During the latest and most anticipated NFT drop of the last month, one person minting a collection paid as much as $500,000 in gas fees. Is it worth incurring such a high cost?

Bots the cause of high prices?

200 ETH in gas is the amount one user paid for minting 950 non-convertible tokens (NFT) from the Tubby Cat collection. This amount, on the day ETH was burned, was equivalent to $500,000. This is most likely the result of a bot that was programmed to knock out as much of the potentially available graphics as possible.

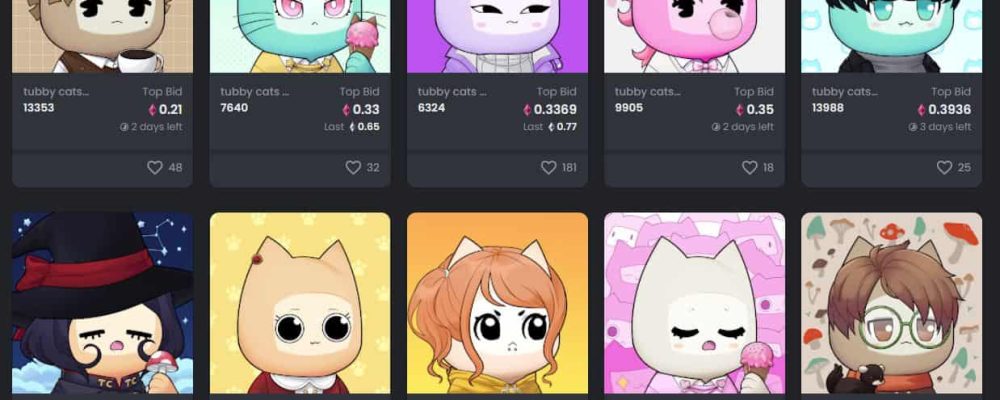

Tubby Cats is a set that features 20,000 unconvertible NFT tokens. It was very popular, causing the team behind the project to create a whitelist where potential buyers could register who could mint their own Tubby Cat for the price of just 0.1 ETH. The list also topped out at 20,000. The collection itself is a classic set of images, featuring pets that reflect different character traits and emotions. They also have their own completely individual style, which makes each piece very unique.

As the creators of the project predicted, the event was even besieged by bots. However, out of the entire collection, only 15,000 cats were minted; the remaining 5,000 were put up for public sale. One of the bots was particularly active. As a result, he managed to cull as many as 950 kittens, spending as much as ETH 100 for this purpose, adding to the amount another ETH 200, which finally covered the gas fees. 500 thousand dollars seems therefore a huge amount for such a simple operation. The question is whether it was profitable…

Was it worth it?

When the emotions associated with the distribution of the new collection have subsided, it is time for a cool analysis. It turns out that the person using the mentioned bot spent on average 0.315 ETH per cat. This is significantly more than the nominal bump amount. The Tubby Cats set is, of course, subject to high price fluctuations, which made the value of individual cats increase significantly shortly afterwards, reaching a price of nearly 0.47 ETH per piece. We don’t know if the lucky owner of the large herd will be willing to liquidate them, but as estimates show, if he was inclined to do so, he could end the venture with a fairly high profit.