Inflation affects every citizen every year. This year, the situation is particularly difficult in the United States. In this country, in June 2021, the consumer prices index (CPI) increased by 5.4% compared to the previous year. This is the highest increase in this index in as many as 13 years! In a postcovid world, prices have gone up, and life for even the common man is unfortunately getting tougher. How can you hedge against inflation? And is bitcoin (BTC) suitable for this very purpose?

Bitcoin – an inflation hedge

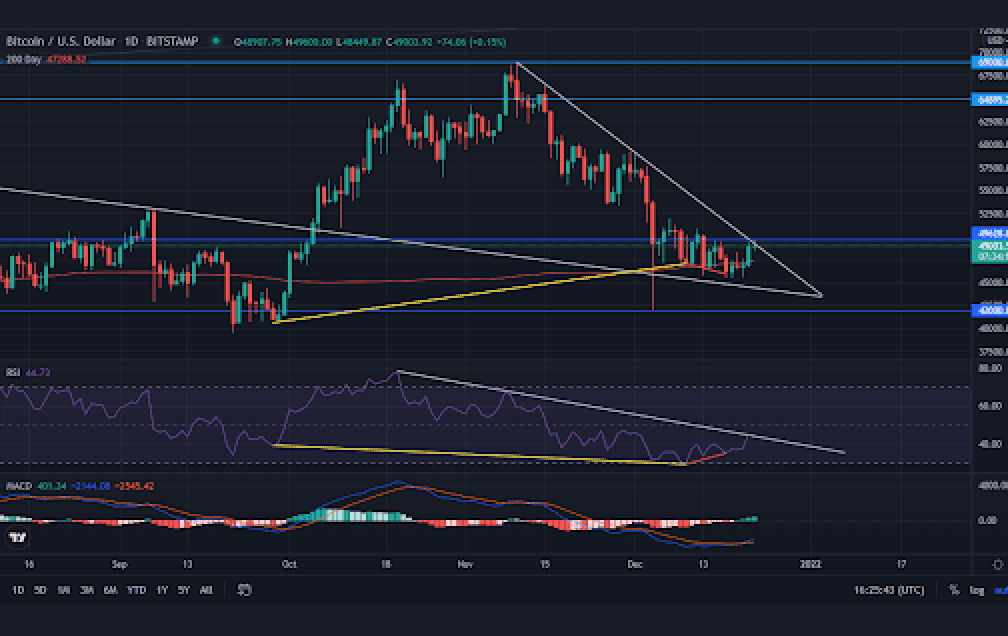

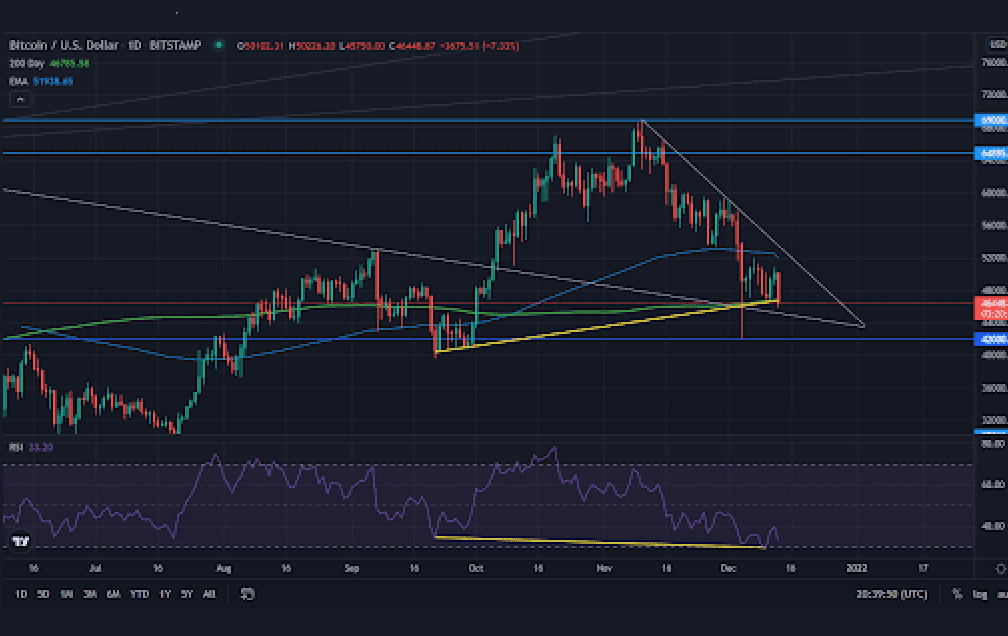

After the public CPI reading, the price of Bitcoin (BTC) began to slowly fall. The price of the world’s largest cryptocurrency, in terms of market capitalization, was lower by about 2%. Bitcoin started from a ceiling of $33,000 to fall to $32,854 after the CPI data was announced (this data is from Tuesday, July 13 1:10 p.m. Eastern Time).

A similar situation occurred with the previous CPI reading. In May of this year, Bitcoin’s price fell 7% on a day when data showed prices rising at their fastest pace since 2008. Theoretically, with higher inflation, there should be increased demand for assets that can serve as assets capable of retaining their value, such as Bitcoin.

Supporters of Bitcoin (BTC) as a hedge against inflation

