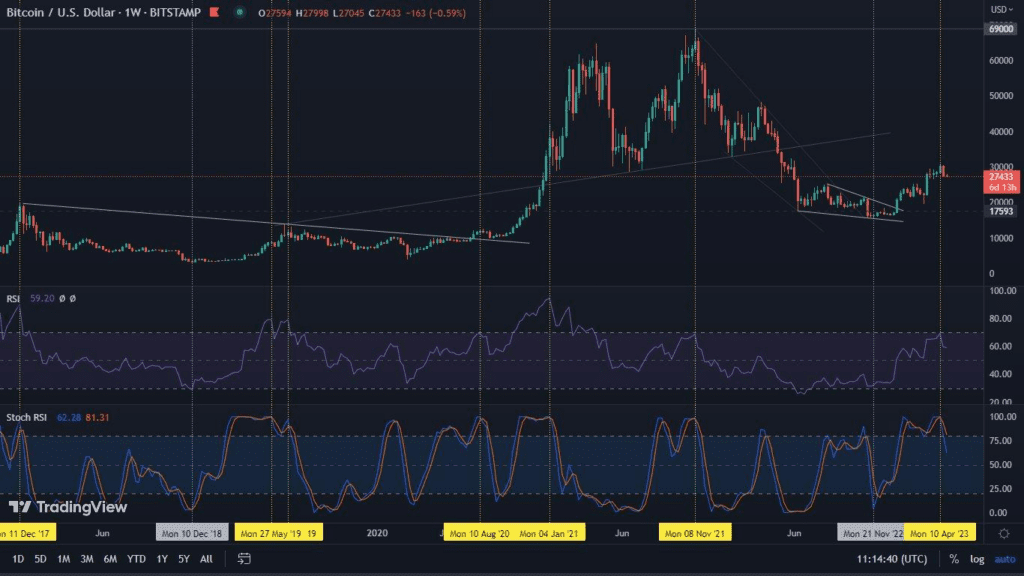

In recent months we have seen a decline in the interest of venture capital (VC) funds in cryptocurrencies. Many voices are sounding the alarm that cryptocurrencies are losing their appeal to investors. However, is it really as bad as it might seem?

Is venture capital afraid of cryptocurrencies?

According to a recent study by Galaxy Research, funding for cryptocurrency projects is experiencing a decline not seen since the fourth quarter of 2020. This is a persistent trend that has been going on for 18 months. For example, in the same period a year ago, there was more than $6 billion invested in cryptocurrency projects in 600 transactions. However, in the last quarter we saw a sharp decline, when funding for cryptocurrency and blockchain technology companies dropped to $2.3 billion.

Still, not all cryptocurrency investors are losing faith in the industry. Kavita Gupta, founder of the Delta Blockchain Fund, says the cryptocurrency industry is still booming, but many projects are simply not announcing their funding rounds. This can lull people into thinking that VCs have lost interest in cryptocurrencies. Gupta reports that its fund made three deals last month and is working on more, highlighting that many other companies are also actively raising capital.

One example is also the initiative of Bitcoin bull Tim Draper, who recently announced a new venture studio called Draper Goren Blockchain (DGB), focused specifically on cryptocurrencies. Alon Goren, one of the founding partners, says the negative market sentiment has not affected their conviction. He stresses that many entrepreneurs are still joining the cryptocurrency space.

MEXC Ventures, the investment subsidiary of the MEXC exchange, also announced a significant investment in Toncoin, proving that there is still a lot of interest in the crypto space.

Increased caution and deeper analysis

However, Gupta points out that the depressed market has had an impact on VC investment. He points to the previous bull market cycle, when there were 1,300 deals worth $11.8 billion in the second quarter of last year. Now “the rounds just aren’t as oversubscribed as before.” This is a good thing from her point of view, as it allows companies to do more thorough due diligence, since 99% of these rounds turned out to be unreliable.

It’s also worth noting other areas that could attract investment, replacing cryptocurrencies in investors’ portfolios. Gupta points to AI on-chain projects that are gaining popularity, although there are doubts that these projects will prove successful.

What does the future hold?

Gupta points to two key issues. First, regulation is needed to clean up the market. But until then, project developers may face restrictions on raising capital. Second, the cryptocurrency industry needs to be more recognized in the mainstream. An example is JPMorgan’s decision to end crypto operations at its Chase UK institutions, which may put pressure on other companies to follow suit.

For entrepreneurs looking to raise financing, the situation is challenging. Much more is now required of them than just the idea phase. Gupta concludes: “We are looking for companies that have contracts showing that their product will be used. That’s now a requirement for credibility.”