The cryptocurrency market is experiencing massive shocks, the epicenter of which should be sought in the US stock market. While the major indices are diving, the dollar index is reaching levels last seen in March 2020.

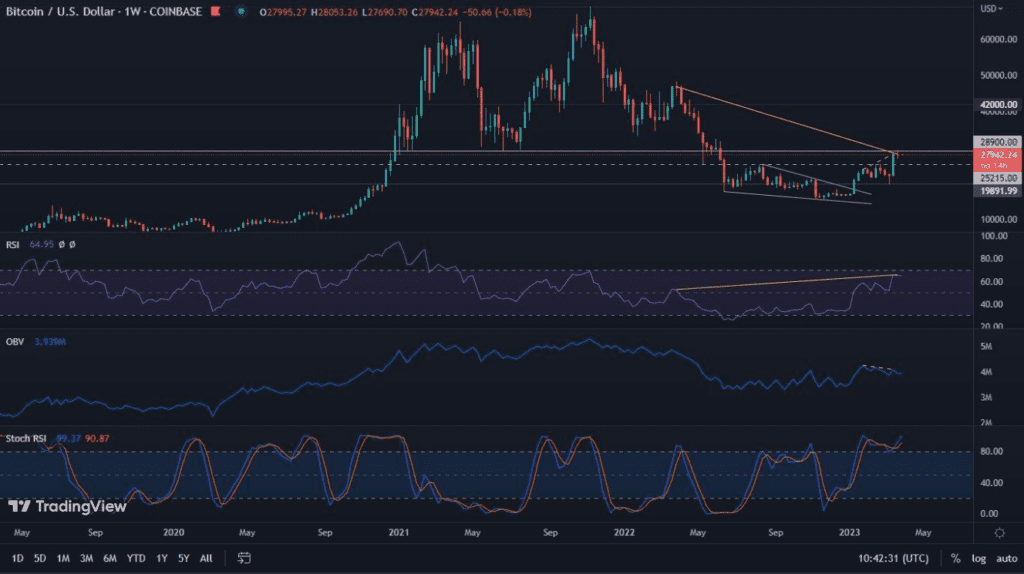

Bitcoin Holds Formation

Since the conference that took place in Miami in early April, the price of Bitcoin has been steadily falling. As a result, its value has shrunk by more than 21% and led the price candles almost to touch the lower border of the upward channel. At the same time, on the indicators there are indications of a potential reversal of the movement.

The first signal is given by the Bollinger Bands, on the lower border of which the current price action is based. At the same time, RSI as well as MACD indicate divergence. These are also signals announcing potential increases. The answer to the question if and when they will come, is worth looking at the traditional markets this time.

DXY soars

So far an undeniable market rule is that when the dollar index (DXY) enters a stable upward movement, the cryptocurrency market significantly slows down or even falls. This is also what is happening now. Dollar rises are often a sign of market uncertainty. This is currently the case on the American stock market, where the published reports of individual companies indicate results lower than expected. Investors also keep an eye on the global situation, such as the war in Ukraine, as well as the growing Covid-19 pandemic in China, which, combined with the Middle Kingdom’s policy to combat it, is significantly slowing down the global economy.

The result is that the DXY is reaching levels last seen on March 23, 2020. Currently there is an attempt to overcome them, however Bollinger Bands indicate excessive pace of index growth, which may result in upcoming deceleration of increases.

SPX with another lower low?

The index of the 500 largest US companies (S&P500) seems to be the catalyst for declines in the cryptocurrency market. Since the beginning of the year, we have seen a regular downward movement on it, with lower and lower lows being formed at the same time. The chart is presented in the simplest possible way, pointing to the downward trend line, created since the beginning of January. In mid-March we saw a breakout from the trend and a subsequent attempt to form a higher high. This one seems to have been only a false breakout. Currently, the index value is close to testing the aforementioned trend line from the top. The rebound from it has the right to calm the markets temporarily, while the possible continuation of declines will have a negative impact on Bitcoin and other cryptocurrencies. Strong is not the word that comes to mind, looking at the SPX graph.

NASDAQ also down sharply

NASDAQ has recently been regarded as the most correlated index with the cryptocurrency market. Looking at its chart we see a story almost identical to the one played out on the SPX index. The American technology stock is currently showing a desire to rebound from the vicinity of the previously beaten downtrend line. Success in this case will give breath to the cryptocurrency market. On the other hand, deepening declines will not fill with optimism. Unfortunately, as in the case of S&P500, we observe lower and lower lows. Therefore, in order to talk about stabilization of the situation, we should look for signs of trend reversal. The best indicator for this would be a higher top and a higher bottom on the chart. However, for this we will probably have to wait a little longer.