There has been a real bloodbath in the cryptocurrency market. Bitcoin has fallen dramatically, causing avalanche liquidations of leveraged positions. Key trends and horizontal support levels were broken. Nevertheless, a gentle light of optimism is emerging in this incredibly dark tunnel.

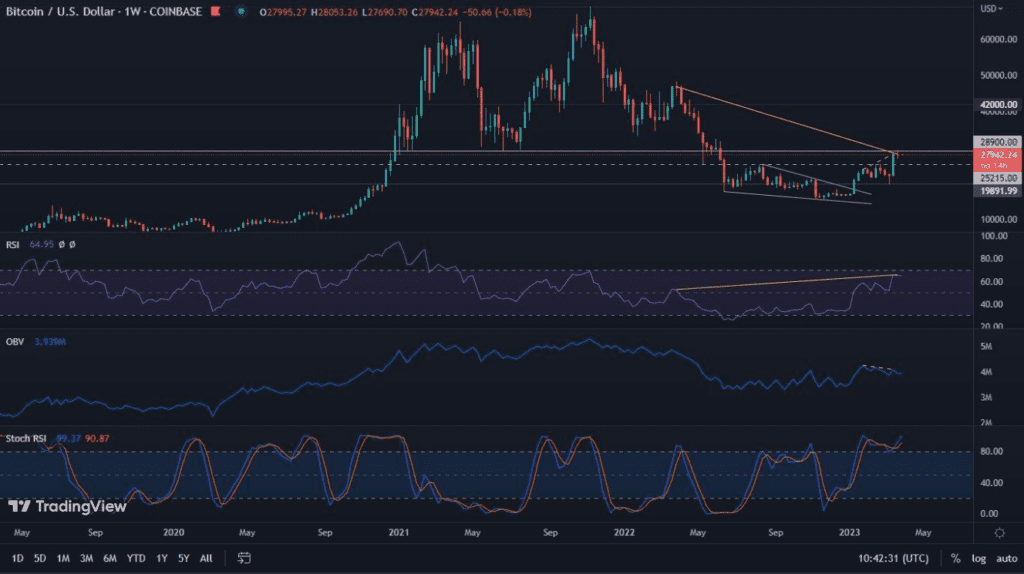

Bitcoin on the weekly chart

We begin our analysis once again by presenting the events on the weekly chart. The first and most important thing that strikes our eyes is, naturally, the drop in Bitcoin’s value by nearly 10.5%. Such a drastic move caused the breakout of the uptrend line, which is absolutely not optimistic. In addition, the RSI value has fallen to 46, which overwhelmingly favors the bears. Another negative aspect of the chart is the loss of the 200-week moving average, which is an important boundary between the bull market and the bear market.

Despite this widespread wave of negative data, there are also positive ones. It is worth noting that Bitcoin reached the $25,200 level during its declines. This did not happen on every exchange, but it was noted on Coinbase, among others. Thanks to this decline, the RSI managed to achieve a bullish divergence. Most interestingly, however, the Hash Ribbons indicator managed to maintain a buy signal. This one (as we wrote last week), in turn, has been infallible so far, and every time it appeared, it suggested increases in the value of BTC.

Bitcoin on the daily chart

It is worth mentioning that the aforementioned 200-week moving average, has so far been in convergence with the 200-day SMA. Despite this, Bitcoin managed to break it clearly. On the daily chart, we also see the aforementioned uptrend line. Its loss is absolutely not in doubt.

Nonetheless, the factors heralding a possible consolidation or even an uptrend keep coming. The first of these is the clear RSI divergence, which reaches the oversold zone. This makes it gain in strength. Another element is the MACD, which is searching for and may already be at its turning point. The whole thing is completed by the TD Sequential, which, filling 9 downward candles, expects a relapse of the local trend.

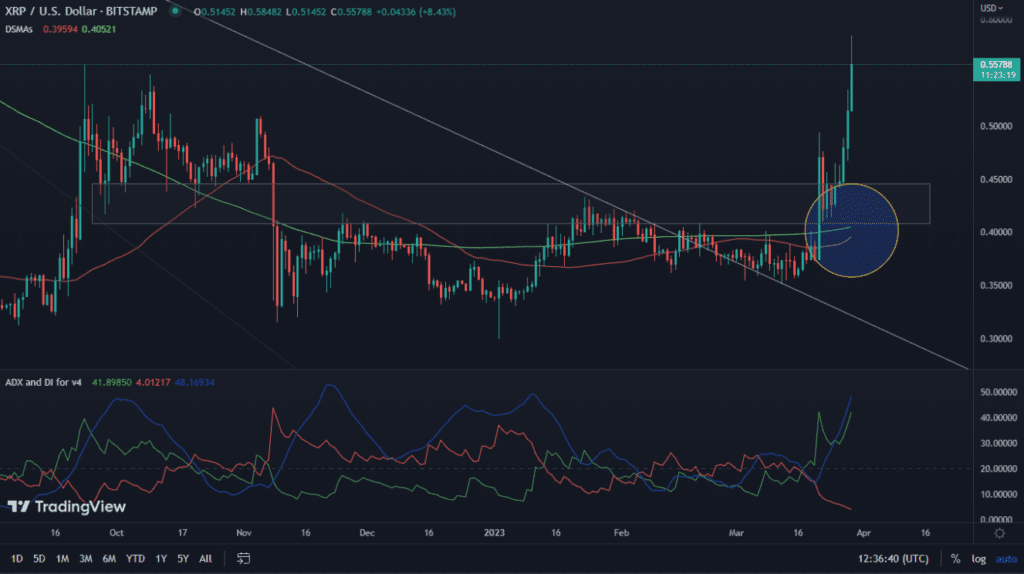

Bitcoin’s dominance surprises with weakness

It is almost a rule that in the face of Bitcoin’s declines, the altcoin market suffers even more. Thus, the dominance of BTC should be clearly increasing. Nothing could be further from the truth. For it turns out that altcoins were able to make up for the losses they suffered in no time. Because of this, the capitalization of the king of cryptocurrencies, fell below 50% of the value of the entire market. The 100-day moving average (yellow line) was lost in the process. We have been paying close attention to it recently, saying that if this happens, another season for alternative coins will become possible. It is difficult for the time being to determine how long it could last. It is worth noting that BTC is currently in a wide support zone, where the 200-day moving average (green line) is inevitably heading. It is possible that this is what will provide the next bounce point. The RSI, meanwhile, remains clearly oversold, and the MACD is similarly looking for a turning point on the Bitcoin vs. dollar chart. Nonetheless, some of the smaller coins may now have their time.