FOMC meetings always generate great excitement, and often during the press conferences of its heads, the market experiences high volatility. It was the same this time as well. The decision on US interest rates, caused a real rollercoaster.

The increase in interest rates in line with predictions

Jerome Powell seems to be a man who knows the weight of his words and wants to prepare the market for any FOMC decision. Thus, the decision to raise interest rates, announced on Wednesday, had been announced for many weeks, and at 0.50% was in line with economists’ predictions. It may seem that stock exchange assets had this move calculated into their price. The confirmation could be the rapid growths that appeared right after the announcement of this de facto negative information. The subsequent press conference was another element of reassurance against possible falls on stock exchanges. Another interest rate hike was announced, but lower than expected, and it was also announced that the reduction of FED’s balance sheet will be initially much milder than it was perceived in earlier plans. All this is good news, one could say. So how exactly did the markets react?

Bitcoin up strongly and down even more

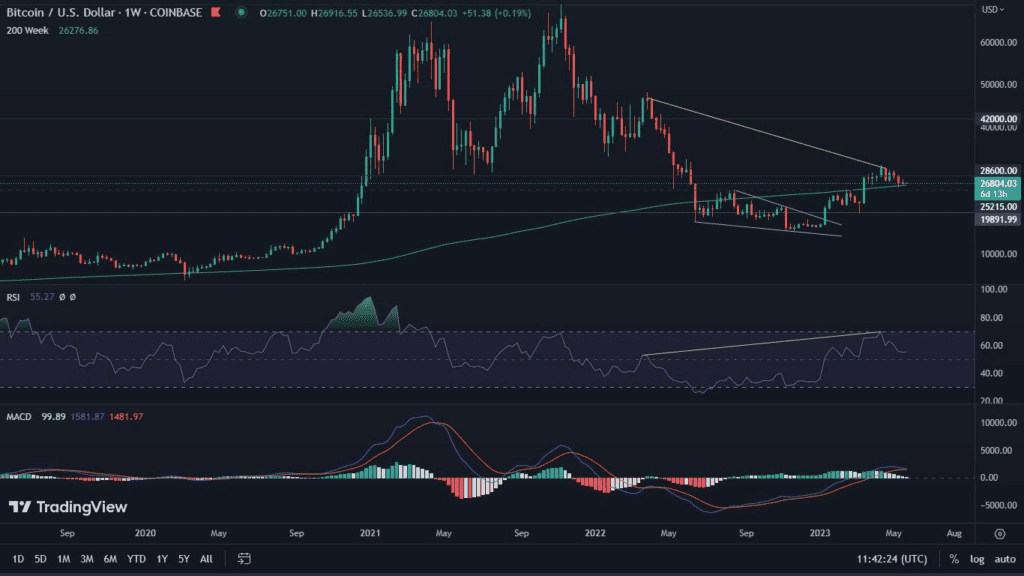

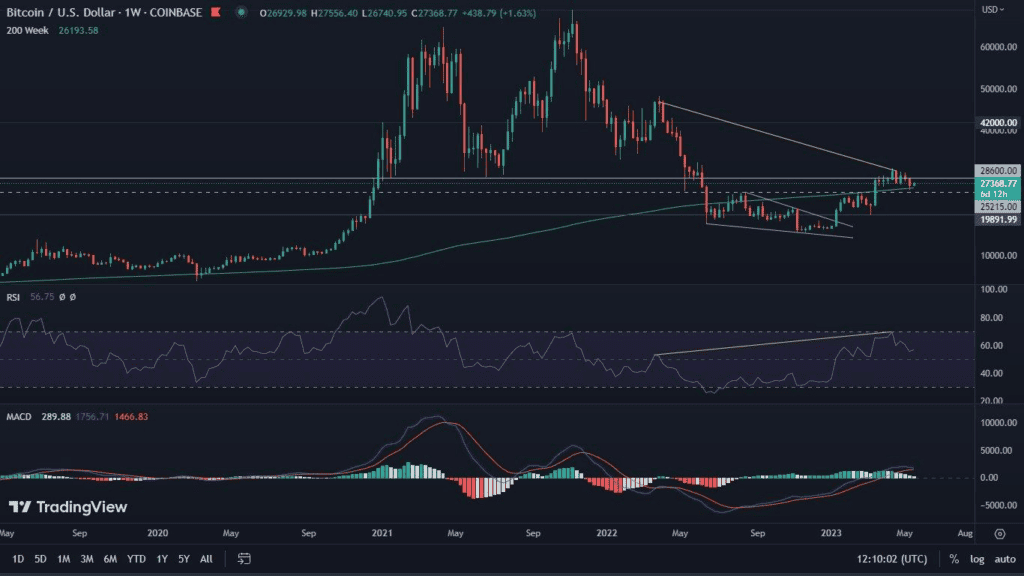

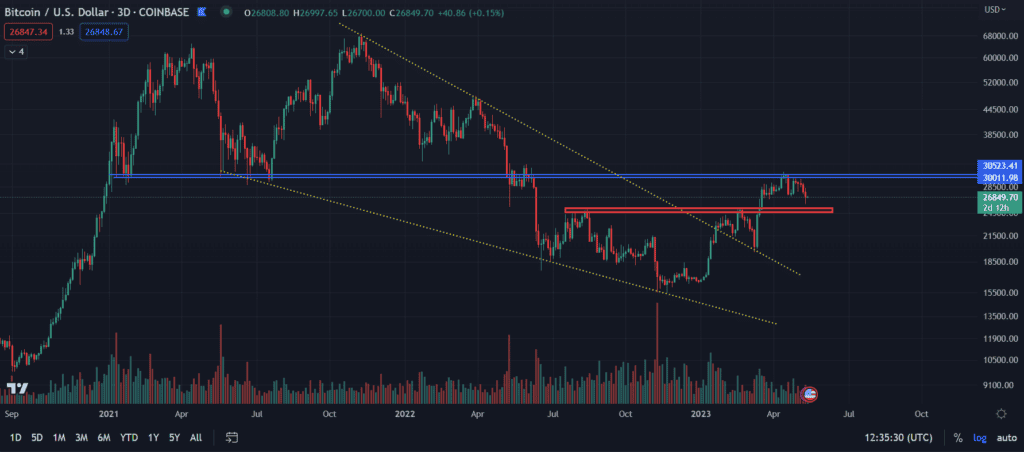

Shortly after the decision was announced, the crypto market surged in value. Bitcoin itself, rebounding from the bottom line of the ascending channel, grew by 5.18%. However, the next day the situation dramatically reversed, making the leading cryptocurrency lose nearly 8%, and as a consequence, broke the structure of the channel (white lines) and moved towards the long-term support line (lower, yellow line). The