Although November was always one of the most bullish months during the bull market, this time the uncertainty flooding the market is causing the price rally of Bitcoin and other cryptocurrencies to fall into a slight breathlessness. Factors such as nervousness around Evergrande, the “Infrastructure bill” in the U.S., Taproot activation (buy rumors, sell facts?), fear in the face of Bitcoin inflows from Mt.Gox, and potential global interest rate hikes are behind this. So let’s clear the market of the surrounding noise and look at what the charts are showing us.

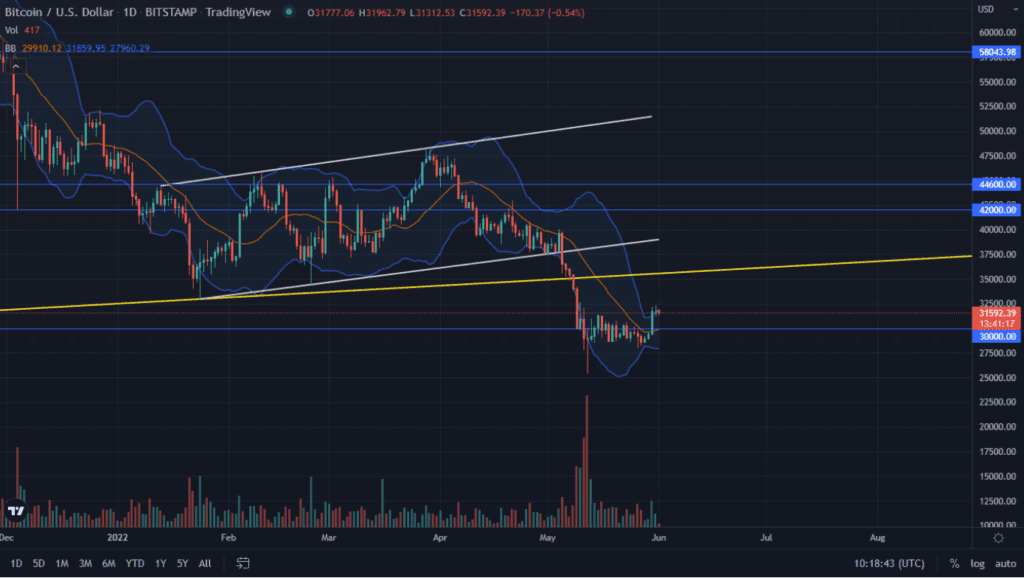

Bitcoin is looking for a bounce point

When we look at Bitcoin’s chart we see several important facts. First of all, the ATH, which was established last week, still did not break through. Moreover, despite the declines, which by the time of writing this analysis amounted to 15.2% at the deepest point, the leading cryptocurrency is trading higher off the previously established higher highs. This is a sign of the uptrend still being sustained. The aforementioned declines are also the aftermath of the bearish RSI divergence, which we wrote about last time. So can BTC dive deeper? Yes, it can. The next support zone is the space between USD 53,000 and USD 55,500 marked in grey, as well as the long-term trend line marked in green, which will be in its area in December.

There are also indications suggesting that the bottom of the correction is already reached. One of them is the mentioned higher lows, which in order not to break the structure should defend the current levels. In addition, the RSI has turned from bearish to bullish, which is even more optimistic.

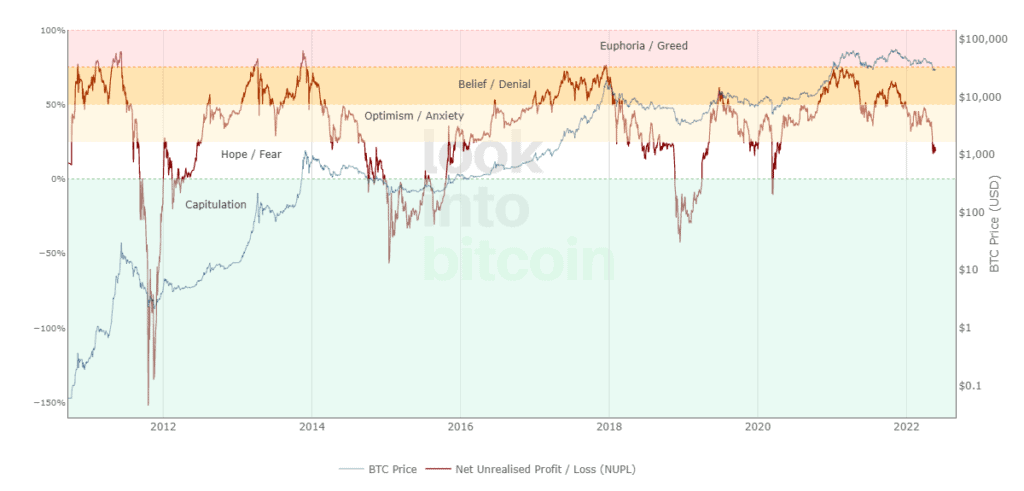

On-chain remains neutral with few exceptions

The situation on the vast majority of on-chain charts does not indicate any particular signs of a shift in either direction. The exception, however, is the SOPR. Thanks to this indicator we can observe when the investors start selling off the coins they hold at a loss. Level 1 is particularly important here. Reaching it during bull market caused many times rebound. At this moment we have just reached it, which may mean that we are waiting for the price reversal soon.

Meanwhile, Ether…

Ethereum broke out the bottom of the ascending channel it has been following so far. This is also the aftermath of the previously mentioned bearish divergence and like Bitcoin, Ether is now forming a bullish divergence. In addition, ETH is also in the area of potential rebound we have already mapped out, while testing the area around the September peak. A downward breakout of this level could deepen the divergence. It is worth watching the lines marked in the previous analysis. In case of further declines, these lines will serve as support.

Cardano quietly draws attention to itself

It looks like the coin, which fell into disfavor recently, is facing a potential next strong move. However, the problem is that it becomes quite a challenge to determine its direction. This is particularly visible on the ADA to BTC chart.

ADA is measuring itself against key support located near 0.00003 BTC, having already bounced off it several times. It is supported by the bullish divergence marked in yellow. However, the frequency with which resistance is touched may suggest a breakout of support and further downward movement. Then the next zone where Cardano should stop is the space between 0.00002 BTC and 0.000025 BTC. Alternatively, a successful rebound should allow ADA to reach at least the 0.000035 BTC levels.