Bitcoin (BTC) is the oldest and most recognized cryptocurrency in the world. Its origins date back to 2008 when its creator, Satoshi Nakamoto, published a whitepaper online titled “Bitcoin: a peer-to-peer electronic cash system.” According to this whitepaper, the basic idea behind the existence of the digital coin was to transfer value exclusively between users of the network and thus without the involvement of intermediary institutions, companies or banks.

Technical aspects of Bitcoin (BTC)

The first block was mined on January 3, 2009. It was called the Genesis block and the value released in this block was 50 BTC. The blockchain is constantly extended and contains the details of all holders of Bitcoins. This prevents counterfeiting as well as double use of the same Bitcoins. The size of each mined block is 1 MB, and it was set during the creation phase of the network. Creating or mining a single block takes about 10 minutes of time.

The process of mining new Bitcoins is based on the SHA256 hash algorithm. This is a cryptographic mathematical algorithm designed in 2001 by the National Security Agency to protect data. This algorithm ensures the security of the Bitcoin blockchain network.

The initial value of the cryptocurrency was determined by the cost of mining it. For example, during the first official valuation, on October 9, 2009, one could buy as much as 1309 BTC for $1. In the first years of its existence, Bitcoin (BTC) was used solely for payments in the world of IT services, but over time it has ventured into much deeper waters.

That is why the situation today is completely different. It has become the result of many factors, ranging from progressive adoption to gradual release of new Bitcoins to limited supply. The release of new Bitcoins is perhaps the most important driving force for the price, which changes about every four years. This has to do with the Bitcoin halving, which reduces the reward to miners for mining a Bitcoin block. Initially, this was 50 BTC and in November 2012, there was a halving of this reward(to 25 BTC). Another halving took place in July 2016 with the number of new BTC per block dropping to 12.5. The last one took place in May 2020, and its effect was that the reward for miners dropped to 6.25 BTC per block. This process will continue until the last Bitcoin is dug up. The timing of this moment is predicted to be around 2140.