ascending channel formation was bearish in nature, so this kind of breakout is not a surprise. The yellow line, on the other hand, is part of a long-term structure that should provide a very strong brake. At the same time, we are seeing an ongoing bullish RSI divergence which, combined with trend support, should herald a bounce. MACD has not changed its pattern since the last analysis.

Bitcoin reflects the behavior of traditional markets

Similar behavior to Bitcoin is seen in the leading US indices. Significant increases on Wednesday and stronger decreases on Thursday is the situation that occurred at least on the S&P500. In this case we also observe RSI divergence, and additionally a test of the downward trend line. Thus, there are signals suggesting a reversal of the current price action.

Almost a copy of the S&P500 movement is the NASDAQ. In its case we also see significant increases on Wednesday and even stronger decreases on Thursday. Nevertheless, the chart structure has not been violated, so here too we see an attempt to test the downtrend line, as well as a bullish, albeit less pronounced RSI divergence.

Altcoin market holds key level

The altcoin market (excluding Bitcoin and Ethereum), despite strong declines is still holding support, in the area marked in the previous analysis. This is definitely bullish news, which potentially has the right to support the formation of a triple bottom. An upward breakout could result in an increase in the altcoin’s capitalization to over $800 billion, while declines are a potential move even to $400 billion. It is worth noting that a slight divergence is visible in the case of RSI. It may be an aspect suggesting the first of the indicated scenarios. MACD still remains neutral.