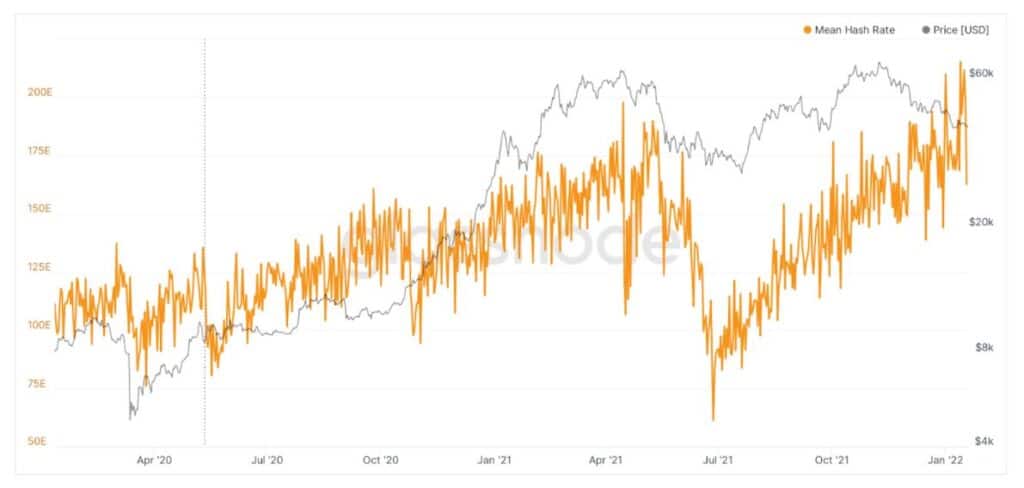

Proponents of Bitcoin (BTC) argue that despite recent declines in the asset’s value, it can still be a leading asset that resists the force of inflation. Their argument is that the number of coins that can be issued is fixed, so Bitcoin is not subject to the manipulations practiced by the government. They are referring to the “easy money” policy practiced by the United States, which involves adding money to stimulate economic growth. The consequence of printing money is a failure to keep up with the production of goods, which in turn raises prices and weakens the purchasing power of American households.

Completion

Bitcoin (BTC) is different from other popular inflation hedges. Its value is based solely on other people’s willingness to own it: this is because the digital token is not tied to any other asset, such as oil, real estate, or gold, which can naturally rise with consumer prices. Therefore, even when inflation rises, it does not necessarily indict the increase in the price of what is already the world’s most popular cryptocurrency. So, is Bitcoin a good hedge against inflation and is it worth keeping your savings in it? The current decline in Bitcoin’s price does not necessarily support this theory, while the idea obviously has many supporters who argue that time will prove that Bitcoin is indeed inflation proof.