Funding Rates are increasingly being discussed and analyzed by popular Bitcoin price analysts. What is behind them and what is their significance for the market?

What are Funding Rates

Funding Rates are periodic payments made by one investor in the futures markets to another. They refer to differences between valuation of a given asset on SPOT market and leveraged market. The funding rate system helps to bridge these differences. Depending on the discrepancy, traders either pay a fee or receive a fee. The system works on a scalable basis, resulting in regular fee collection. This is most often done at intervals of about 8 hours.

Financing rates include an interest rate and a premium. The interest rate value remains constant and relates to the size of the position. It usually amounts to tenths of a percent.

The premium, on the other hand, is a variable value. It is based on the spread between the SPOT and futures markets. The higher it is, the more the premium is.

It works in a very simple way – when financing rates are high, it means that traders taking long positions pay a fee to investors shorting the market. The overall sentiment towards the price movement of the asset is positive. Conversely, when funding rates are negative, short traders, who are naturally more numerous, pay the upside traders.

Impact of Financing Rates on Bitcoin Price

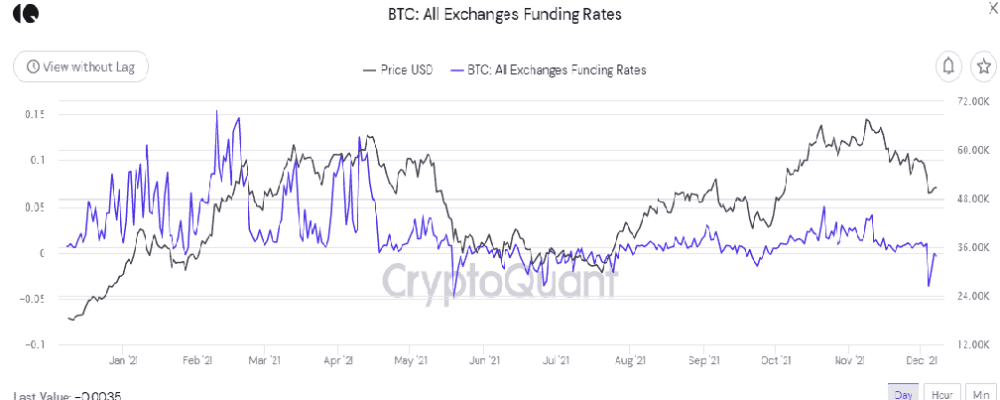

The general sentiment mentioned earlier is crucial. When funding rates get higher, there are a lot of open long positions. The market thus expects to see increases. Thanks to charts like the one cited above, this data is publicly available. Big players like to use them, which means that many times the price is suddenly pushed down in an over-leveraged situation. It knocks out stop-losses and liquidates leveraged positions that were excessively optimistic. Very often after such an event the Bitcoin price goes up again. Liquidity is then gained, while funding rates level off to relatively neutral levels.

Is it worth watching funding rates when investing in Bitcoin on the SPOT market?

Although funding rates apply to the futures market, it’s hard to get past them when analyzing the SPOT market itself. As it turns out, often the excessive optimism or pessimism they exhibit can suggest a potential price reversal. Thus, they are the perfect complement to technical analysis in the process of finding the right buy and sell levels for both Bitcoin and other cryptocurrencies. The data on them is publicly available and applies to the entire market as well as selected exchanges. It’s worth having them on hand!