“Sell in May and go away”. – this phrase constantly stirs up huge emotions and leads to discussions, not only in the cryptocurrency market, but also on the traditional trading floor. According to its premise, May is the month when most investors close their positions to spend their vacations in peace, returning to the market at the end of the summer period and repurchasing assets at lower prices. However, does the theory always apply? How does it look in the case of Bitcoin?

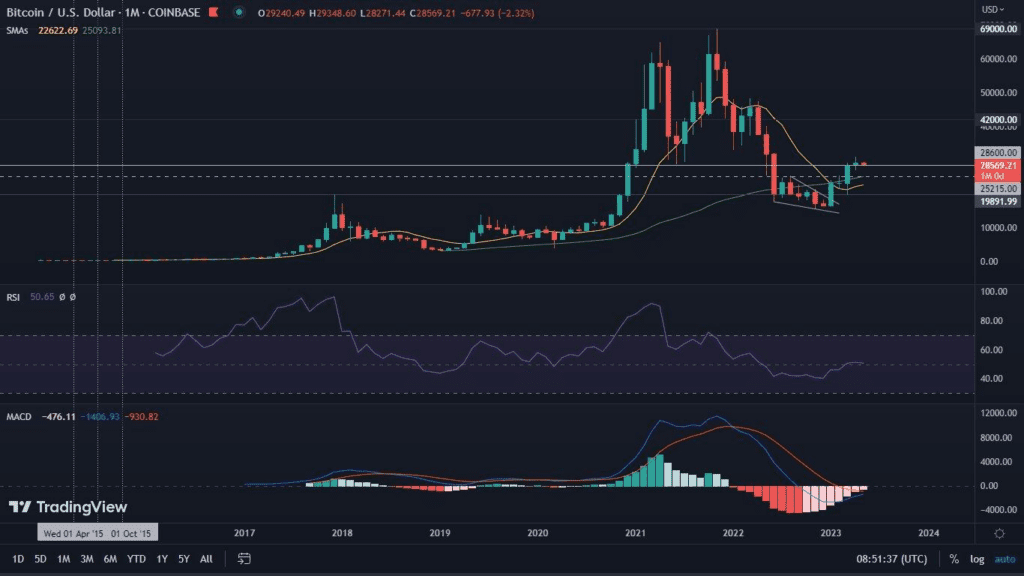

Bitcoin on the monthly chart

Since the keynote of this analysis is the monthly health of Bitcoin, it is worth looking at the leading cryptocurrency from this perspective. April has come to an end, which brought average returns of 2.7%. On the chart, we see that the RSI has remained above 50. The MACD also remains bullish. Importantly, if May closes in the green, there is a high probability that this indicator will experience a bullish cross, which in the long run has the right to prove a strong pro-growth signal.

It is noteworthy that this is the third consecutive time that bitcoin has closed the month above MA10, and the second time above MA20. Such a situation underscores the positive momentum of the cryptocurrency and justifies expectations for further increases. However, a lower low has still not been registered, hence investors are waiting for a red candle. Its achievement and an upward bounce would be a clear confirmation of Bitcoin’s entry into the uptrend. Until this happens, the current rally can still be qualified as a bear market rally.

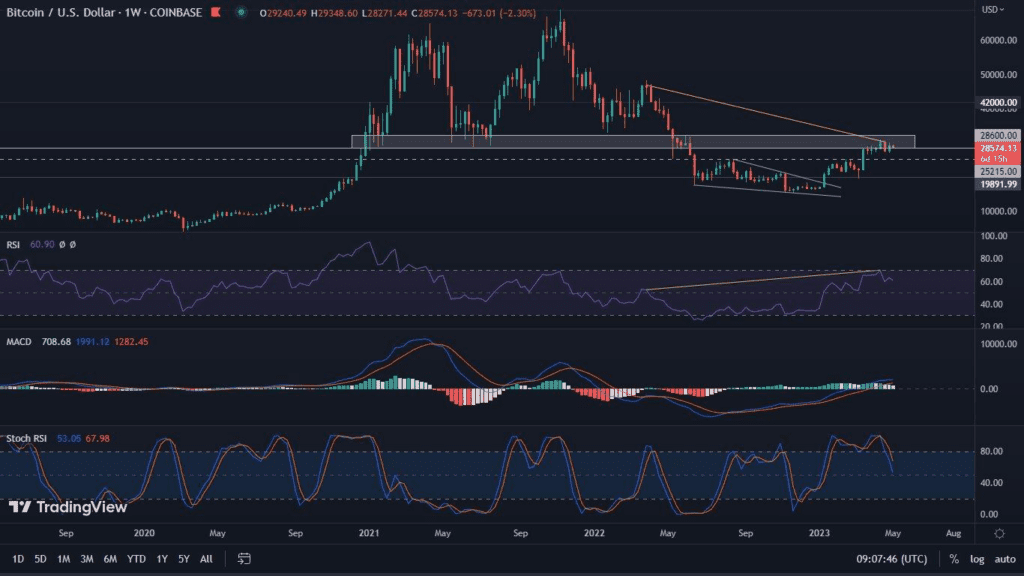

Bitcoin on the weekly chart

On the weekly chart, on the other hand, we see BTC up 6.0%. The RSI has risen above the 60 level because of this. However, this indicator shows a bearish divergence, which may steadily deepen. MACD for the second week in a row indicates weakening momentum. Although the price has returned to a broad resistance zone, the stochastic RSI is clearly heading for a reset.

