According to the CEO of Compute North, Bitcoin’s Hashrate could double in the coming year. What’s behind there optimistic prediction?

The power of miners is growing

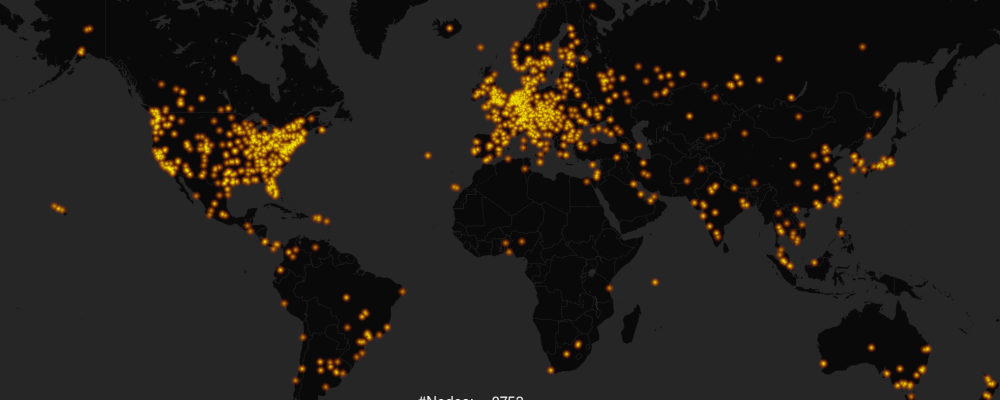

A surprising insight was shared by Dave Perrill, CEO of Compute North. In his opinion, 2022 could be a very good year for the king of cryptocurrencies. However, he is not talking about the price, but about the hash rate, which in his opinion has the right to double. This would be from the level at which the indicator is currently located, and let us remind you that it is close to ATH. Behind such an optimistic prediction are, of course, the Bitcoin miners. According to Perrill, the major players in the mining market, promise to connect a very large number of excavators, and thus significantly increase the mining capacity. We are talking about hundreds of megawatts that are expected to come online just in 2022. Perrill adds that even if things don’t go according to plan, there will still be a minimum mining capacity of 3 GW in every corner of the United States.

“In 2022, large power producers and grid operators will become more involved in the crypto market as low-cost, scalable and renewable energy will continue to be critical to the mining supply chain,” Perrill adds.

It is worth noting that Compute North is a company that supports crypto mining across North America. It provides the mining infrastructure, and in doing so, sources energy from renewable sources, making cryptocurrency digging increasingly green.

