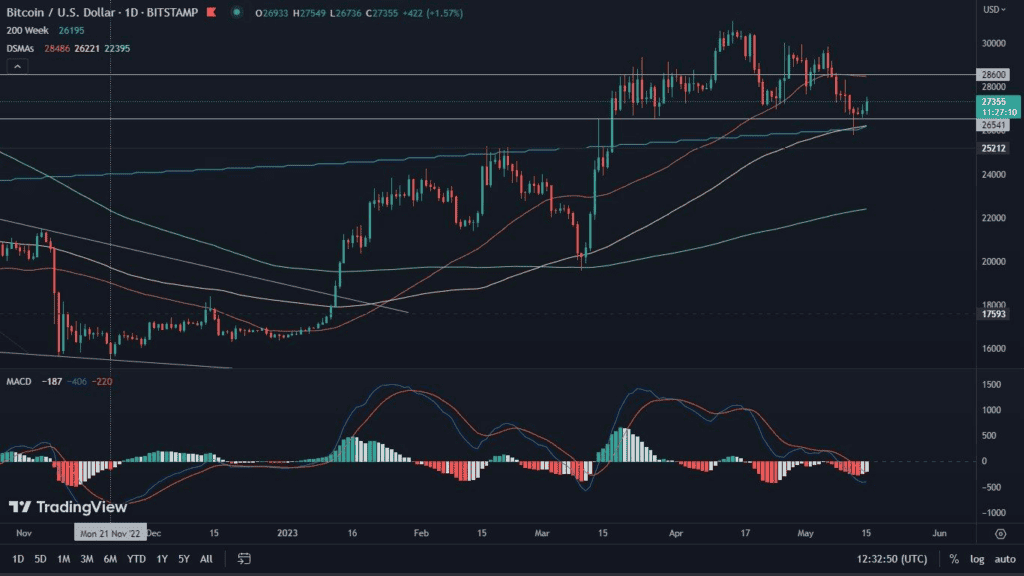

Bitcoin on the daily chart

To get an idea of where the price of Bitcoin is heading, it is worth taking a closer look at the situation on the daily chart. Here we have also considered the 200-week SMA (blue line), which coincides with the 100-day SMA (yellow line). This area allowed bitcoin to find support. Interestingly, the price itself went below the key level of $26,500, but encountering the aforementioned moving averages, it managed to rebound strongly and close above this area. Thus, there may have been a so-called false breakout, which further has the right to result in an attack higher. This scenario is supported by the MACD, which in this case finds bullish momentum. The area to watch is the price level of $28,600. This is not only horizontal resistance, but also the area around which the 50-day SMA oscillates. Possible declines could lead to a test of levels near $25,000.

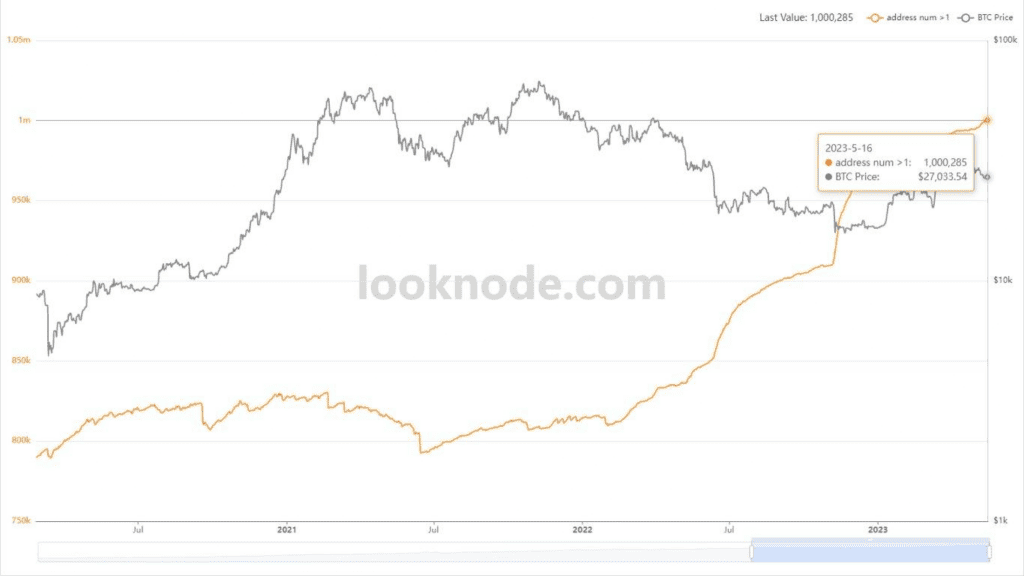

One million wallets hold a minimum of one whole Bitcoin

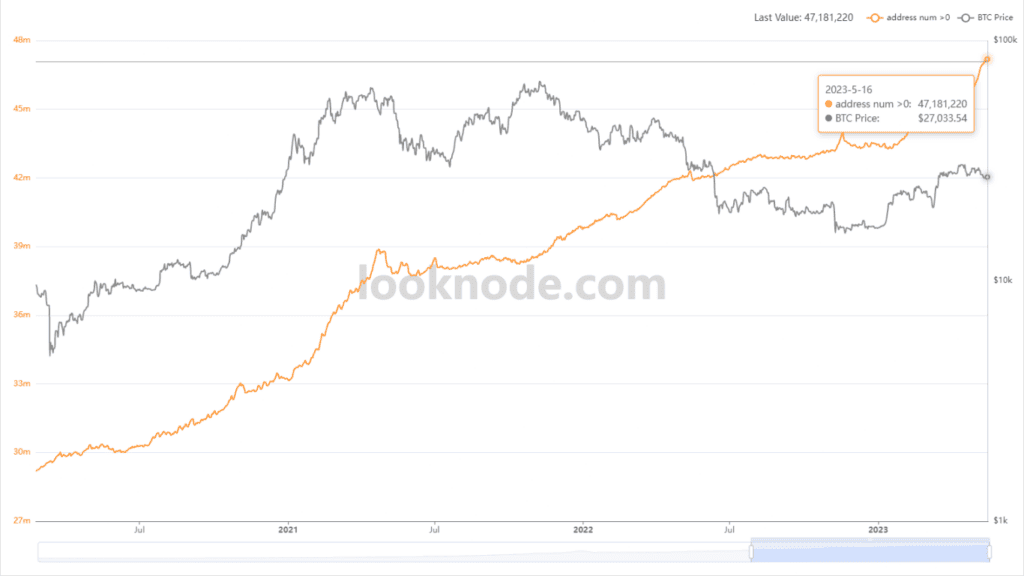

It’s worth stepping away from the technical data for a moment and looking at the on-chain situation. Well, a jubilee thing has happened in the Bitcoin network. Well, the number of wallets holding a minimum of one, all Bitcoin, on Tuesday, May 16, reached 1 million. This is confirmed by charts. In this case, we present data provided by the Looknode.com platform.

This is an absolutely special event, because it shows that no matter which way the price of Bitcoin is heading in the near future, the adoption of the leading cryptocurrency is gaining momentum. Confidence in BTC is on the rise.

More than 47 million Satoshi holders

Staying on the topic of wallets, it is worth noting how many of them hold any part of Bitcoin. In this case, the data from the Looknode platform comes in handy again. Thanks to them, we can see that there are already less than 47.2 million wallets holding Satoshi worldwide.

At the same time, it is worth remembering that a sizable proportion of network users may have more than one wallet. Therefore, this number does not determine the number of market hodlers. Nevertheless, it still remains impressive.