A long weekend is coming up in the United States. The extended closure of traditional financial markets there, may further reduce Bitcoin’s price volatility. This one is currently defending an important level. Is it therefore in for a rebound?

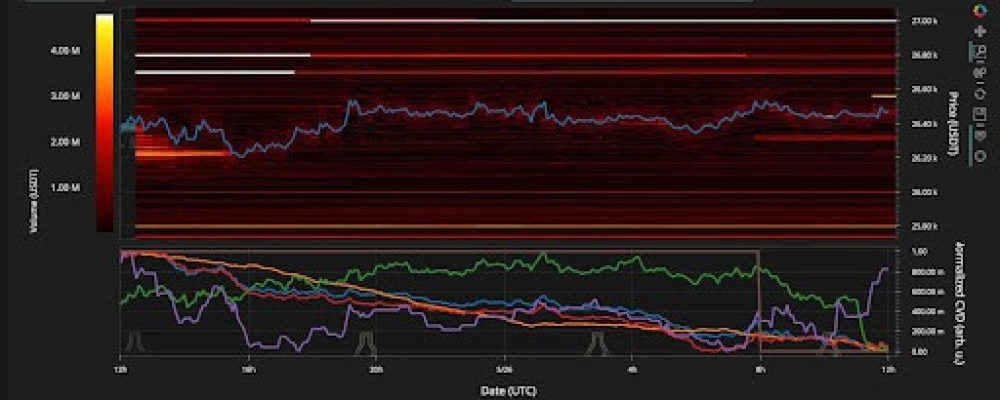

Observations from Material Indicators

We begin our review of opinions almost traditionally with @MI_Algos and his observations on the distribution of market orders. According to the latest data, we can observe a new Bitcoin price resistance, which appears just below the $26,600 level. It is not particularly strong, but it has the power to influence further movements of the cryptocurrency.

Hardly, we are already seeing an attempt to break through the designated area as we write this content. We will soon see if it will be successful.

Here is how the #BTC order book is set up ahead of the Economic Reports. pic.twitter.com/m6hUwkTHEj

— Material Indicators (@MI_Algos) May 26, 2023

In turn, the first significant support appears in the area of $25,800. This data coincides with our analysis, in which we pointed out that Bitcoin’s descent to the vicinity of $25,250-25,500 is as reasonable as possible from a technical point of view.

Seth sees a double bottom

@seth_fin is an analyst who is very optimistic about Bitcoin’s long-term value, while taking a common-sense look at short-term price action. In his latest analysis, he notes an interesting bullish pattern:

#Bitcoin 🔥🔥🔥

— Seth (@seth_fin) May 26, 2023

Yesterday I told you a possible double bottom is forming.

Today we can see the formation taking shape.

I buy more $BTC here. Hard to get rekt when u hold on spot x1 no Leverage!

Not Financial Advice pic.twitter.com/rLsZGvK7OU

“Yesterday I told you that a possible double bottom was forming. Today we see the formation taking shape. I’m buying more BTC here.”

In his analysis, the analyst points out the supportive formation, a bullish divergence. We definitely admit he is right here! However, can the range of the breakout be that high? The formation indicates that yes. First, however, it will be necessary to overcome horizontal resistance, in the area of $27,500.

Blake takes a cautious look at moving averages of BTC

While the entire market is watching the reaction to the 200-day moving average, an analyst known as @blaakke is looking at the chart a little differently:

#Bitcoin needs to start flipping these MA's on the 3D chart soon for a continuation… So far it's been rejected at 7EMA consistently. RSI trying to breakout. Still 1 day 10hrs for that candle close. pic.twitter.com/BoOwsCuBof

— ₿lake (@blaakke) May 26, 2023

“Bitcoin needs to start reversing these MAs on the 3-day chart soon for continuation… So far it has been consistently rejected on the 7EMA. RSI is trying to break out.”

Blake’s observation is very uncharacteristic but particularly interesting. Looking back, it finds justification.

Roman with a positive outlook on the cryptocurrency market

@Roman_Trading is one of those analysts who predicted the bottom of Bitcoin’s valuation with great accuracy. This time he decided not to share a chart, but only his thoughts, which read as follows:

Many of you aren’t ready for this next leg up on $BTC.

— Roman (@Roman_Trading) May 26, 2023

Too many bullish indications with massive amounts of people wanting to short for no reason.

Volume is telling you this is consolidation for higher. Much higher.#bitcoin #cryptocurrency #cryptotrading

“Many of you are not ready for the next leg up in BTC. Too many upside signals with a huge number of people wanting to take a short position for no reason. This tells me it’s consolidation before growth. A significant rise.”

Certainly Roman’s prediction is what most of us expect in the long term. However, when exactly will this leg up take place? Perhaps we will soon find out.