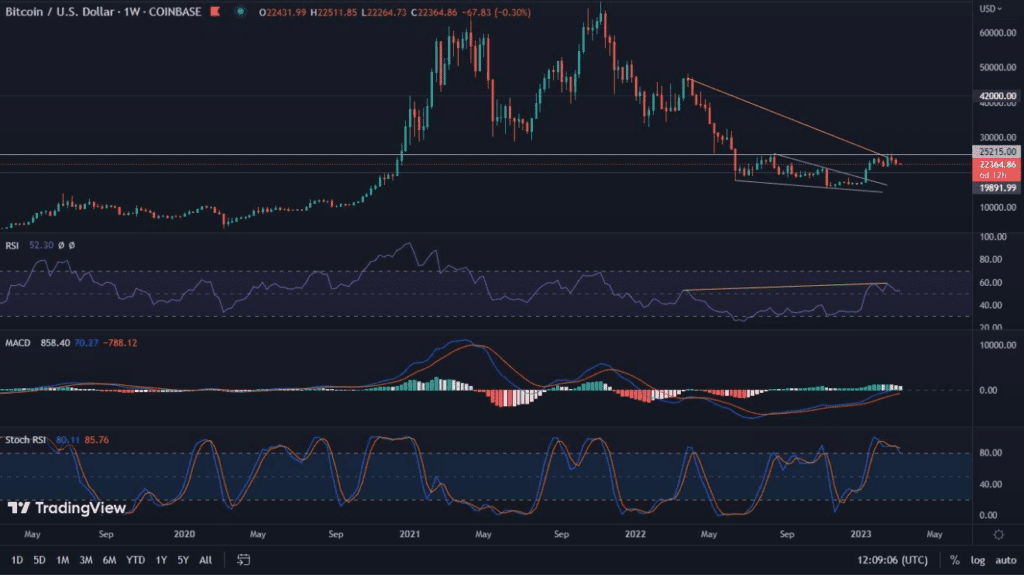

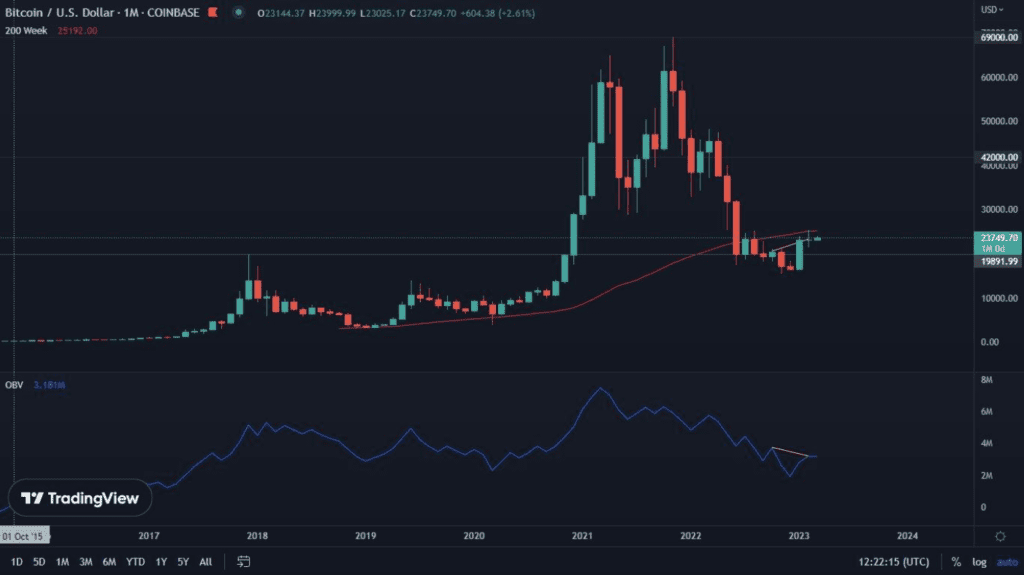

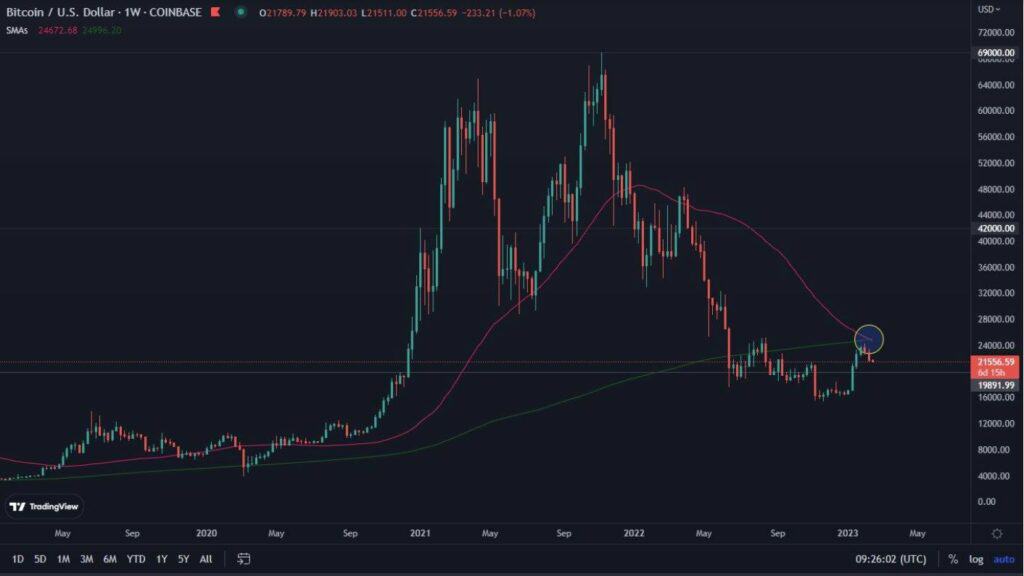

Bitcoin’s Hashrate continues to rise

Thanks to string data, we can constantly monitor the Hashrate of the king of cryptocurrencies. An excellent graph of it is shared with us by Glassnode.

As you can see, Bitcoin’s mining power gained strength during the bull market of 2017. It continued to grow well beyond the point where BTC reached its ATH. We also see here that when deep and prolonged corrections occur, miners disconnect. This is due to the low profitability of digging the cryptocurrency during a given period. One such moment is the end of 2018. We can clearly see Bitcoin’s value falling, to levels of ultimate capitulation, and Hashrate falling at the same time. Similar situations occurred in March 2020, during the early days of the Covid-19 pandemic, and when China completely banned cryptocurrency mining on its soil. The latter decline was the largest and strongest so far in history. The consequence was a mass repatriation of miners from the Middle Kingdom, to countries such as Russia, Kazakhstan and the United States, for example. Today, Bitcoin’s hashrate is doing well and regaining the levels it faced just before the great migration period.