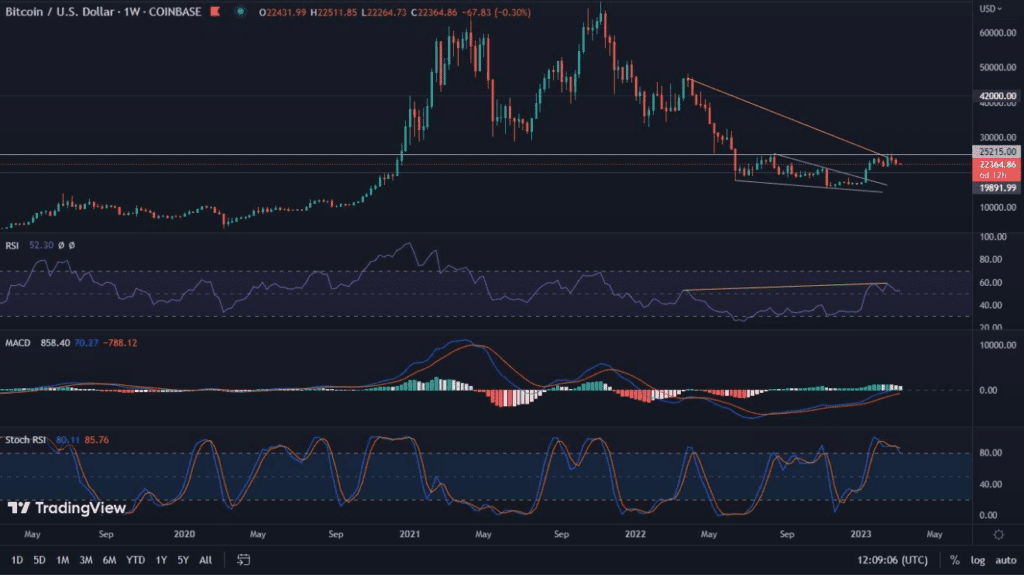

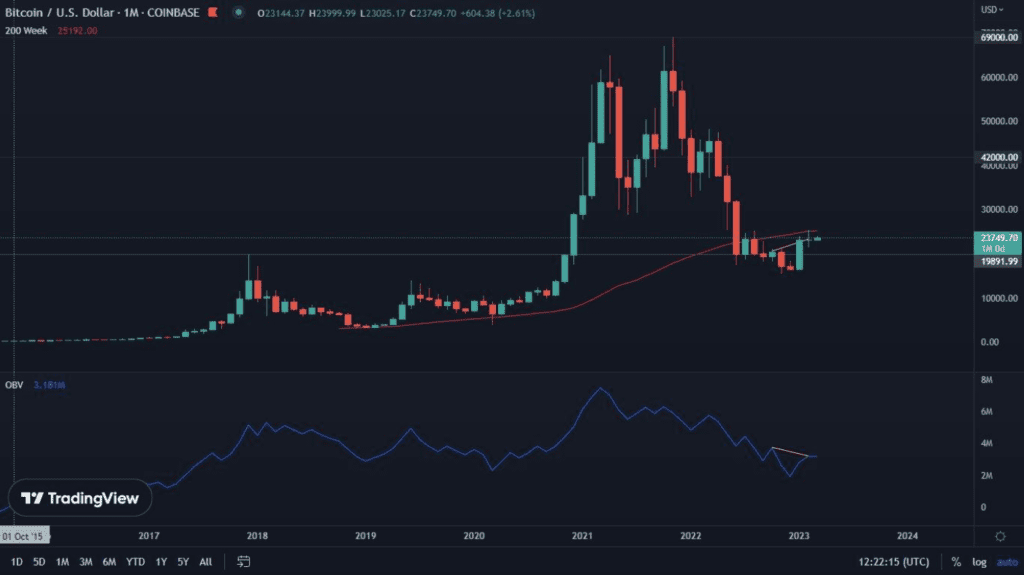

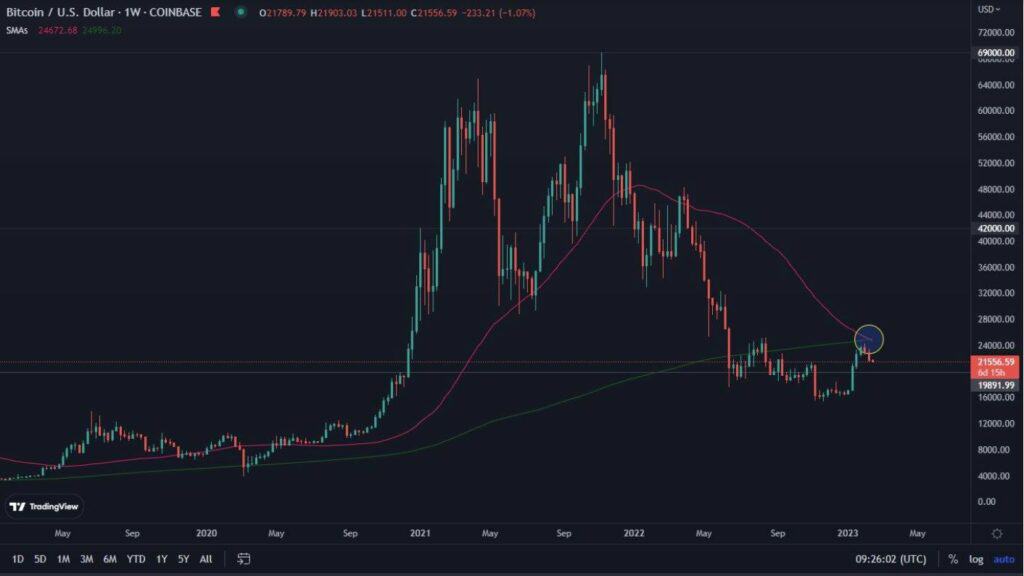

Bitcoin (BTC) price development

Looking at the Bitcoin price chart, one can get the impression that the peaks in its value are closely related to the previously discussed halving. This effect causes the supply to decrease which causes the Bitcoin price to rise further in value. For example we witnessed the first bubble in 2013, where Bitcoin exceeded $1,160. After this it fell into a multi-month downward trend. The Bitcoin (BTC) price went up even higher in 2017, when the price almost hit $20,000 in December, after which it again fell into a long downward trend. Up to now, its old peak was reached in July 2020, which put the coin back into a bull market. Having surpassed previous peaks, we are looking forward to witnessing new all-time highs in price.

Uniqueness and Opportunities of Bitcoin (BTC)

Fundamental to Bitcoin’s existence is the fact that only 21 million BTC will circulate into the global market. Given the massive influx of Fiat currencies, as well as ongoing inflation, Bitcoin has the potential to become a true “store of value” that has the power to overtake gold market capitalisation in the long term. Whether this will happen is uncertain. However, Bitcoin’s divisibility as well as its ease of access means that literally anyone can benefit from its market presence one way or another.

An increasing amount of payments are made using Bitcoin (BTC). It is becoming increasingly common to be able to pay for goods or services with cryptocurrencies. Bitcoin is the most common among them. At the moment Bitcoin is very popular due to its market cycles and a potential high return on investment. This is shown by emerging investment funds such as Grayscale and Microstrategy, which invest in Bitcoin and count on high returns. However, a large part of investors present on the market believe in Bitcoin as the mechanic to revolutionize the financial market. If this is going to happen? We will find out soon enough.