The cryptocurrency market moves quite fast and offers the public the opportunity to make a lot of money in a short period of time. Nevertheless, people often want this already high rate of return to be even higher. This is where leveraged trading opportunities come to our aid.

Leverage the derivative of greatest interest

We explained a lot about trading with leverage in the article under the title “Trading cryptocurrencies“. We encourage you to take a look at this material, as it illustrates the principles of leveraged instruments using the example provided. In short, leverage allows us to invest using margin. This gives us the opportunity to dramatically increase our profits. However, there is a very high risk at stake.

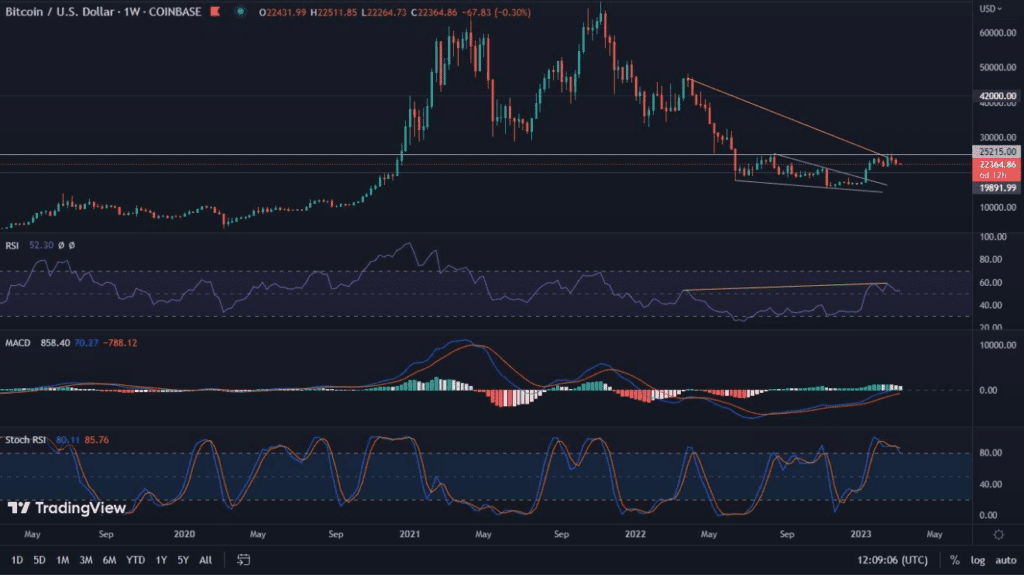

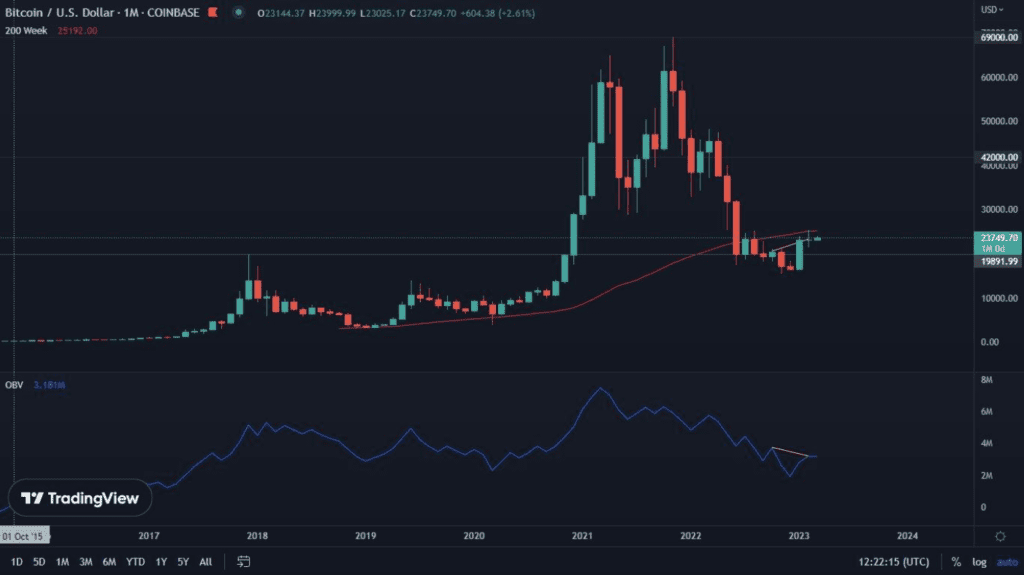

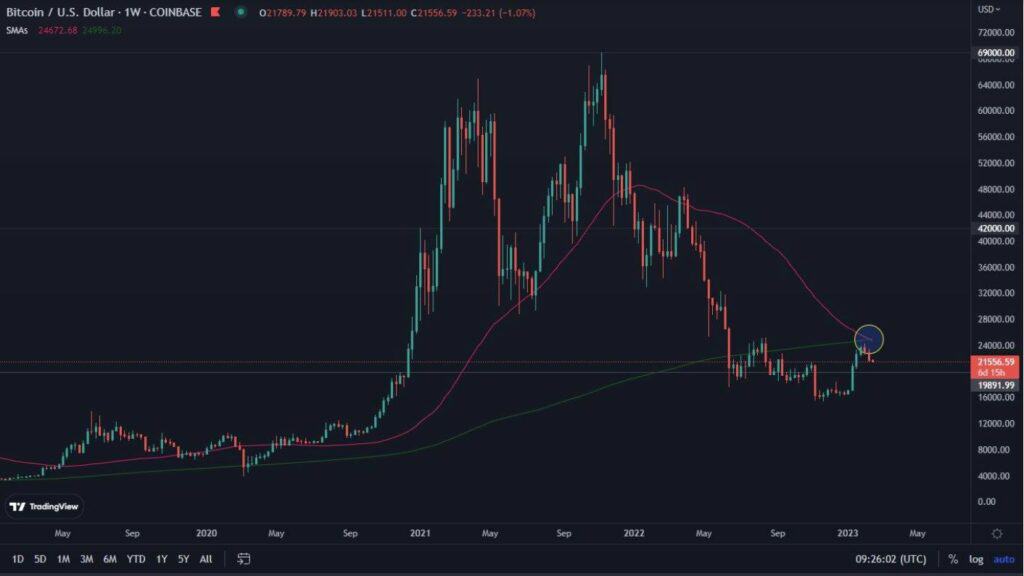

Leveraged trading is one component of the wide range of derivatives available for trading. It is very popular and attracts a growing number of investors. It allows positions to be set on both ups and downs. In this way, no matter which way the market moves, we can keep making money. A number of analyses are necessary here, therefore it is worth taking a look at the foundations of the projects we want to play for. On-chain analysis can also be very useful, as well as precise technical analysis of the chart.

Where to trade with leverage

There are many platforms that allow trading with leverage. However, we would like to introduce you to two, created directly for trading derivatives.

Bybit

