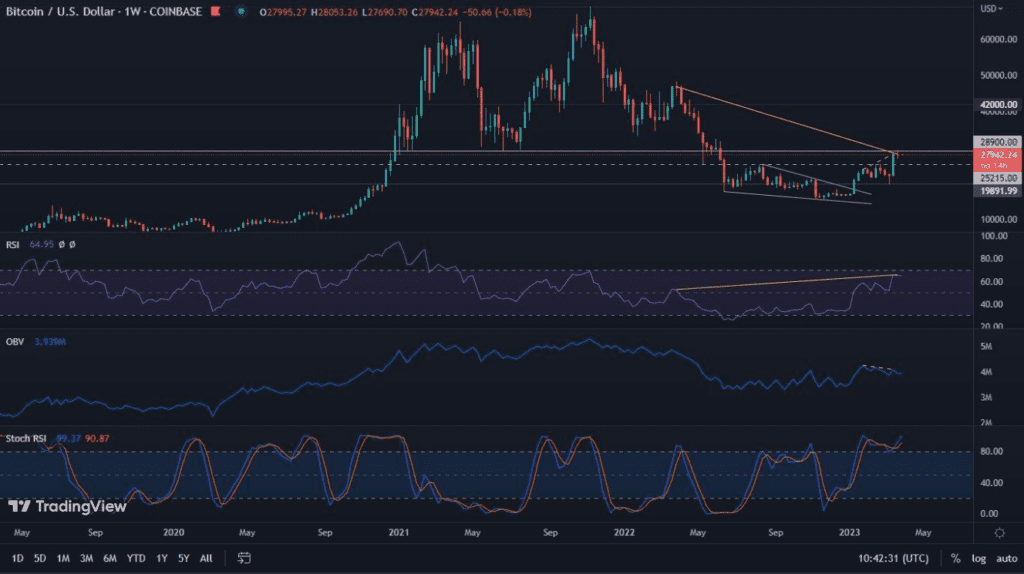

Uncertainty in the market is growing. Ever since Bitcoin reached the ATH of $69,000, it has continued to remain in a downtrend. So, let’s answer the question of what may await us in the coming days.

Technical point of view

For several days, the Fear and Greed indices have been indicating fear. It is a most justified situation. A series of negative news, and the lower low formed on the chart, effectively intensify the negative sentiment.

As we can observe, the area around the level of USD 60,000 has become an area of psychological struggle between bulls and bears (yellow dashed line). On November 16-17, we observed the former successfully defending it. Today, in turn, the region became resistance from which Bitcoin managed to rebound and deepen its downward movement. Negating the earlier bullish divergence, it came across our designated area of potential deceleration of the movement, where support has already been found several times. However, it is not obvious whether it will be sustained. The stochastic RSI tells us that it is time for a rebound. Similarly, the TD Sequential indicator suggests that it is time for a bounce.

So what should we expect?

If support in the area is maintained, Bitcoin should fight to regain the $60,000 level. However, if it is not able to achieve this, we should observe the green uptrend line marked in the previous analyses.

On-chain data fosters optimism

In the previous material we drew attention to the SOPR indicator. We will take a look at it also now, because very interesting things are happening around it. As you can see, the level 1 was breached and some investors began to sell their coins at a loss. When we look back, we can see how important this area is and that its breakout resulted very often in subsequent stable growth impulse.

Although short-term investors sell off their coins, the number of non-zero addresses continues to grow. On November 23, their new ATH of 38,800,381 was reached and importantly, the prior ATH occurred just 2 days earlier. This means that the current correction, is perceived by the market as an opportunity.

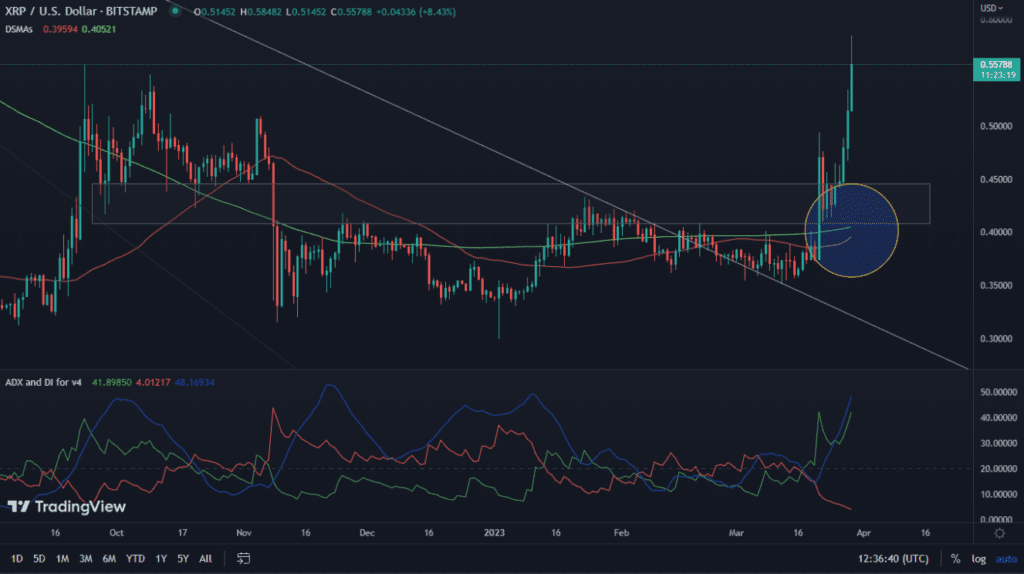

Ether consolidates

Slightly better than Bitcoin, behaves Ether, which fell to the area of support we determined in earlier analyses. As it turns out, it is currently using its entire width for accumulation, while bouncing from the September peak of its value. The ETH/USD pair gives the impression as if it wants to initiate the next stage of growth. This is suggested at least by the MACD indicator, which is moving towards a bullish cross. If the increases occur, we should see a rally towards the new ATH. On the other hand, if Ether fails to maintain the consolidation and breaks out towards the bottom, we will observe the struggle for the defense of support lines determined in previous analyses.

US Cardano, delisted from eToro, broke downwards

The previous time we also discussed Cardano and its situation against Bitcoin. After the negative news experienced by ADA, we see a continuation of the downward movement. In turn, it deepens the bullish RSI divergence (yellow lines), indicating that despite Cardano’s current delist on the eToro US platform, a trend reversal is possible soon. Here, the area between 0.00002 and 0.000025 BTC, indicated by the grey rectangle, is worth watching.