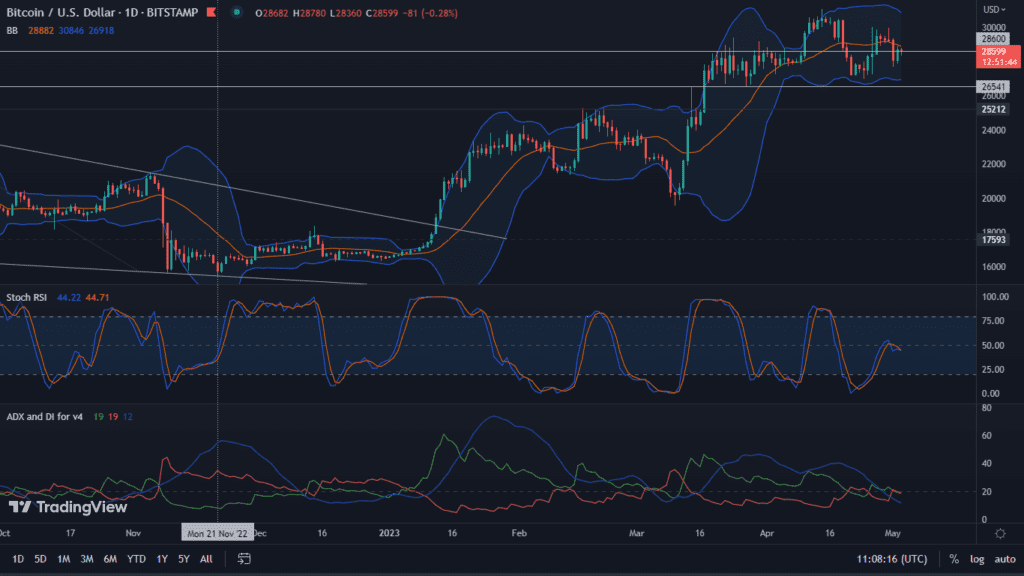

Bitcoin on the daily chart

For the first time in a very long time, the daily chart gives absolutely no signals as to the price’s further movement. At the moment, Bitcoin is sluggishly traveling between the Bollinger Bands, not particularly paying attention to the 20-day moving average located in their midst. The stochastic RSI is near the 50 level, a completely neutral space. ADX, on the other hand, does not detect any trend.

It is worth noting that at the time of writing this analysis, we are awaiting a decision on a possible interest rate hike in the United States. It is expected to affect Bitcoin’s volatility and perhaps initiate a new medium-term price movement. The accompanying speech by Fed Chairman Jerome Powell, accompanying the decision, is also entitled to influence the upcoming volatility of the cryptocurrency.

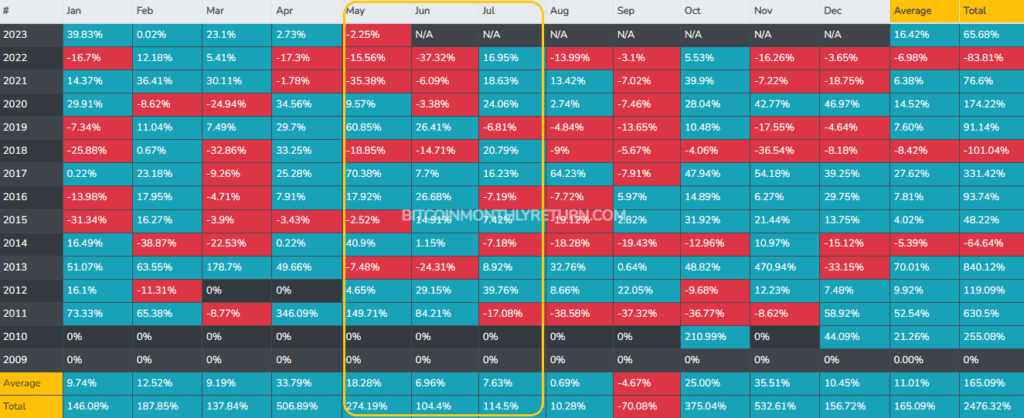

So will May be a bloody month?

Using data from the bitcoinmonthlyreturn.com platform, we can look at the exact returns on Bitcoin investments, by month, over a number of years.

Here we can clearly see that not every May was a red month. However, it should be remembered that the phrase “sell in May and walk away” applies not only to this one month, but also to subsequent months. For this reason, in the graphic provided, we have highlighted the 3-month periods that are considered dead in the financial markets. Thanks to this, it is easy to see that only in 2012 and 2017 none of the indicated months were down months. This therefore gives the likelihood that a potential lower low in the Bitcoin price on the monthly chart will soon become a reality. Given that BTC is currently at price resistance, it could be constructed right now.