Almost 40% growth, in less than 2 weeks. This is the result that bitcoin has achieved in recent times. Moreover, it found itself above the key level, which is the 50-day SMA. What’s next for the price and what’s next for the overall market?

Strong breakouts of consecutive resistances

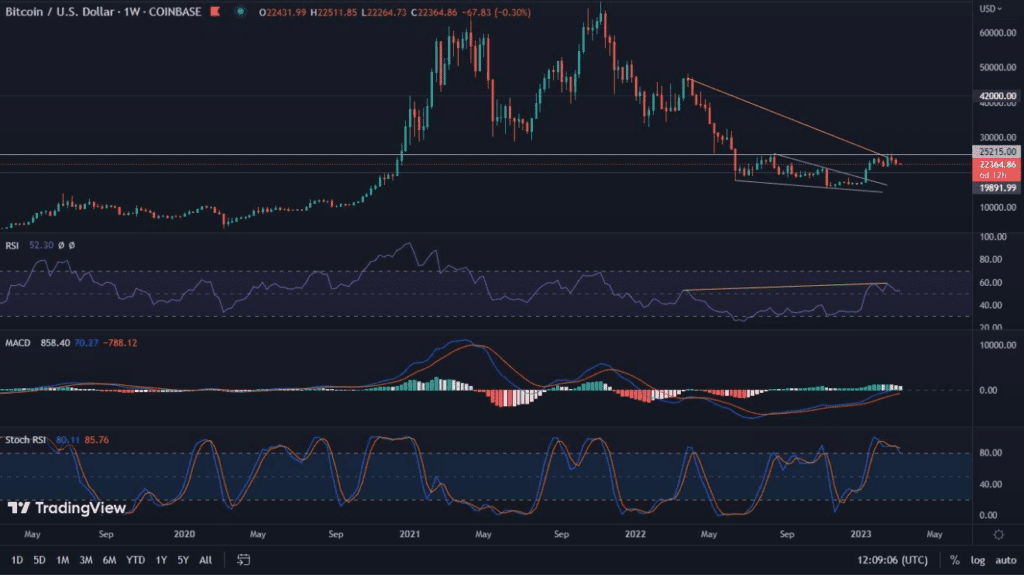

It seems that the area around $33,000 for Bitcoin may be the real bottom of its medium-term valuation. This is evidenced by the growth that the leading cryptocurrency has recorded over the past 14 days. The strong breakout that took place on February 4 successfully broke through the 3-month downtrend. This means, by the way, that the line we have recently set as a potential long-term support has done well (yellow). What is very optimistic is the ease with which BTC crossed the resistance in the zone between $40,000 and $42,000 and quite smoothly broke through the 50-day moving average (maroon line), which in the history of its rallies has more than once provided a bounce point. This points to steadily waning bearish pressure and bulls increasingly coming to the fore. Such a strong breakout from an equally strong trend may fill us with optimism, but we should not turn off our vigilance.

It is worth noting the forming bearish divergence, marked in this case in pink. It indicates the potential reversal of the price movement direction. It does not, however, indicate the exact point of the trend change. A hint can be found in the graphic recently released by Whalemap. It points to historically large buying moves in the space between $46,200 and $49,000. This is also the space where short-term investors have added to their portfolios, some of whom will probably want to exit the market without taking a loss. Volumes of changing hands in this area are high. The 200-day moving average, which is located at the level of USD 49,500, strengthens the mentioned resistance. Its subsequent breakout will be an important signal for further increases.

So where can bitcoin fall to? It may seem that once again the area of USD 40,000-42,000 may constitute support. However, it is worth noting that the downtrend line, from which BTC just broke out, has not yet been confirmed from above. Its dynamic decline to the area of $33,000 indicates yet another possibility to go down to this level.

Not only Bitcoin has moved – the entire crypto market is following it

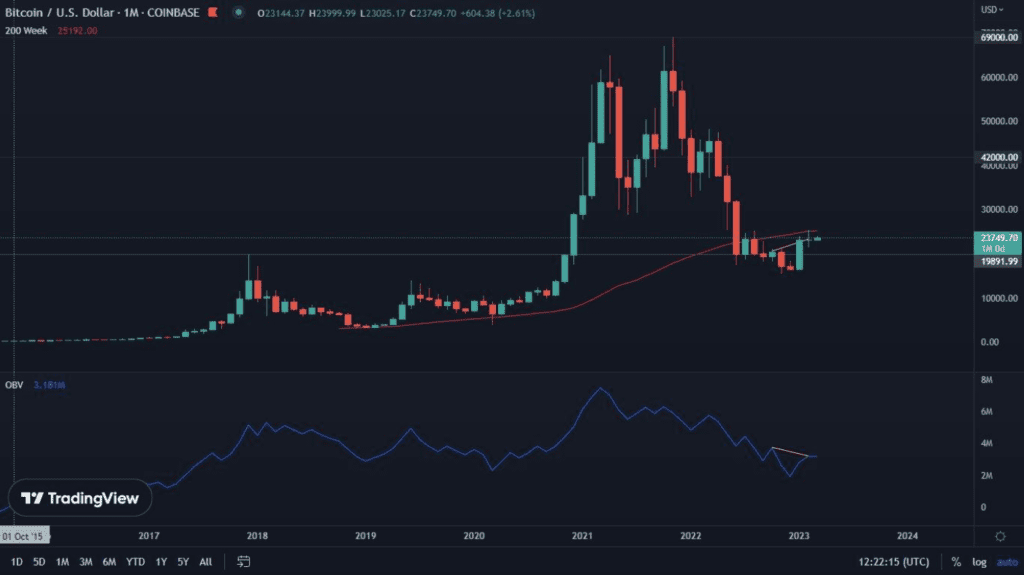

The capitalization of the entire cryptocurrency market also looks promising. Admittedly, the divergence we indicated earlier has been invalidated, but in its place another one has appeared, indicating a longer period of anomaly, and at the same time heralding a greater strength of the potential movement. Thus, the market bounced off the 0.786 Fibo level and went as high as 0.5 Fibo, where it reached $2 trillion.

The next levels of resistance and support are perfectly drawn on the abolitions themselves. Thus, we can read from them that the next region to break through is 0.382 Fibo, which is close to $2.3 trillion, while support is 0.618 Fibo, which is close to $1.85 trillion.

Fear and Greed Index at 3-month record high

Market sentiment is improving significantly. Dynamic upward moves usually wake up many bulls and turn the sentiment positive. This time is no different. Bitcoin is now above the 50 level of the Fear and Greed index. It hasn’t been on it since November 18. This is an optimistic sign for the near future of the king of cryptocurrencies.