Bybit is one of the world’s largest cryptocurrency platforms for trading with leverage. It was launched in March 2018 and registered in the British Virgin Islands and Singapore. It is very popular on forums related to Bitcoin (BTC) and Ether (ETH). The exchange’s highest allowable leverage is 100x. A very big advantage of Bybit is that there is no need to go through the KYC procedure, which greatly facilitates trading. A welcome bonus is available on first registration.

Phemex

Just like Bybit, Phemex is registered in Singapore. It was founded at the same time as its competitor and, like it, allows trading with a maximum leverage of 100x. It too does not require going through the KYC procedure and also offers a welcome bonus.

Since the two exchanges are so similar, how to choose one of them? Here, we recommend looking at the available currency pairs, whose offers are constantly expanding. The commissions of both platforms can also be crucial, as well as the welcome bonuses. It is worth keeping these factors in mind to make the right choice for your preferences.

High risk and (possible) high return

Due to the potentially very high rate of return that can be achieved, leveraged trading is extremely attractive. However, it is not without reason that we have mentioned the need to conduct an in-depth analysis of projects before setting the first order. Of course, such analysis should precede any investment, but it is particularly important here. Leveraged trading is recommended for players with years of experience. Many investors easily lose their money in leveraged trading. Others, on the other hand, get significantly richer. Before you take your first steps on Bybit or Phemex, make sure you are able to bear the risk.