Futures and options market analysis indicates a shift in investor preferences, reporting that funds may be shifting from Bitcoin to Ether.

CME quotes suggest increased activity around Ether

A compilation of key derivatives market indicators indicates that sophisticated investors have turned their attention to Ethereum (ETH) at the expense of Bitcoin (BTC), signaling Ethereum’s potential dominance in the coming weeks.

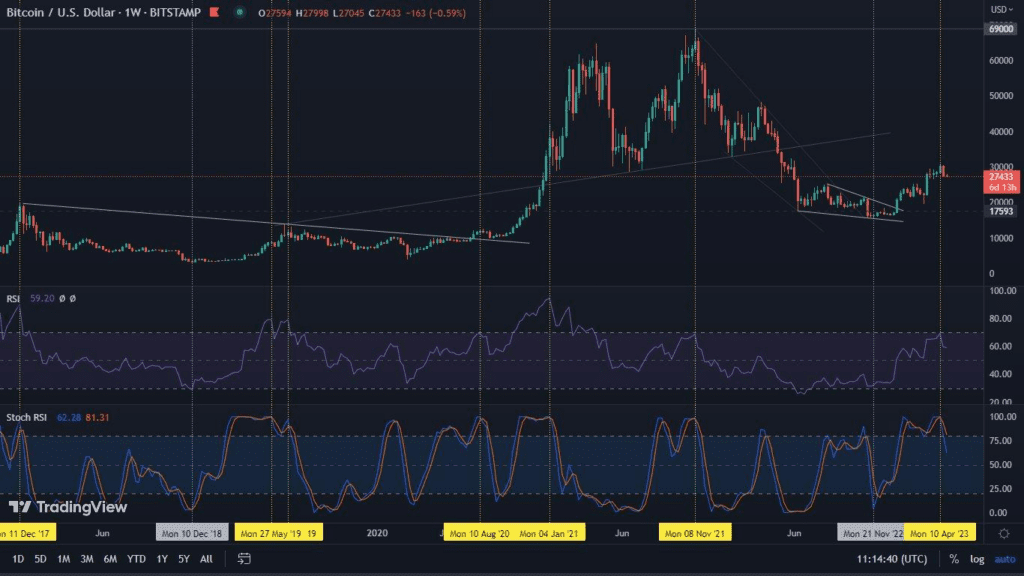

Bitcoin’s rise in value was more than 60% in the current quarter, while Ethereum, considered a deflationary currency with bond-like characteristics and in line with ESG ethics, saw a rise of 35%. The difference in their performance is even more noticeable if we look at longer periods, where Bitcoin has gained 163% since the beginning of the year, compared to Ethereum’s 89%.

These discrepancies are likely to narrow significantly, as funds are now moving at a higher rate into Ethereum futures than into Bitcoin. Ether futures, the dollar value of blockchain funds in the Chicago Mercantile Exchange (CME) cash-settled contract, rose 30% to reach $711 million in the past five days, outpacing Bitcoin’s 19% rise to $4.9 billion. The standard CME ETH futures contract is for 50 ETH, while the equivalent for Bitcoin is 5 BTC.

The market anticipates ETFs on Ethereum

The growing positive differential between CME futures prices for Ethereum and Bitcoin confirms this trend. According to Reflexivity Research, the premium in Ethereum futures over the spot index price was 5% higher than for Bitcoin earlier this week.

“The underlying futures level (representing the difference between the market price and the futures price) for Ethereum on the CME is currently at a 5% premium over Bitcoin, exceeding 20%. In addition, we note that open interest in ETH on the CME has begun to increase, after delaying the initial upward movement for Bitcoin,” reported a representative of Reflexivity Research in a December 5 market update.

“It may be too early to say conclusively, but it looks like tradfi – traditional financial players – may start trading Ethereum ETFs after two months. This is something to watch as an early signal that the market may be anticipating a potential Ethereum ETF,” – Reflexivity Research added.

Optimism for ETH, pessimism for BTC

Meanwhile, in the Deribit-listed options market, investors are increasingly opting for call options on Ethereum and puts on Bitcoin. A call option gives the right, but not the obligation, to buy the underlying at a predetermined price in the future. The call option buyer is optimistic about the market, while the put option buyer takes a more pessimistic stance.