Although Bitcoin has been moving sideways for a long time, the market expects that a stronger move will be made soon. In which direction will it be directed? Let’s see how leading analysts assess the situation.

To begin with, Material Indicators again

It is difficult to make a substantive analysis without looking at the layout of the BTC order book. Here, as usual, @MI_Algos rushes to help. On Friday, May 5, he tweeted an update on the distribution of demand and supply.

TLDR: Good News = Good News#BTC #FireCharts pic.twitter.com/3tdGt2Wr94

— Material Indicators (@MI_Algos) May 5, 2023

From the data presented by the FireCharts analyst, it appears that bitcoin is currently in the battle zone against local resistance, at around $29,350. Overcoming it could send the cryptocurrency into a larger supply zone, located between $29,750 and $30,000.

Interestingly, these data say that any declines, if any, could trigger a strong sell-off, which is easily capable of pushing Bitcoin at least to the $28,000 region.

Roman optimistic but with a cool head

On the same day, @Roman_Trading published its outlook on Bitcoin’s price action. Looking at the chart on the one-day interval, he wrote:

$BTC 1D

— Roman (@Roman_Trading) May 5, 2023

Volume remains flat so I anticipate a rejection here with a bounce off the lower range for formation of reversal pattern for higher.

Again this entire thing looks like consolidation for continuation of our uptrend.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/mmzEFYwbSo

“Volume remains flat, so I expect a rejection here with a bounce from the lower range to form a reversal pattern for higher. Again, this whole situation looks like a consolidation for the continuation of our uptrend.”

Given that the chart pattern has absolutely not changed for a long time, Roman’s assessment seems very reasonable. Moreover, it largely coincides with the data presented by Material Indicators.

Jackis very bullish

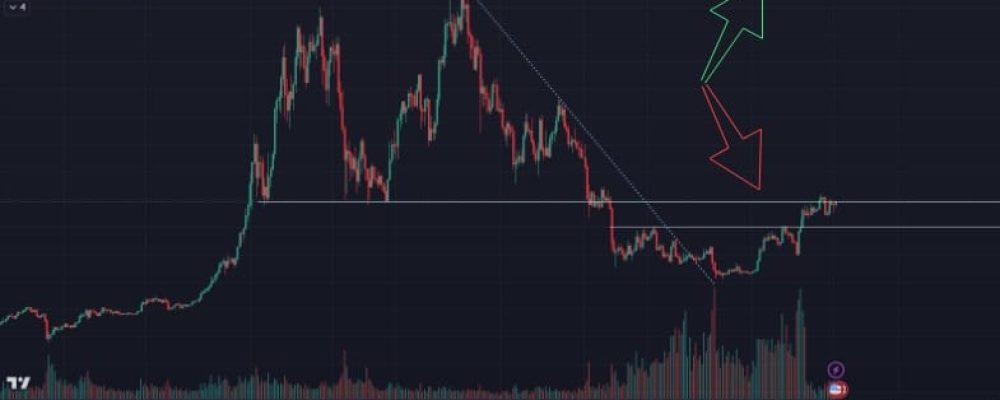

The analyst known as @i_am_jackis shares a very different perspective with his watchers. In his analysis, he cites a fractal, while adding:

“They say history doesn’t repeat itself, but it often rhymes.”

They say history does not repeat but it often rhymes#Bitcoin pic.twitter.com/174CZNZQ1t

— JACKIS (@i_am_jackis) May 4, 2023

The graphic he points out suggests that a breakout in the price of BTC could happen soon. A strong argument for this fact is the movement of the Bitcoin price, which is proceeding remarkably similar to the one we saw in May/June 2019.

This type of analysis is very specific, but also worth noting. A key aspect of the similarity of the price movement in both cases is that both in 2019 and now, Bitcoin is rising after previous prolonged and strong declines. An equally strong rebound is therefore warranted.

Our analyst’s perspective

While the market is in consolidation, and thus in a state of waiting for the breakout of regions of support, or resistance, it is worthwhile to take a broader perspective. This is what we present in the pages of our press. Read the article entitled: “The month that is causing the most concern in the Bitcoin market has just begun. What can be expected from it?”. You will find out from it whether May can indeed be such a terrible month as many expect.