On Wednesday, October 20, 2021, Digital Currency Group, which is the parent company of Grayscale Investments, LLC, authorized DGC’s purchase of $1 billion worth of Grayscale Bitcoin Trust (GBTC) shares. By October 19, 2021, DGC already owned approximately $388 million worth of GBTC shares. What is the role of the aforementioned companies, as well as what consequences this decision will have – later in the article.

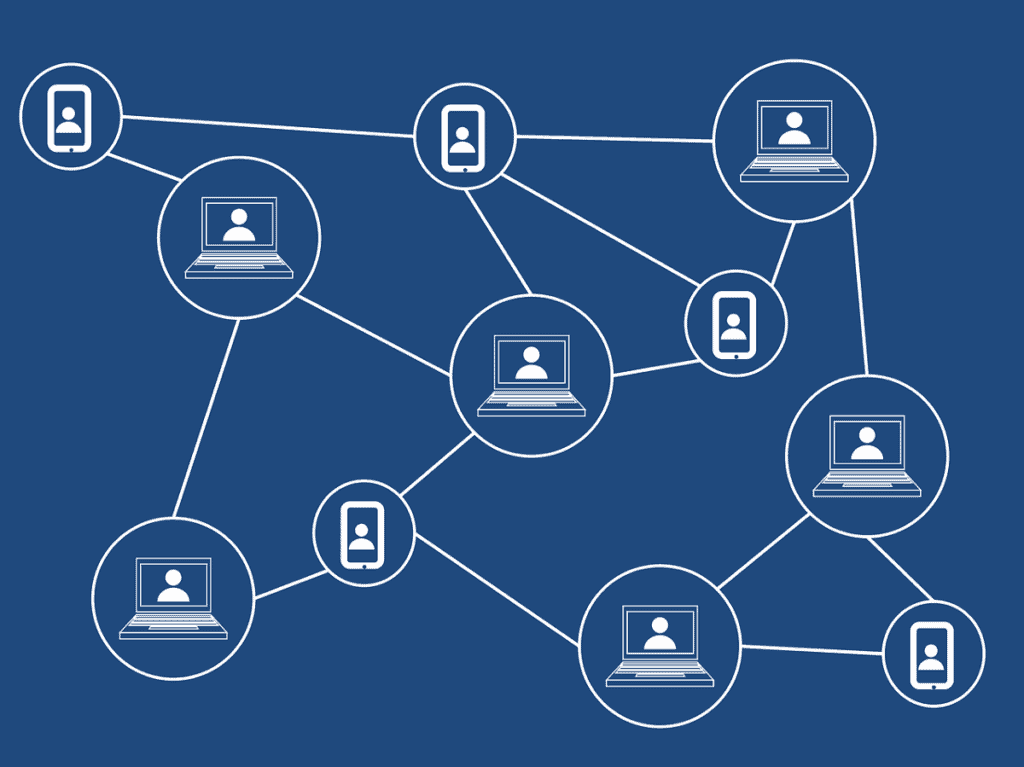

Digital Currency Group – the world’s largest investor in blockchain technology

Digital Currency Group dates its origins back to 2015, when the current CEO and founder of the group, Barry Silbert decided to start investing in blockchain technology. Since then, DCG has become one of the most active investors in this sector, driven by the belief that cryptocurrencies represent the future for the financial world. Today, the company backs more than 175 companies from 35 countries that are related precisely to blockchain technology. DGC also invests directly in digital assets and is the parent company of Greyscale Investments, which we will talk about in the next paragraph. It is also worth mentioning that Digital Currency Group is also the owner of CoinDesk portal, Luno platform and tools under the TradeBlock brand.

About Grayscale Investments – digital asset manager

Grayscale Investments, which is owned by DCG, is a digital asset management company. As of 2021, the company had over $53.5 billion in assets under management. The company was founded in 2013 and as of today, it has as much as 8 years of experience in the crypto market. Through the investment products provided by Greyscale Investments, clients are exposed to crypto assets without the challenges that come with holding and directly acquiring them, and most importantly, those associated with hedging this asset class. Greyscale Investments’ products also operate in compliance with current regulations, making them a safe investment for those looking to enter the cryptocurrency market.

By agreeing to purchase even more shares of Greyscale Bitcoin Trust, Digital Currency Group will triple its position in the Bitcoin (BTC) market, making it likely that the company will remain a leader among investors in blockchain technology.