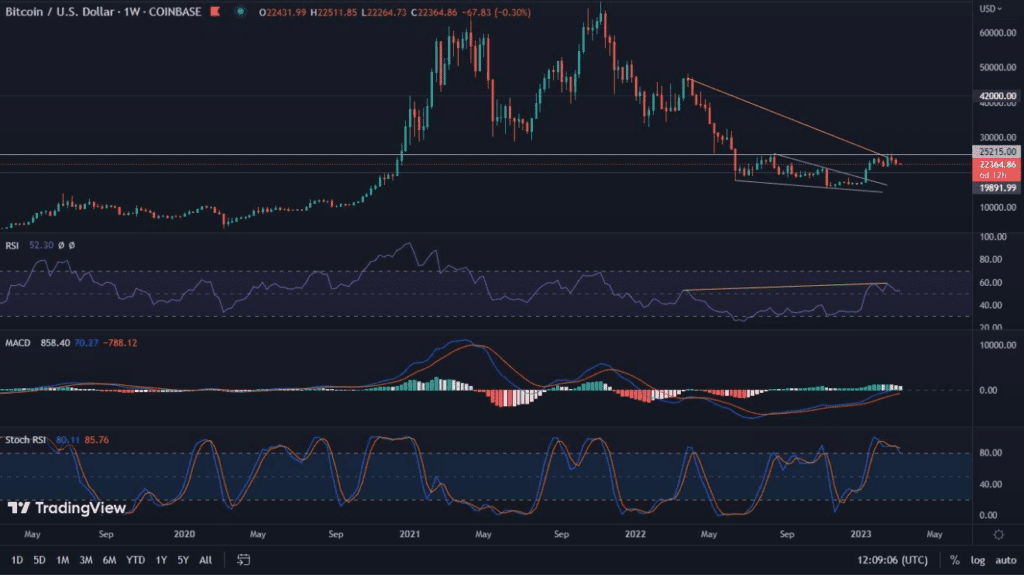

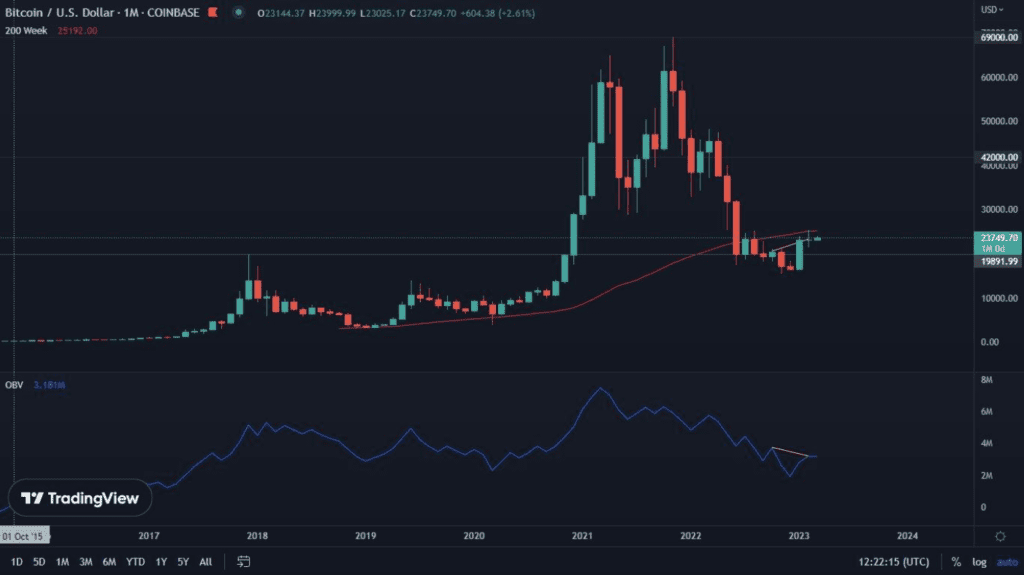

Virtually a daily occurrence in the crypto market is speculation about Bitcoin’s valuation in the coming months or years. Predictions vary. Among those that on the surface appear to be common sense, there are also those that are completely detached from reality. One such prediction ended in a bet, which in addition closed ahead of schedule.

The genesis of the bet for $1 million and Bitcoin

In March, a heated discussion took place on Twitter between Coinbase’s former chief technology officer Balaji Srinivasan and James Medlock. Medlock publicly placed a $1 million bet on the U.S. dollar, claiming that it would never enter a state of hyperinflation. Balaji picked up the theme and offered a bet, the terms of which were as follows: if the price of Bitcoin does not reach $1 million by June 17, Medlock will receive $1 million in stablecoin USDC and 1 BTC. On the other hand, if the Bitcoin price reaches $1 million, Balaji will keep $1 BTC and $1 million in USDC.

Srinivasan based his crazy bet on the assumption that hyperinflation in the U.S. economy is not only inevitable, but is just around the corner and will cause an immediate devaluation of the dollar. As it turns out, however, the former Coinbase director has backed away from that thesis.

Honorable shutdown

Although the parties gave themselves 3 months to verify the bet, this one was closed by mutual agreement as early as May 2. This happened 97% below the target price, and Srinivasan as an equivalent decided to transfer a total of as much as $1.5 million to three different entities.

According to the agreement, Srinivasan paid $500,000 to James Medl, and another $500,000 went to Bitcoin Core developers. The third entity to gain was the non-profit charity Give Directly. The donation to it was the same amount as the others. As Srinivasan himself points out: “I settled the bet ahead of schedule and donated even more than I pledged.”

Bitcoin won’t escape the $1 million value

“The shockingly expensive signal I sent was intended to raise awareness that the economy is in trouble and this will not be a soft landing, as Powell assured. What follows will be much worse,” Srinivasan said, commenting on his decision.

Despite the action carried out, the former Coinbase director firmly believes that the US economy will eventually plunge into hyperinflation. According to his belief, investors will rush to secure the value of their rapidly losing dollars by just moving them into Bitcoin and rapidly driving the cryptocurrency’s value up. Then a $1 million BTC will only become a matter of time.