We have been observing a clear decline in the market capitalization of one of the largest market stablecoins for quite some time. The project’s CEO has no doubt that the reasons for such events are to be found in the behavior of American regulators, who are clearly against cryptocurrencies.

American attack on the cryptocurrency market

According to Jeremy Allaire, CEO of Circle, the main factor that caused the decline in USDC’s market capitalization was the US crackdown on cryptocurrencies. His comments come at a time when regulations in the United States are making life increasingly difficult for industry entrepreneurs.

Allaire indicated that the world has “tremendous concerns” about the US banking system and the “regulatory environment in the US.” These words are particularly pertinent in the context of the currently watched decline in USDC capitalization. As we know, stablecoin experienced a shock in March in the wake of the US banking crisis. USDC reserves worth $3.3 billion were stuck in Silicon Valley Bank, which was shut down by regulators. At the time, Circle assured its customers that it had the support of investors, but the market did not believe the news, and USDC briefly lost $1 in value.

In the wake of these events, there are legitimate concerns about what further steps the U.S. government will take against cryptocurrencies. Will it continue to launch an attack and impose strict regulations, or will the prevailing narrative change completely?

Rest of the world set for crypto market growth

Coinbase, as one of the world’s largest cryptocurrency exchanges, expresses concern about the lack of regulatory clarity in the United States and warns that such uncertainties could force cryptocurrency companies to move their operations overseas. Allaire believes that the United States will fall behind the crypto industry. This is supported by the recent MiCA law passed by the European Parliament and the pressure to pass a similar one in Hong Kong.

Allaire stresses that this is a critical time for cryptocurrencies in the United States and urges Congress to take action. Meanwhile, the Securities and Exchange Commission led by Gary Gensler is intensely enforcing the law, threatening regulatory action against many cryptocurrency platforms and exchanges.

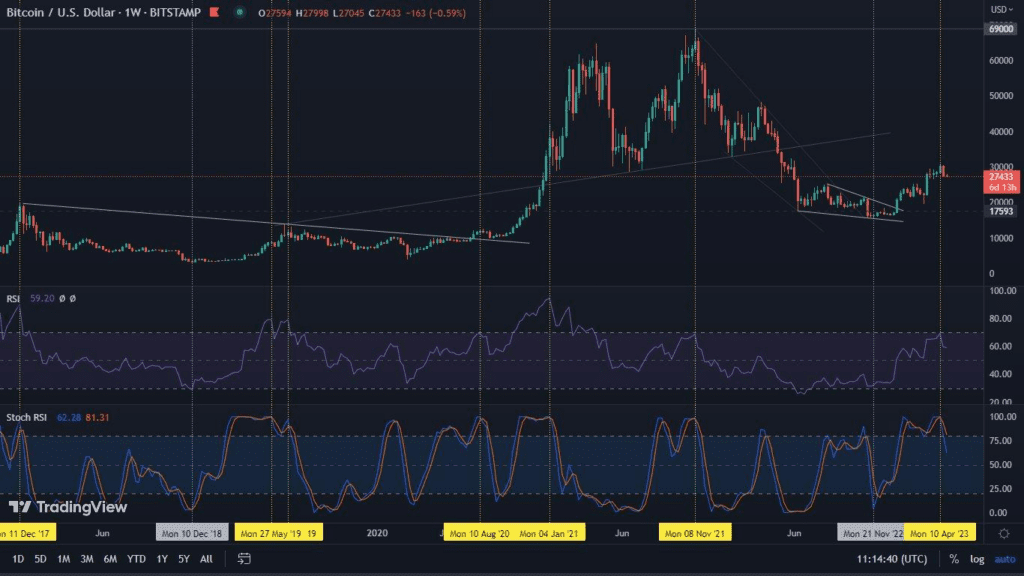

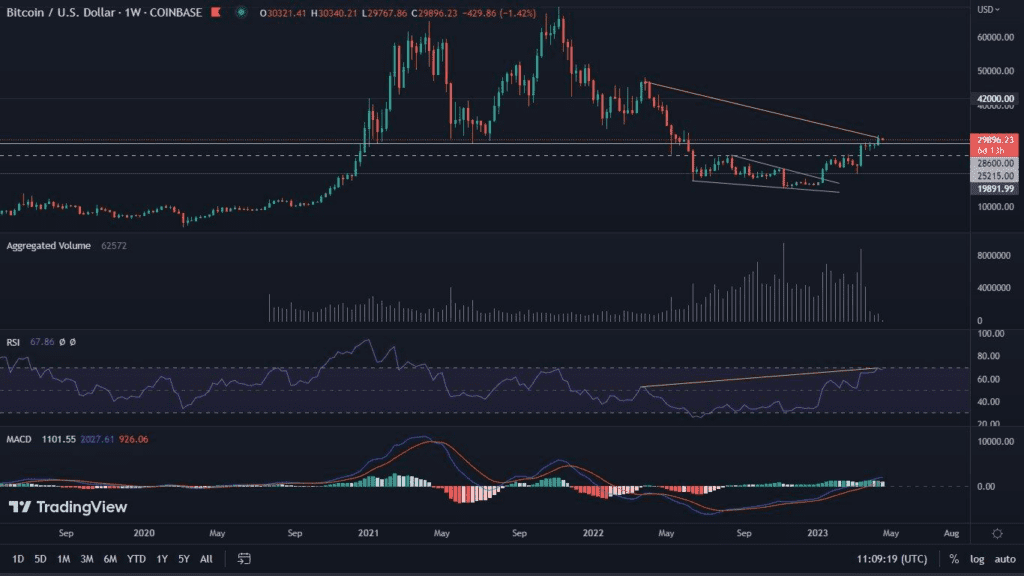

USDC’s dramatic drop in capitalization

Using data provided by the on-chain analysis platform Looknode.com, we can see that the market capitalization of USDC has been clearly falling in recent months. It peaked on June 22 of last year at $55.905 billion. At the beginning of March 2023, as a consequence of the prevailing bear market, it went down to around $44 billion. Unfortunately, the collapses of the previously mentioned banks accelerated its collapse. At the time of this writing, stablecoin’s capitalization is trading at $30.7 billion.