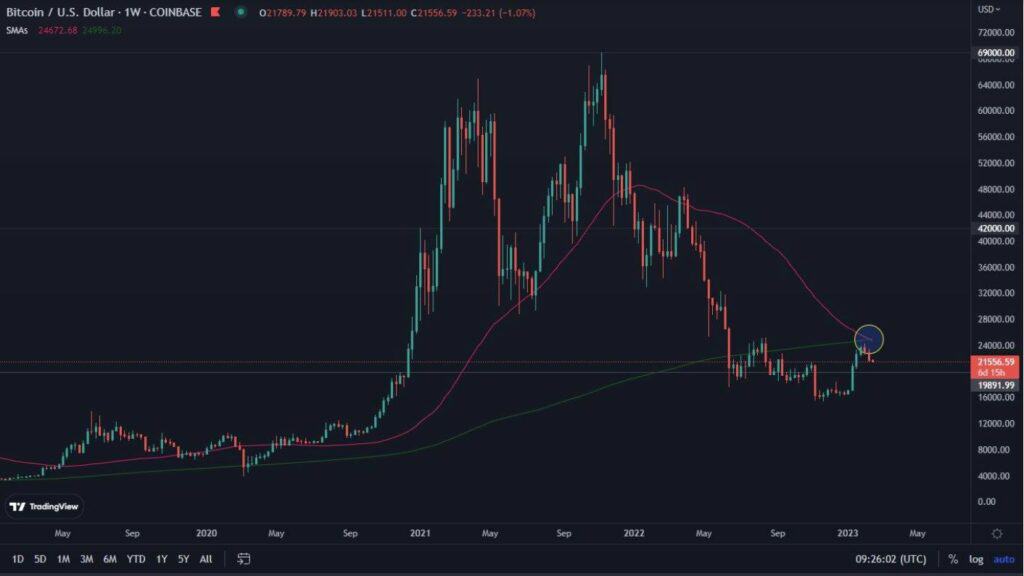

The period of severe declines on the cryptocurrency market seems to be behind us. Is the current pause the end of the downward movement or just a way to distract investors’ vigilance? Let’s try to answer this question!

New lows

Close to $25,400 is the new low that Bitcoin has reached during the current rally. This valuation seems to be a confirmation of the local peak that was recorded back in December 2020. Although the exact levels from the two periods differ slightly, together they form a zone that is currently a support area.

Looking at the chart from a broader perspective, we see that a bullish RSI divergence has been forming since January 22. It does not herald an immediate reversal point for the Bitcoin price, but it does suggest that it should happen soon. The MACD is also bullish, showing a clear desire to reverse the ongoing downtrend and mark it with a bullish cross. It is worth remembering that we have had many attempts to achieve this recently, but so far they have been unsuccessful.

A different perspective can be gained by looking at the volume. This, as it turns out, does not fill with optimism. Since the beginning of the 2020 bull market, every time there were similar declines, accompanied by high volume, the price at least once again reached the levels from which it registered a rebound, or even lower. We notice a similar situation in January 2021, in the period from May to July 2022, or in December last year. The dynamic decline, combined with a high red volume candle, and the subsequent lack of an intense rebound with upward volume, resulted in a further downward move. Here it is natural to look towards the 200-week moving average (green line). In moments of market collapse, it was often the level of the final price rebound. Currently, it oscillates in the region of USD 22,000. Its possible confirmation as support may take a few more weeks. In the situation of the market rebound, it is worth watching the level of the lower edge of the growth channel, from which the fall took place. Currently, it is the region of $38,300, which may be an upcoming resistance.

Total cryptocurrency market capitalization

The 200-week moving average is also an important area for the chart of the total capitalization of the cryptocurrency market. The level set by it is located around $830 billion. The capitalization itself, since the peak in November 2022, has already lost 63.8% to the lowest point. Currently, it oscillates around $1.26 trillion, confirming on this occasion the downtrend line from which it previously had the opportunity to break out. However, the price action around the line indicates that this is not a particularly stable area. Further declines could bring the price into contact with the average. Possible successful play of the RSI divergence could lead to increases in the $1.6 trillion area. MACD bullish.

Altcoins in very bad shape

Since our last analysis, altcoins have managed to break their key support area, marked by the grey rectangle. In doing so, they have reached another key region, which is the $400 billion area. At the same time, the bullish RSI divergence was negated. Currently, this indicator shows no signs suggesting movement in either direction. A possible market rebound may lead to a return to the area of $600 billion. On the other hand, declines could result in a move towards the 300 billion mark. The previously suggested 200-week SMA is also heading to this area.