The ETH coin, the blockchain token of the Ethereum network, is one of the most popular cryptocurrencies currently on the market, next to Bitcoin (BTC). Many technologies are based on the Ethereum blockchain, and hundreds of users around the world use it every day. These technologies include, for example, the DeFi app, or the non-exchangeable NFT tokens, and after all, this is only a fraction of what the ETH blockchain is capable of. So what is currently happening with it? It seems that the supply of ETH token has been steadily decreasing. With the beginning of December, it has reached a record low of 14%. What will be the consequences of this and what does this trend mean?

What is the “percentage of supply on exchanges” indicator?

According to analyst CryptoQuant, the “percentage of supply on exchanges” indicator shows the share of total Ethereum (ETH) supply held in the cryptocurrency wallets of all exchanges on which this token is traded.

This supply, is usually referred to as the “supply of ETH sales”, so with an increase in this indicator, it can be assumed that the number of available coins on the market is increasing. And while this would seem to be a favorable trend, due to the dynamics of this specific market, a higher number of coins can adversely affect the price of the cryptocurrency.

On the other hand, if the value of the “ETH supply” metric decreases, it means that the amount of ETH tokens available on exchanges decreases. Consequently, a smaller number of tokens affects their uniqueness, which can lead to an increase in the price of the Ethereum cryptocurrency.

How will a decrease in the supply of ETH token affect the market?

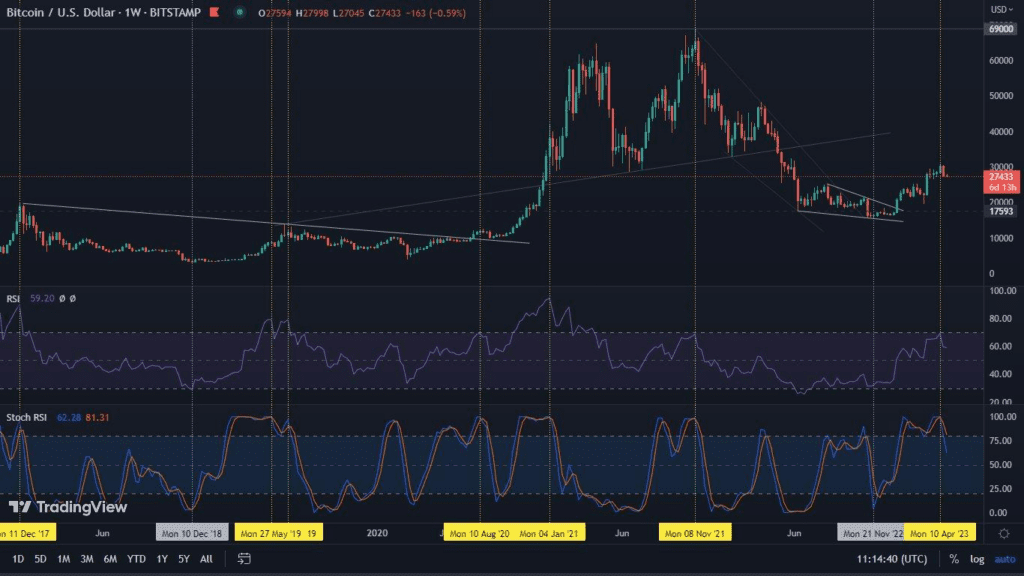

In the case of Ethereum, a steady downward trend in the percentage supply of ETH has been observed since the beginning of 2021. Currently, this indicator has reached its minimum so far, around 14%, while in January it was around 21%. Thus, it comes out that as much as 7% of ETH supply was taken away from the exchanges during the year.

The fluctuations in the ETH supply ratio could be seen in the ever-increasing price of this token. Since the beginning of the year, the price of ETH has grown almost 6 times from $700 to over $4,000 at the time of writing this article. In contrast, over the past week, the price of Ethereum has been going through huge fluctuations, from $4,000 to $4,600.