There is no end to the market turmoil. After Bitcoin reached new lows of the current bear market, uncertainty continues. Centralized exchanges are under tremendous pressure. Let’s take a look at key on-chain metrics.

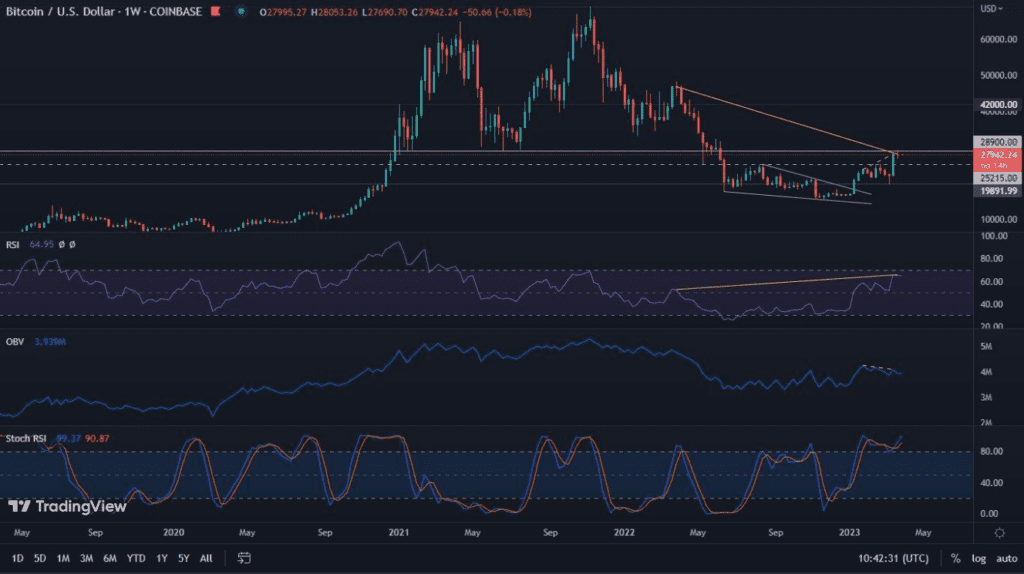

Bullish rationale on the weekly chart

Traditionally, we start with the weekly chart. This is where you should look for the first signs of a trend reversal. And while it’s hard at the moment to have full confidence that one will occur, there are significant suggestions towards it. Bitcoin, by reaching a new low of $15.632, has broken a key RSI support. Thus, it appears that the breakout above the downtrend line that we recently registered was a false move.

Nevertheless, staying with this indicator, we can observe another important point. Well, the RSI has formed the first clear bullish divergence in a long time. It finds its beginning in the oversold area, which gives it particular strength. Nonetheless, it can be assumed that this divergence has the right to be entirely in the oversold zone, which will be an even more important signal suggesting a turnaround.

Meanwhile, the price action creates the potential to form a descending pennant, which is also a bullish signal. In opposition to it is the MACD, which for a long time, was able to maintain a bullish momentum. It is now clearly reversing.

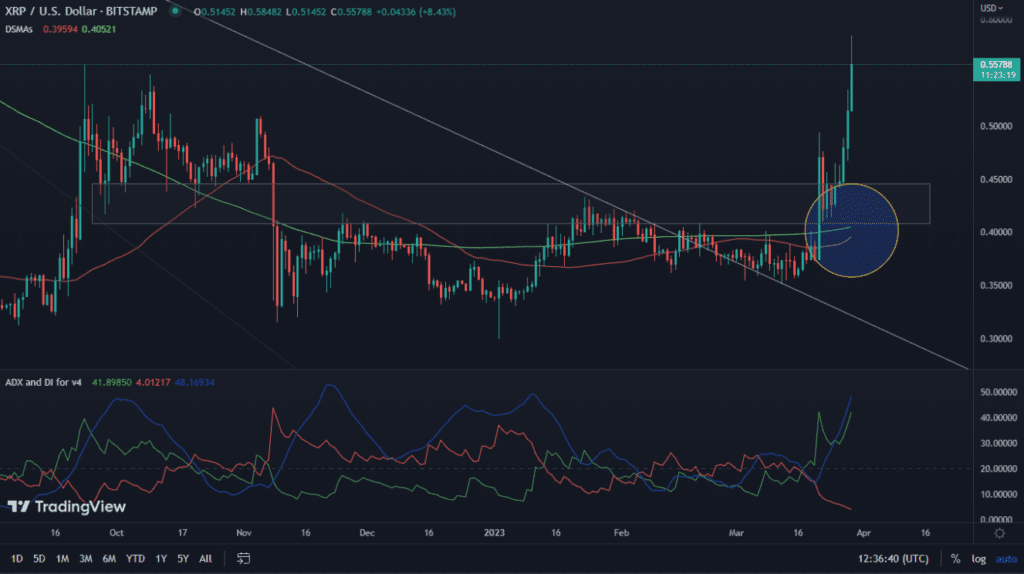

Bullish also on the daily chart

Equally interesting as the weekly chart is the daily chart. Here, too, there is a clear bullish divergence, fully located in the oversold area. The MACD, on the other hand, is gaining bullish momentum, and volumes confirm buying strength.

Concerns over short-term price action

Although the above factors are clearly cause for optimism, it should be remembered that Bitcoin, in order to regain investor confidence, must break out above the lows reached in June this year. This task is not easy, as the uncertainty surrounding the health of many centralized exchanges continues. Moreover, Bitcoin’s current valuations put even more selling pressure on miners. Their averaged profits from mining are lower than their costs. Hence, it is worth watching the Hash Ribbons indicator, which may soon signal the capitulation of mines. Such events, not always, but often heralded the achievement of a final bottom.

This pressure is also confirmed by on-chain data, which indicates that miners are just selling their BTC holdings.

Bitcoin flows within exchanges

The increased lack of confidence in exchanges, resulted in a strong outflow of assets from such entities. This is perfectly reflected in a graphic presented by BTCInOutAlert analysts on Twitter. In just one week, the number of BTCs that left trading platforms was as high as 120,000. However, at the time of writing this analysis, the situation is changing dramatically. Bitcoins are dynamically returning to exchanges, which may herald another price movement.

Resources on wallets are increasing, but not on all of them

One last, and undoubtedly interesting statistic, is the amount of Bitcoin on individual wallets. The number of entities holding between 0.1 and 10 BTC has been increasing very rapidly recently. Meanwhile, the larger the wallet, the weaker its accumulation. In this way, we arrive at the whales that are currently selling. Such behavior, at current valuations, seems surprising and may mean that large players are expecting further price declines.