Cryptocurrency exchange Coinbase announced on Wednesday, August 16, that it has cleared another milestone on the road to revolutionizing the cryptocurrency market in the United States. In doing so, it has received specific approvals from two key regulators – the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) – which will allow it to introduce a new service for customers.

Coinbase expands its offering

Coinbase will allow customers to trade new regulated cryptocurrency futures contracts. Coinbase Financial Markets, Inc. is now operating as a Futures Commission Merchant (FCM), which gives it the authority to offer new forms of investment. Customers in the United States will soon be able to take advantage of them.

Although the platform announces that the service will not be available immediately, it is already possible to sign up for a waiting list for early access. Coinbase is thus becoming increasingly competitive, combining both traditional crypto trading and regulated cryptocurrency futures in its offering.

“The introduction of these new investment opportunities is a huge step towards federal regulation of the cryptocurrency market,” – emphasizes Faryar Shirzad, director of policy at Coinbase. “With CFTC and NFA oversight, Coinbase will be able to offer futures contracts that guarantee consumer protection and support the development of digital innovation. It’s also an opportunity for Americans to expand their financial options.”

A long and arduous process

Reaching the goal of being able to offer cryptocurrency futures was not easy. The company admits that obtaining the required approvals is a time-consuming and paperwork-intensive process. The application for FCM registration was submitted to the NFA in September 2021. Since then, many months have passed consisting of work to meet all the requirements.

The story of the platform’s development is extremely inspiring. For many months now, Coinbase has been focusing on expanding its offerings with new instruments. In 2022, a landmark acquisition was made of the FairX futures exchange, which now operates as Coinbase Derivatives Exchange.

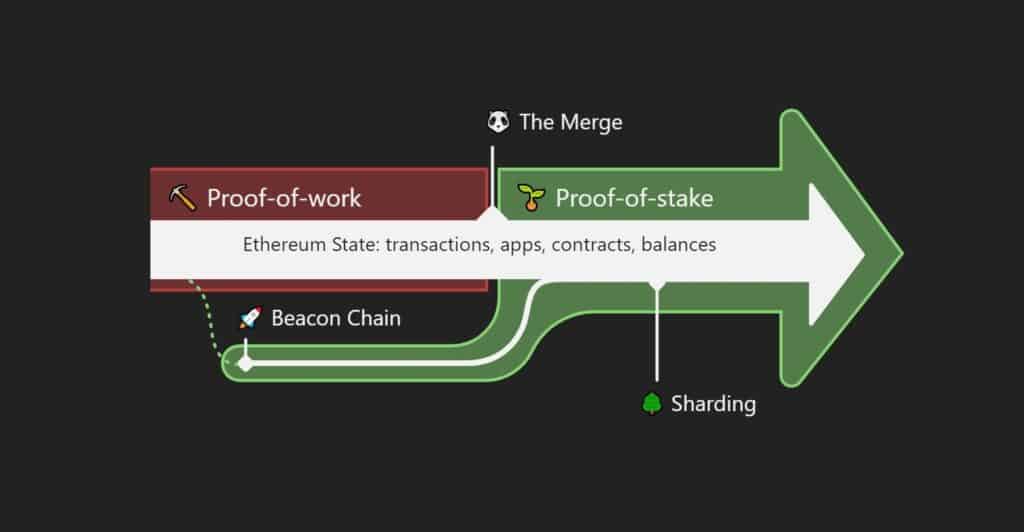

The first futures contracts to appear on the platform were nano Bitcoin and Ethereum contracts, aimed primarily at retail investors. However, larger versions tailored for the institutional market were launched as early as June 5.

Coinbase operates on a mission

The move described above is not only a response to growing market demand. It’s also a response to regulatory challenges the company has been facing for some time. Accusations from the SEC have prompted Coinbase to focus even more strongly on its strategy, as well as its commitment to compliance. This new direction is proof that the platform not only wants to comply with regulations, but also to create solutions that change the face of the cryptocurrency market.