A surge in the number of Bitcoin whales was reported on the last day of February. Is this an accumulation before a further rally?

A significant spike in whale volume

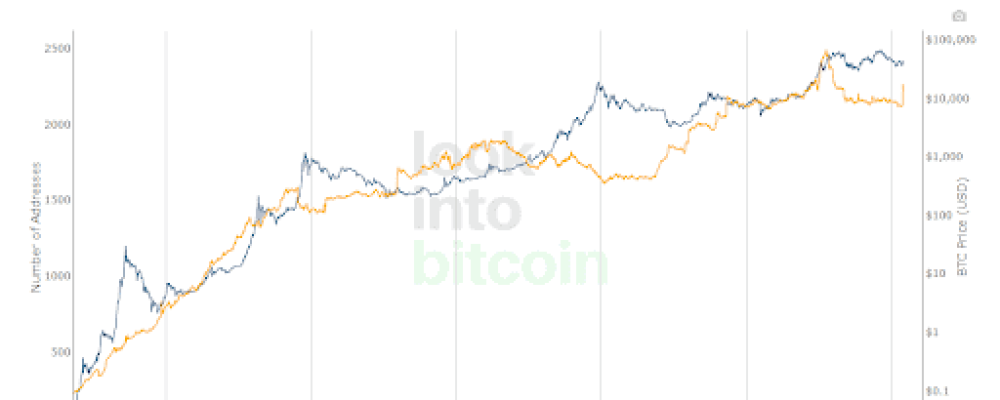

The sharp breakout of the BTC price on the last day of last month was accompanied by a sudden increase in the number of Bitcoin whales. Recall that the term “whale” is used for holders of wallets with more than 1000 pieces of the leading cryptocurrency. On February 28, there were as many as 137 similar ones on the market. Such a dynamic growth is rarely seen. Thus, 10-month maximums were reached. This coincides with the escalation of the Russian invasion of Ukraine, as well as with the introduction of significant sanctions against the aggressor, including banking sanctions.

Glassnode Chief Technology Officer Rafael Schultze-Kraft is looking into the matter. In his opinion, however, this does not necessarily indicate that investors are hoarding BTC. It might as well be the result of significant Wrapped Bitcoin (WBTC) funds being transferred to new addresses.

The surge to 2,265 addresses is a one-day jump of nearly 5% and equals the May 2021 results. There was also an increase in addresses with balances over 100 BTC. It amounted to 1.3%, bringing the number to 15,964 wallets.

Julian Hosp, CEO of Cake DeFi, also spoke on the matter. He wrote on Twitter that he is not sure what is behind such market behavior. He suggested that it could, however, be a matter of initiative by people with “deep pockets,” or that it is a sort of rebalancing of exchanges and trust services. The latter theory coincides with Rafael Schultze-Kraft’s vision. Nevertheless, he recognized that the event is unprecedented.

Are the rich Russians behind it?

It is hard to resist the impression that the Russians may be behind the sudden increase in Bitcoin whale wallets. The day on which this behavior was observed coincides exactly with the moment when Western countries, which include the entire European Union, the United States, Canada, Australia, Japan, and the so far neutral Switzerland, took very heavy sanctions restricting the Russian economy and its banking sector. This has caused a great collapse of the Russian ruble in the currency markets. Thus, there is an assumption that Russian multimillionaires, fearing the dramatic impact of sanctions on their fortunes, have decided to move a sizable portion of their possessions into the crypto space.