Being a participant in the cryptocurrency market, you have probably noticed that it operates continuously 24 hours a day, 7 days a week. You can purchase Bitcoin any day and also any day you will observe movements on the charts. So it would seem that it doesn’t matter whether you buy crypto during the week or on weekends. However, it turns out that there are certain factors that effectively distinguish between the two periods and can affect price fluctuations.

Traditional markets versus crypto markets and how they relate

The traditional market differs from the crypto market in that it operates at fixed hours specific to selected time zones. Importantly, trading on these types of exchanges does not include weekends. This is the primary difference between the two forms of trading.

However, over time, BTC has become such an interesting asset for investors in traditional markets that it has also appeared in this area. An example of such a venue is the widely known Chicago CME. This is an American exchange, offering, among other things, futures derivatives trading, where Bitcoin is listed.

This means that BTC is an instrument that in the case of the CME is traded in a rigid timeframe, closed in a classic trading week. This is not the only example of this kind of attempt to move BTC to the traditional market, but it is special in its own way.

CME gaps and their significance

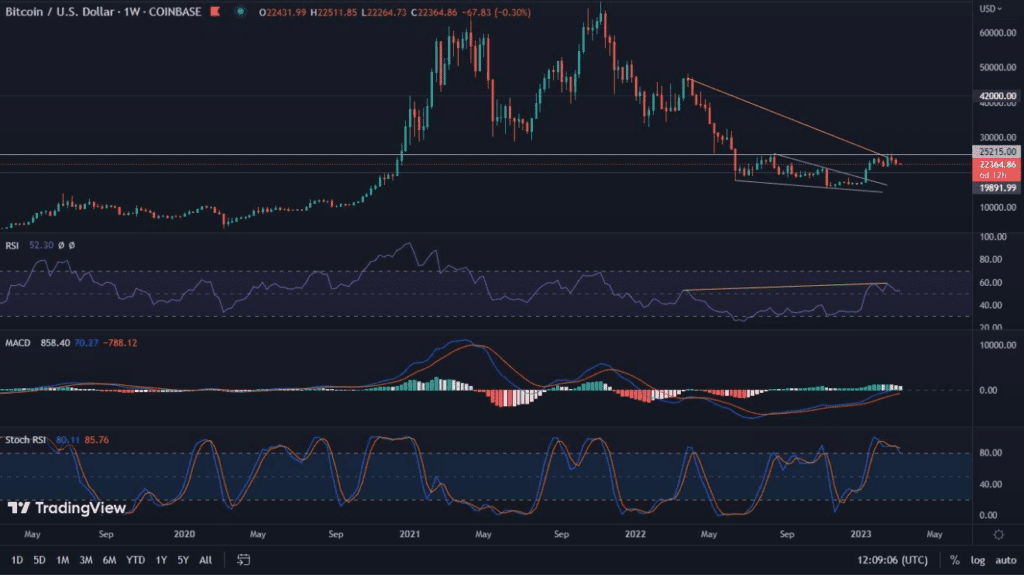

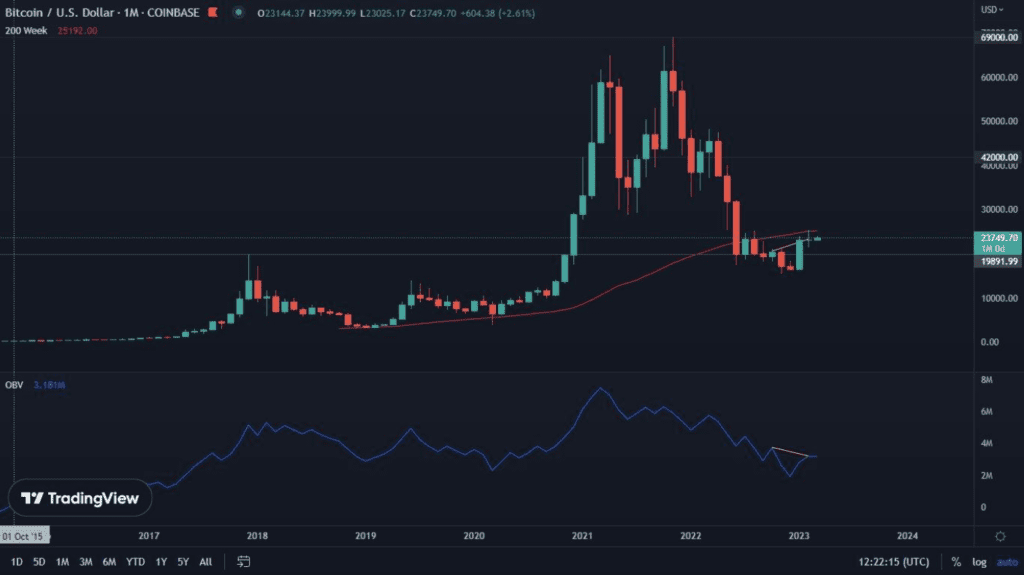

The uniqueness of Bitcoin’s listing on the CME lies in the fact that, due to the lack of buying and selling traffic within this exchange, price gaps can be observed between Friday and Monday. Bitcoin on weekends is a volatile asset, which means that its closing price in one week in the traditional market, does not necessarily coincide with its opening price in the next week.

Such gaps most often (but not always!) seek to be filled. With the tools available on the Tradingview platform they become easy to track. They can be found using the CME Gap Finder or a similar function. The CME Gap Finder will show sectors on the chart where the price moved on the weekend, creating a gap that was not closed on the weekdays.

This is important because in the vast majority of cases, the Bitcoin price during a traditional trading week will pass through this area, closing the gap. However, there are instances when this does not occur. One of the most notorious unfilled gaps on Bitcoin is the area from the beginning of the 2020 bull market, between $9,600 and $9,900. The probability of the price of the king of cryptocurrencies going down to this level again is very low.

Other factors worth paying attention to

The year 2020 as well as 2021 became landmark years for the cryptocurrency market thanks to institutions that have also decided to invest their money in this market. It is the nature of institutions to have a market presence primarily on so-called business days. Their potential lower exposure to cryptocurrencies on weekends, could potentially result in less volatility in the prices of these particular assets. This does not mean that Bitcoin will tend to stagnate on weekends. However, its price movements between Monday and Friday are starting to become more significant.